On Tuesday 20th april, Topix dropped by 1,2% and NIKKEI (JAP225) tumbled by 2%, but the BoJ did not intervene - this was the first time since 2016 that the BoJ did not make an ETF purchase after such a decline in the morning session. The day after, the BoJ made the first purchase since March (70.1BN yen of ETFs), but japanese indexes kept under pressure as rising coronavirus infections in Japan capped gains. In this analysis we will focus on three intervals and try to figure out the perspective of the NIKKEI (JAP225).

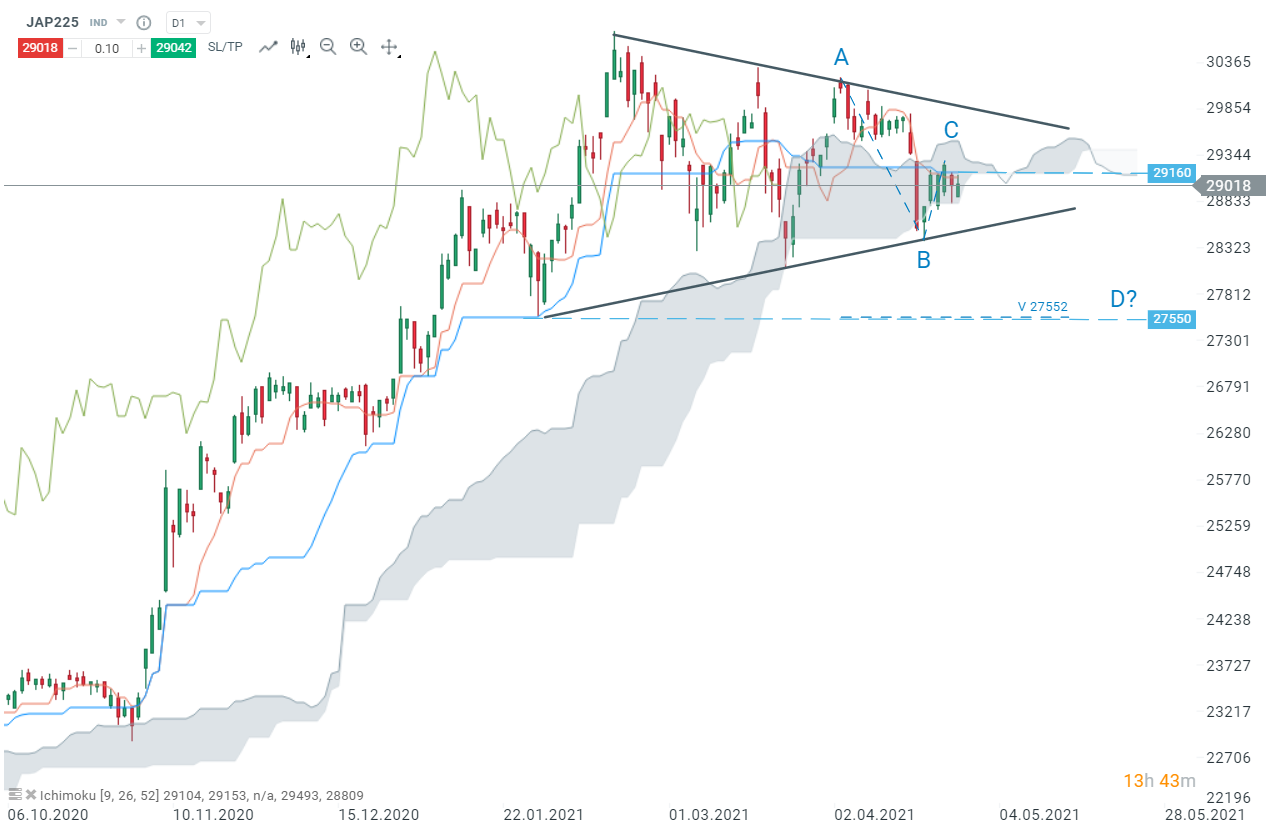

Daily interval :

After a rebound on the lower limit of the triangle (B), JAP225 could not break above the Kijun-line (blue line) at 29 160 pts and remained inside the daily Ichimoku cloud. In case bulls managed to keep prices inside the cloud, another upward impulse may be launched. On the other hand, breaking below the lower limit of the triangle could result in a deeper downward move. In such a scenario, the first support to watch can be found at 27 550 pts.

