- Tech stocks are leading gains at the start of the week.

- Alphabet is lifting the indices again with the launch of Gemini 3 and its new NATO contract.

- Rising risk appetite isn’t hurting defensive sectors such as healthcare and pharmaceuticals.

- Tech stocks are leading gains at the start of the week.

- Alphabet is lifting the indices again with the launch of Gemini 3 and its new NATO contract.

- Rising risk appetite isn’t hurting defensive sectors such as healthcare and pharmaceuticals.

US equities are extending Friday’s rebound, attempting to erase the recent sell-off that even strong Nvidia earnings failed to stop. Tech leads the move higher (US100: +2%, US30: +0.3%) as risk appetite is boosted by renewed hopes for a December Fed rate cut.

Rate-cut expectations jumped above 70% on Friday after comments from the New York Fed’s John Williams, who said monetary policy remains somewhat restrictive. Another dovish signal came today from Christopher Waller — considered a contender for Fed Chair — who cited labour-market concerns and voiced support for a December cut.

The return of dovish rhetoric is giving Wall Street fresh momentum, supported further by upbeat news from key tech names, including the release of Gemini 3, Alphabet’s latest AI model. The company also announced a multimillion-dollar cloud-services contract with NATO.

Big Tech is driving the rally, including the Magnificent 7 (Alphabet: +5.4%, Amazon: +2.5%, Tesla: +6.5%, Meta: +3.4%). Nearly the entire semiconductor sector is also in the green (Broadcom: +9%, AMD: +4%, Micron: +6.7%). Interestingly, today’s tech euphoria isn’t weighing on more defensive sectors like pharmaceuticals and healthcare (Pfizer: +1.1%, Merck: +3.5%). Source: xStation5

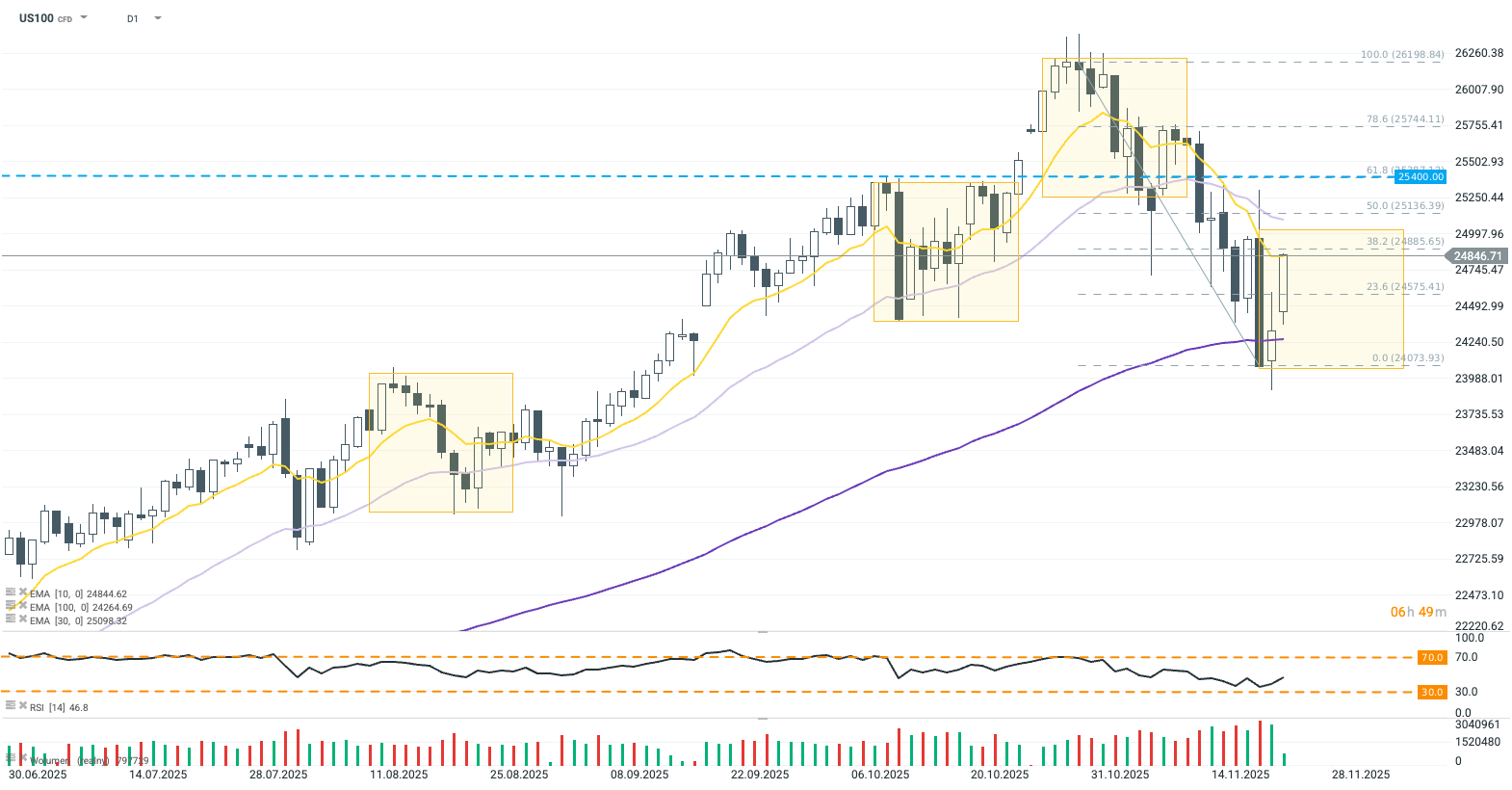

The US100 contract continues to climb despite already bullish opening. The index has broken above the 23.6% Fibonacci retracement and is pushing toward a test of the 10-day EMA (yellow), which roughly aligns with the 38.2% Fibo level and the upper geometry boundary. Erasing Thursday’s sell-off would open the door to a broader recovery on Wall Street, supported by neutral RSI. A rejection at the 10-day EMA, however, would signal growing investor caution ahead of the Fed decision. Source: xStation5

Block Inc. lays off 40% of its workforce and rises 16% - Is this a new paradigm?

US OPEN: Wall Street holds its breath ahead of Nvidia earnings

Michael Burry and Palantir: A well-known analyst levels serious accusations

Palo Alto earnings: Is security cheap now?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.