- China unlikely to benefit much from the PhaseOne

- Europe mired in manufacturing slowdown

- US Fed not willing to deliver more cuts

Asia – PhaseOne trade deal could have minimal impact

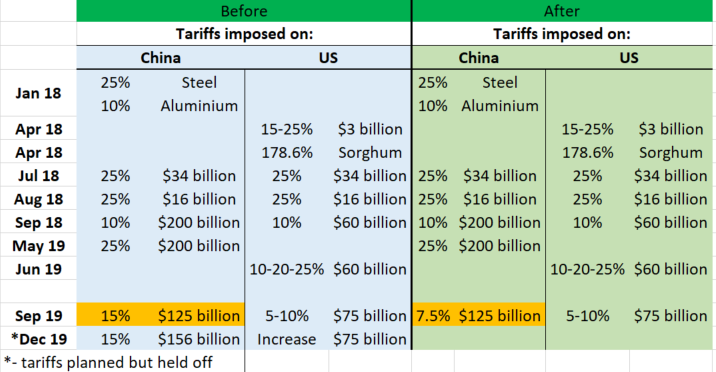

The PhaseOne China-US trade deal has been much hyped on the markets and in the media and there can be impression that it will bring major economic benefits. Do not hold your breath for them. China will see only a minimal bump in exports that could easily be dissolved by other factors (like a persistent manufacturing slowdown) as halving tariffs (15 to 7.5%) on $120bn of imports (mostly clothes) could maybe result in additional $10bn of exports. If China increases its imports from the US by $100bn annually, as it has promised, it could drive US output noticeably but we just cannot see how it could deliver on a promise of nearly doubling (!) imports from the US right away (and with some tariffs still in place). For that reason, markets may soon start having second thoughts about the deal and trade uncertainty is likely to stay with us in 2020.

Effective decline in tariffs on China will be minimal. Source: XTB Research

Effective decline in tariffs on China will be minimal. Source: XTB Research

Key economic event this week: Bank of Japan decision (Thursday)

Europe – manufacturing weakness persists

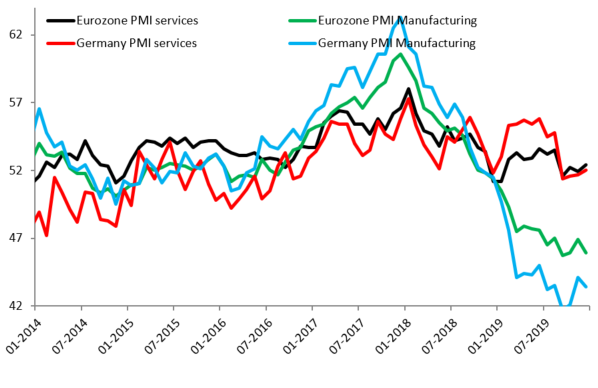

There was a lot of hope on the markets that manufacturing crisis that’s been especially severe in Germany is slowly going away. The latest data pour some cold water on these expectations. PMIs in both Germany and France slid, defying expectations. In Germany the pace of new orders contraction is the lowest in months but the overall index is still in the recessionary territory. Another weak reading in Japan (8th month of sub-50 prints) mean the plight remains global in nature and the drop in UK to multiyear low means some Brexit clarity might not be enough to kick-start growth.

After some hopes last month, December’s PMIs disappoint again. Source: Macrobond, XTB Research

After some hopes last month, December’s PMIs disappoint again. Source: Macrobond, XTB Research

Key economic event this week: Bank of England decision (Thursday, 12:00 pm GMT)

US – Fed refuses to cut rates

The US Fed has maintained interest rates unchanged at the December meeting and has pretty much ruled out further moves – up or down – for many months ahead. On one hand, it’s a good news for indices, as the bar for higher rates now seems to be very high. On the other hand, it means that a major correction would be necessary for the Fed to deliver another hand. This stance could technically support the US dollar but abundant repo operations (and corresponding balance sheet expansion) change this arithmetic and the US currency could be losing in weeks ahead.

With US indices at all-time highs the Fed has little incentive to cut rates. Source: xStation5

With US indices at all-time highs the Fed has little incentive to cut rates. Source: xStation5

Key economic event this week: PCE inflation (Friday, 3:00pm GMT)

Three Markets to Watch Next Week (30.01.2026)

Market wrap: European indices outperform US stocks ahead of the opening bell on Wall Street 📉

Economic calendar: markets await Trump’s official Fed chair nomination 🔎

Morning wrap (30.01.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.