In the last month of this year, increases in global markets are driven by speculation about upcoming cuts in interest rates and decreasing inflation. Particularly important here are data from the USA, which drive the rest of the markets and to some extent dictate the policy of other central banks. The last meeting of the Fed was received by the markets exceptionally dovishly and was a catalyst for increases. Indices are quoted around or above historical highs, all in the hope of the first Fed cuts as early as March, and certainly before the middle of next year. New projections indicated a total of 75 basis points of cuts in 2024. However, for the Fed's narrative to be maintained, inflation in the USA must continue its current downward trend. Let's look at a few charts to learn more about the possible direction in the coming months.

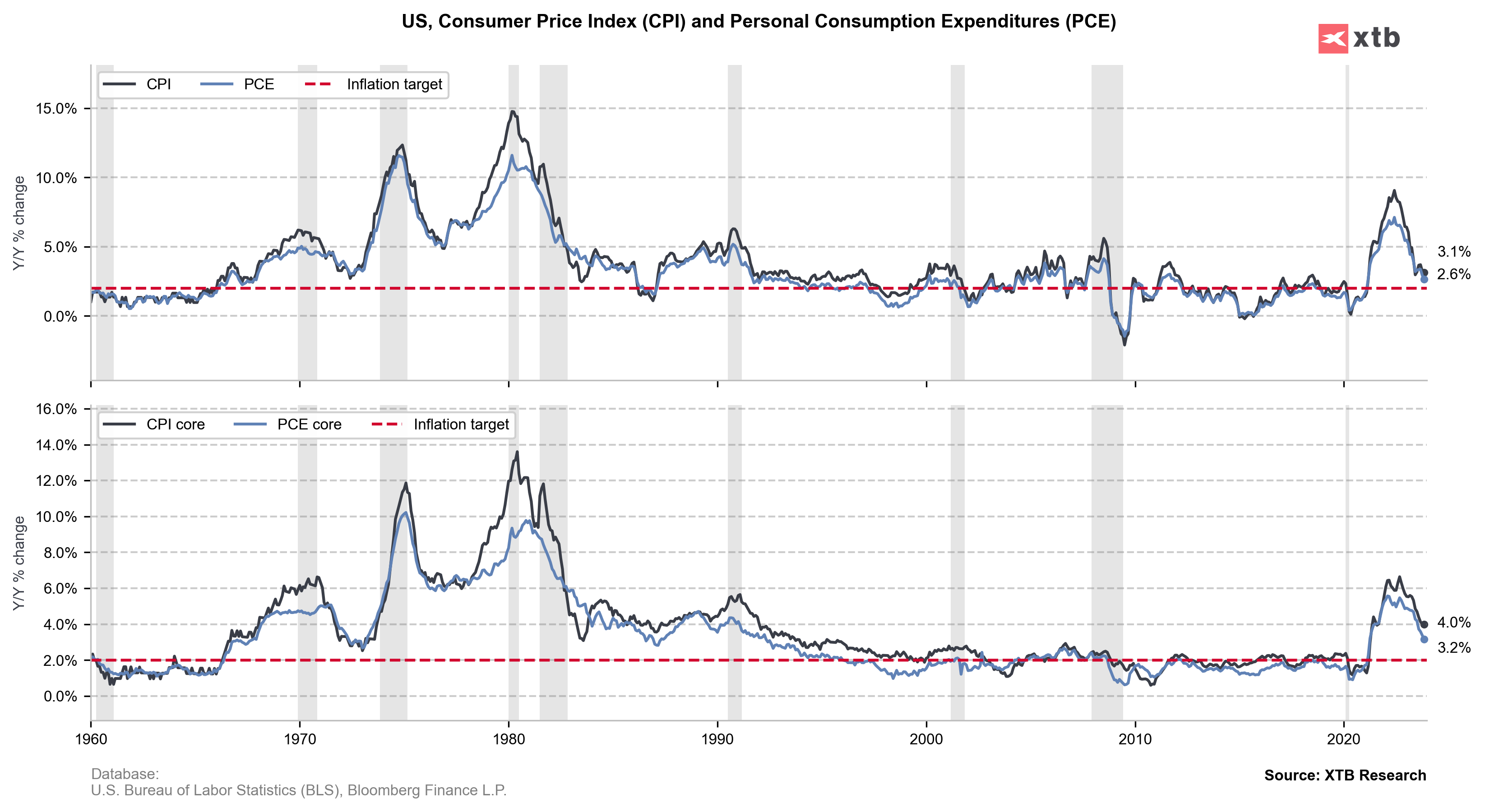

Today's PCE inflation report from the USA confirmed the continuing downward trend. Overall prices last month rose by just 2.6% year-over-year, which is simultaneously very close to the historical average of the last decade. It's important to remember that the Personal Consumption Expenditures (PCE) index is a preferred measure of inflation by the Fed, therefore its decline, higher than expected, should support the scenario of policy easing.