JAP225, D1 interval, Source : xStation5

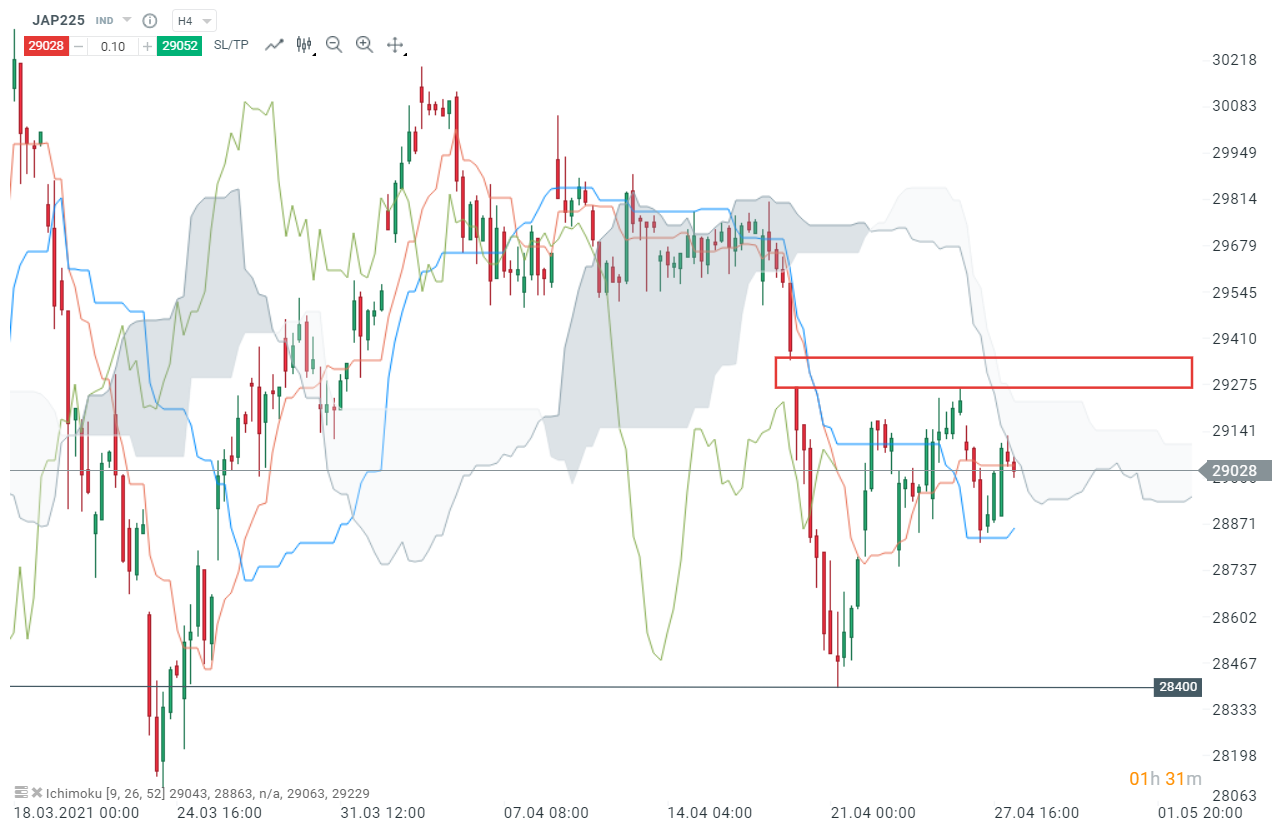

H4 interval :

On 26th of April, prices failed to fill the bearish price gap (red box) and dropped to the H4 Kijun-line (blue line) at 28 830 pts. Bulls managed to defend this support and an upward move led to the next resistance - the H4 Ichimoku cloud. This cloud is still acting like a strong resistance and pushing prices lower. The next support is the aforementioned Kijun-line at 28 830 pts. Breaking this level could lead to a deeper downward move to the next resistance at 28 400 pts. On the other hand, if bulls manage to cross the H4 cloud, a strong resistance can be found at the bearish price gap (red box).

