- Cautious, data-driven approach to future rate cuts

- Confidence in ongoing disinflation process

- Optimistic outlook on eurozone recovery

ECB President Christine Lagarde emphasized a cautious, data-driven approach to monetary policy, indicating that further rate cuts will depend on incoming economic data. She highlighted the ECB’s ongoing efforts to address inflation and the need for flexibility, warning against any pre-set strategies for rate cuts. Despite recent disinflationary trends, Lagarde remains cautious, noting that while the ECB could ease its restrictive stance, any decisions would be made cautiously and based on evolving economic conditions.

Similarly, ECB Chief Economist Philip Lane expressed optimism about the eurozone's economic recovery, citing strong wage growth and ongoing disinflation as positive signs. While some data raised concerns about growth, Lane reaffirmed the ECB’s confidence in the overall recovery, ruling out a dramatic weakening of the economy. Both officials underscored the ECB's commitment to adjusting policy based on economic developments, focusing on managing inflation while supporting recovery.

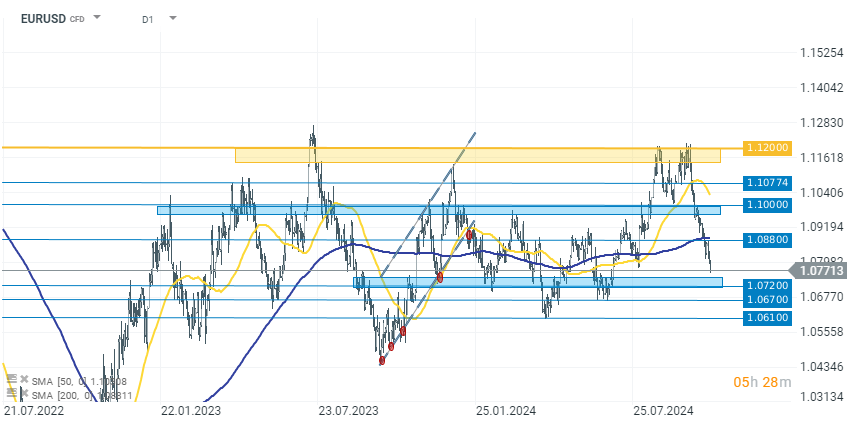

EURUSD (D1 interval)

Although the EUR is one of the stronger currencies today, demand for USD is even higher. As a result, the EURUSD pair is down 0.25% today, reaching 1.07700. As shown in the chart, the recent attempt to break above 1.1200 was unsuccessful, and since then, the rapidly strengthening dollar has pushed the EURUSD rate back down into the consolidation channel. The nearest support level for the current downward movement could be around 1.07200.

Source: xStation 5

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?

Chart of the Day: EURUSD after data from Europe and weaker US labor market

Economic calendar: Canadian labor market and Michigan Index (06.02.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.