Tonight, another central bank monetary policy meeting will take place, concluding the busiest week of monetary policy of the entire year. In principle, the Bank of Japan will leave interest rates unchanged at 0.5% given the political, economic, and social uncertainty the country is experiencing.

Japan's Economic Situation

Since the last meeting in July, there have been major developments in both the economic and political arenas in the Land of the Rising Sun.

On the economic front, the latest data released show higher-than-expected GDP growth, at 2.2% annual growth, adding a factor that supports the possibility of a short-term rate hike.

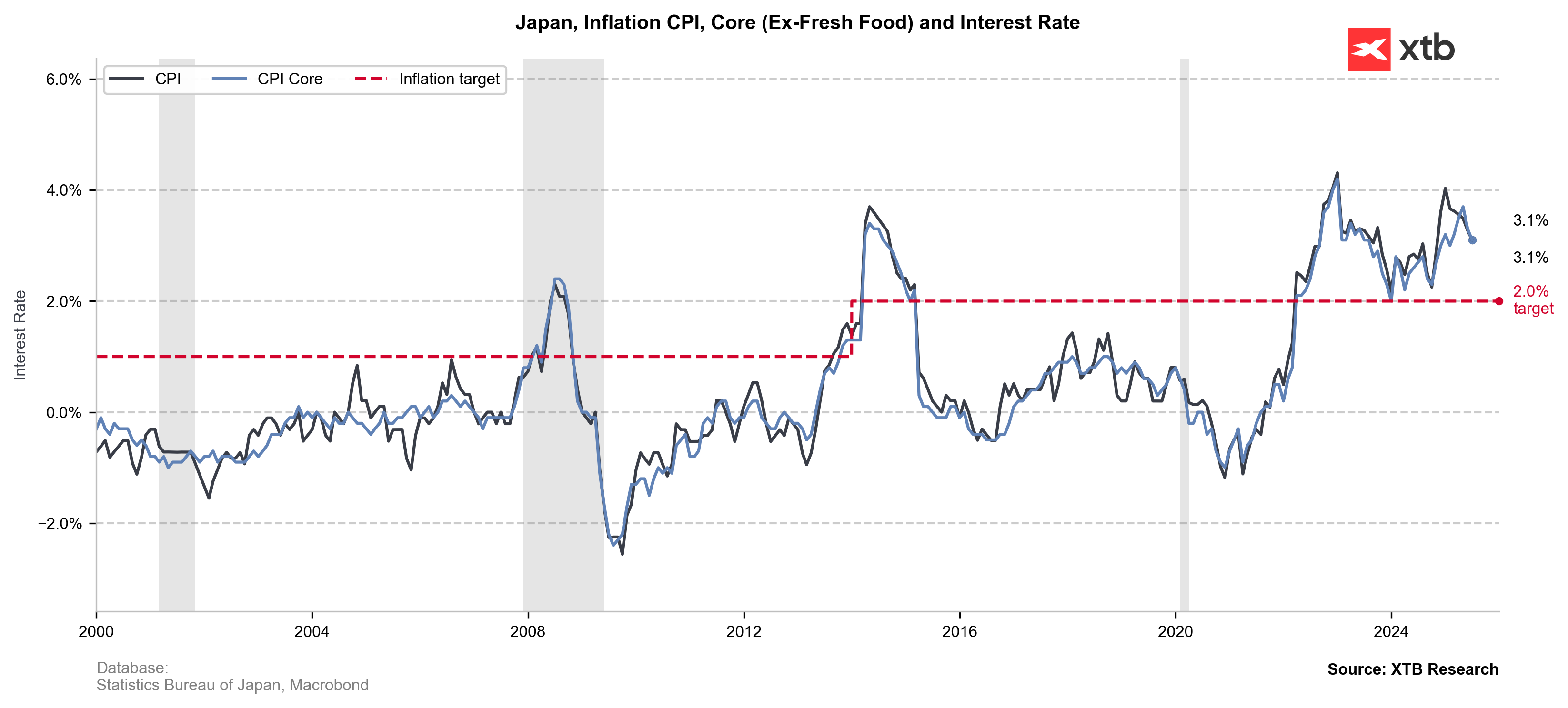

Inflation has been above 2% for more than three years. Although there has been some disinflation since February, the level remains high, adding pressure to the BoJ to raise rates. The point supported by advocates of more flexible monetary policy is that the latest reported data shows a 3.1% increase, and surveys project that the new inflation data due this morning will show growth falling to 2.8%.

CPI and CPI core in Japan. Source: XTB

This data, coupled with the trade agreement reached with the US, which reduced overall uncertainty, suggested an interest rate hike at tonight's meeting.

However, those expectations faded earlier this month when Prime Minister Shigeru Ishiba announced his resignation, sparking some concerns about political instability and the possibility that the new administration might prefer a more flexible monetary policy.

Investors believe that Agriculture Minister Shinjiro Koizumi, who officially joined the race for the LDP presidency on Tuesday, is more in favor of rate hikes than his likely rival, Sanae Takaichi, who is considered a proponent of monetary easing and a more flexible fiscal policy. The LDP, the ruling coalition's largest party, will hold its leadership vote on October 4.

Stock Market, Bond, and Yen Performance

The country's stock index, the Nikkei 225, has just broken its all-time high. This is the fifth record so far in September, following four in August. It was also the first time in history that the benchmark index closed above 45,000 points. The Nikkei has risen more than 15% so far this year and nearly 25% in the past 12 months.

This time, it has been boosted by gains in the real estate, technology, and other export-related companies after the Fed's decision to cut rates calmed concerns about the US economic outlook.