Although the labor market has begun to stabilize a bit, wages remain high. However, the data are no longer as high as at the turn of 2021-2022. Inflation is falling, and so far, the progress is really noticeable. However, a decrease in wage growth from 4.0% to around 2.0% historically may already be much more difficult to achieve in such a short term.

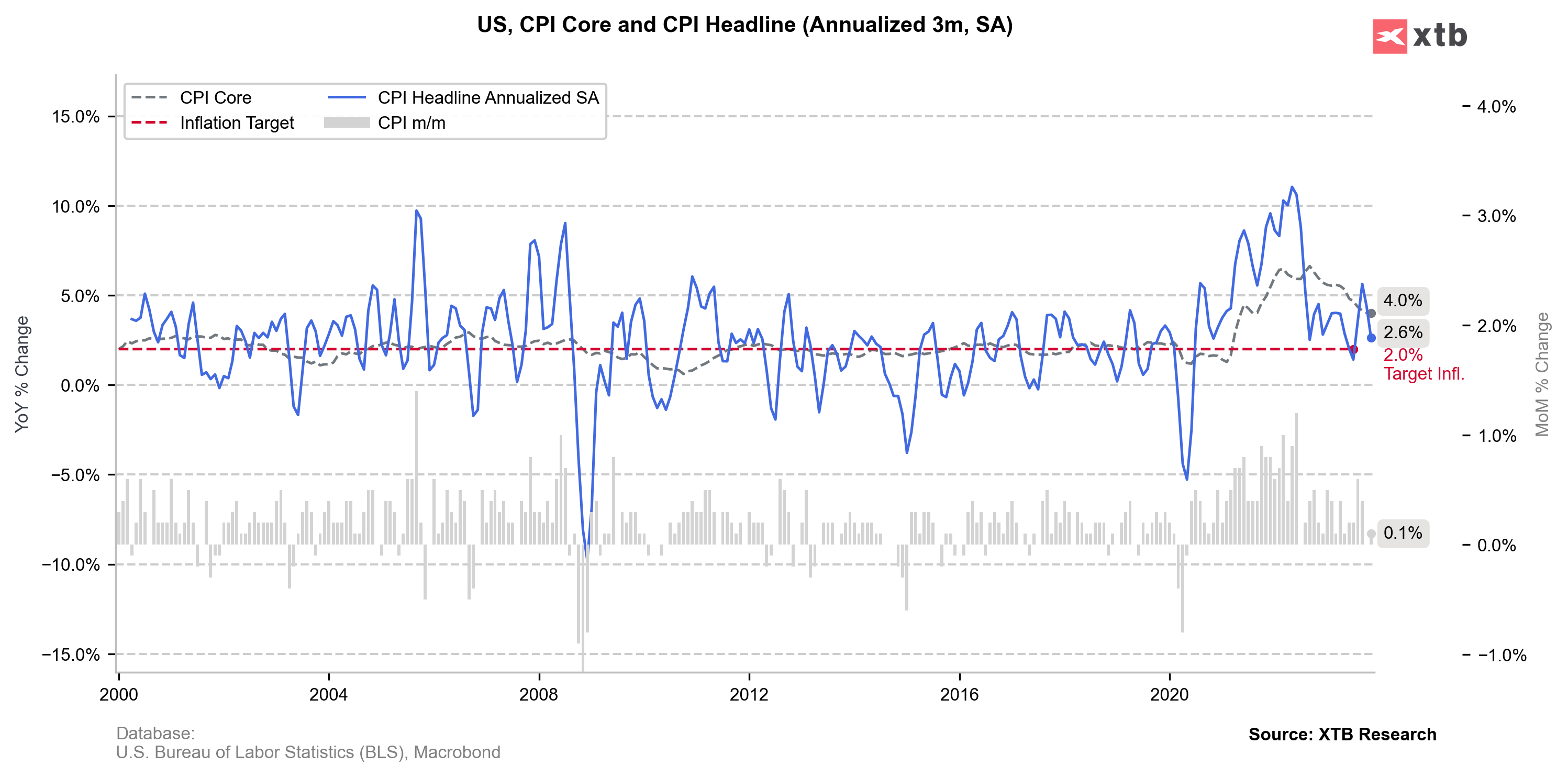

Annualized inflation based on price changes over the last 3 months also indicates a potentially good direction. Monthly changes show satisfying dynamics. Although there are still higher readings caused by the base effect and other factors, the direction is clear.