JAP225, H4 interval, Source : xStation5

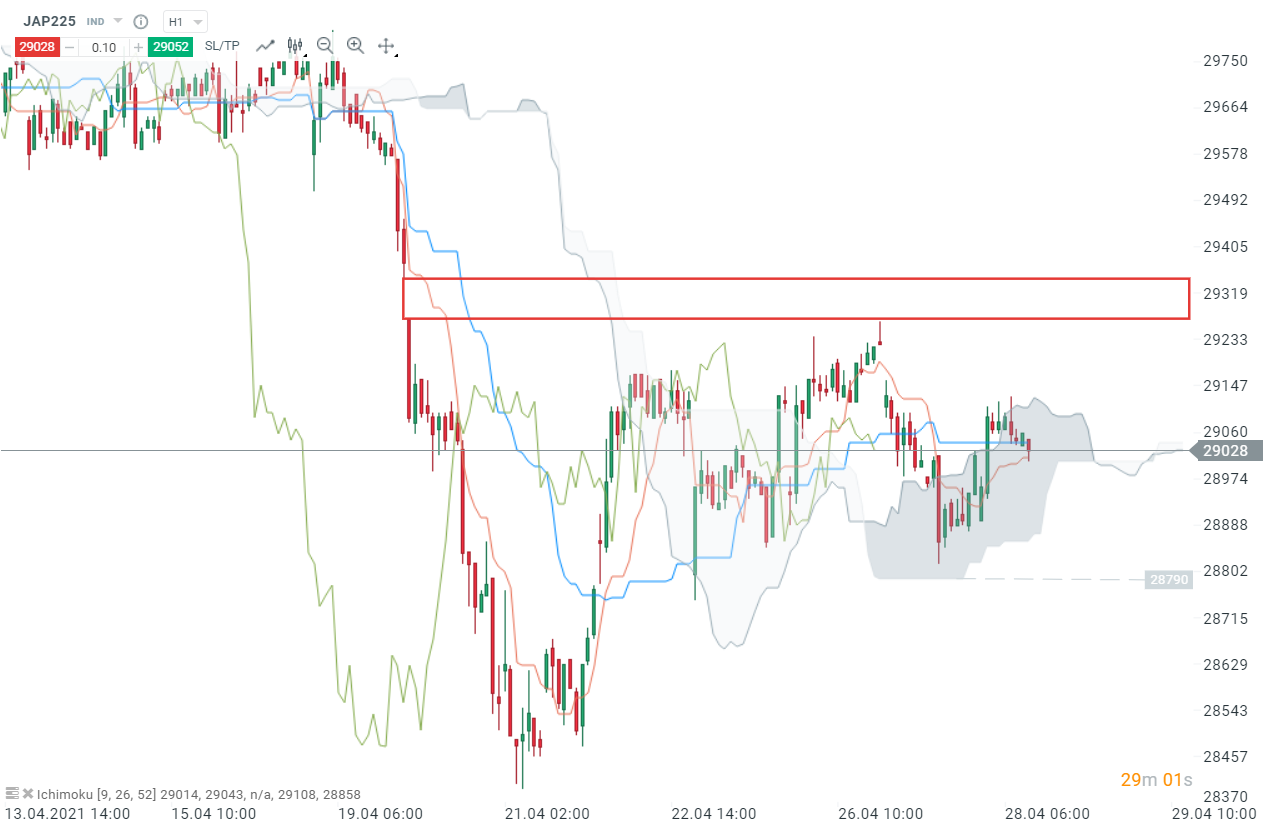

H1 interval :

When analysing this short interval, one can notice that prices are located inside the cloud. According to the theory, this tells us that the market equilibrium is reached. Should break of the lower limit of the cloud occur, then downward move may be extended to the previous Senkou-span B level (grey line) at 28 790 pts. This level is the last support before the local lows at 28 400 pts. On the other hand, if buyers will manage to halt declines on the Tenkan-line (red line), then another upward move towards the upper limit of the cloud at 29 120 pts is possible.

JAP225, H1 interval, Source : xStation5

Réda Aboutika, XTB France

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.