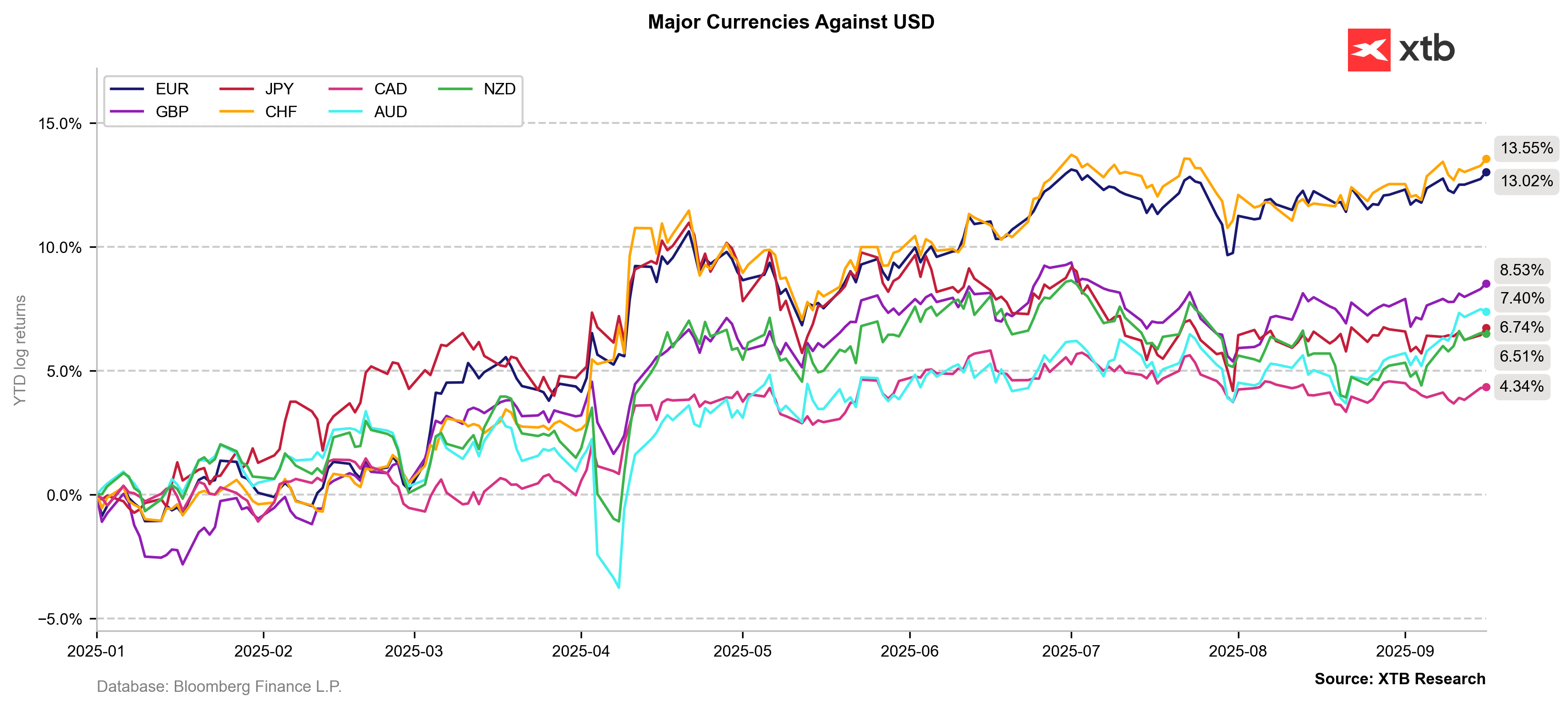

On the currency front, the US dollar has become the scapegoat for Donald Trump's policies. This has caused international investors to seek alternative currencies, as has happened with the Japanese yen, which has accumulated gains of 6.74% since the beginning of the year against the US dollar.

Currency performance against the dollar since the beginning of the year. Source: XTB

Rate cuts by most of the world's central banks could generate further increases in the Japanese currency at a time when it is near key levels closer to 147 on the dollar-yen pair.

Source: Xstation

A rapid appreciation of the Japanese currency could exacerbate the reduction in profit margins for Japanese companies. On the other hand, this would increase inflationary pressure, which could force the Bank of Japan to implement rapid rate hikes.

One of the key aspects of the markets in recent months has been concerns about global fixed income. Political and fiscal uncertainty has pushed up very long-term bond yields. The 30-year bond reached an all-time high of 3.285% earlier this month, amid investor distrust of government policies, high debt levels, and the possibility of rate hikes by the Bank of Japan.

The market now appears to be calming due to the latest auctions, but it could be a one-time event. Japanese 20-year bonds rose after an auction attracted the highest demand since 2020, offering some respite to investors facing heightened political and fiscal risks.

Key Questions at the Meeting

Although the market is 100% pricing in no change in the monetary policy adopted, the subsequent press conference and the explanations offered by Governor Kazuo Ueda will be especially important. Among the key points, we highlight the following:

- What will the next steps be? Currently, there is a 67% probability of a rate hike before the end of the year, with October being the main focus of attention, with a 30% chance of a 25 basis point hike.

- Is politics influencing decision-making? The central bank is unlikely to discuss the implications of Ishiba's resignation as it seeks to reassert its independence from the government. Still, the political impact will likely be part of the meeting.

- How will the Fed's decision influence the Fed? Decisions made by the world's most important central banks have repercussions for the rest of the world. While the next move in Japan should be a rate hike, the US is expected to see two additional rate cuts later this year

Economic calendar: US CPI in the spotlight (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.