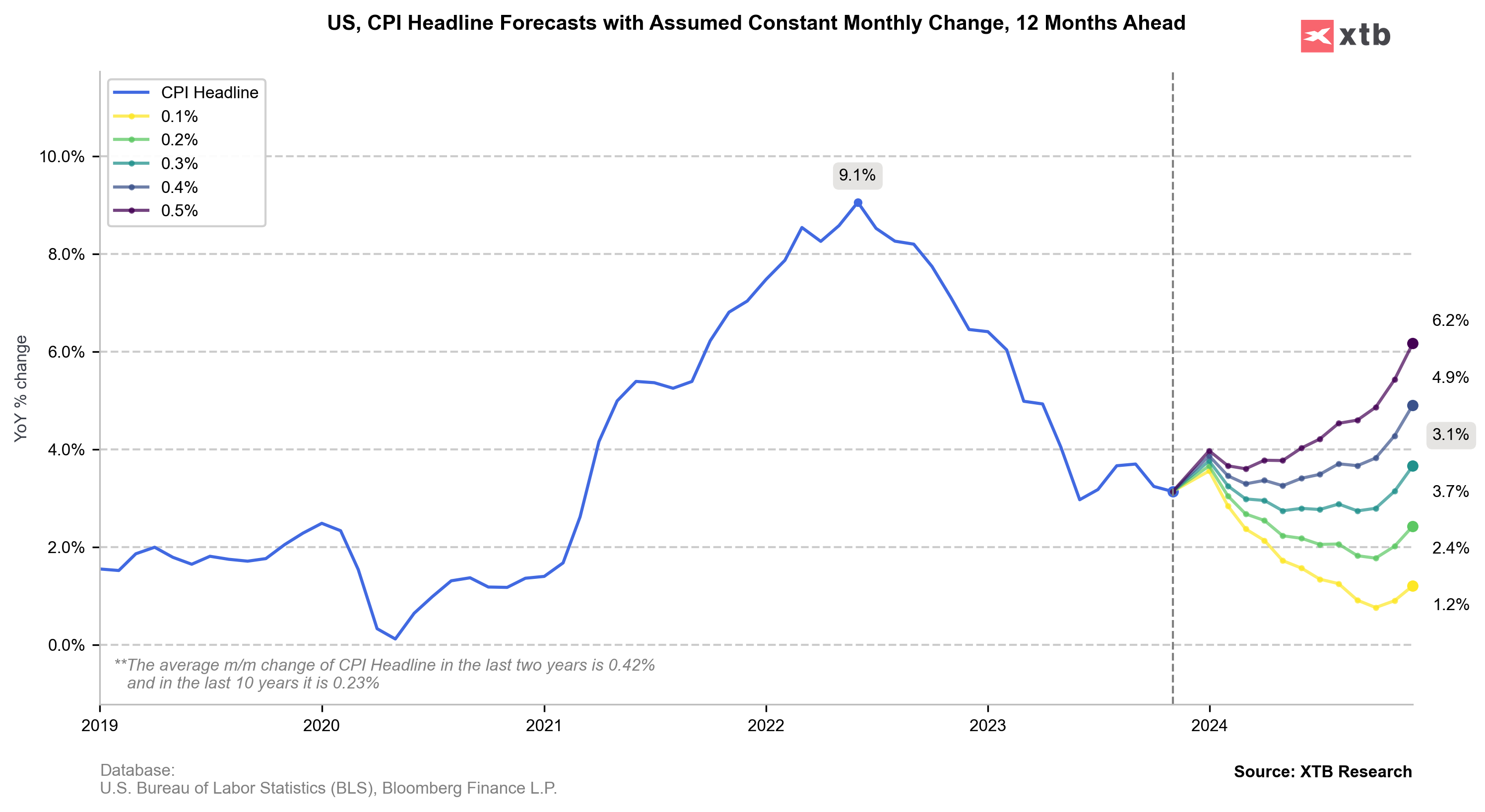

The above chart allows us to analyze how annual inflation readings would shape up, assuming constant month-over-month changes. Here, assuming a historical average of about 0.23% (green path), inflation in 2024 would maintain a downward trend. The exception might be the beginning of this year when, due to the base effect, we might see slightly higher readings.

The data show that the US economy is currently heading in the right direction and should gradually ease off. However, it's important to remember that we still remain in an environment of high-interest rates, and their impact on the economy may be visible in 2024.

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.