Markets love monetary easing. There’s a broad consensus that a 11-year old bull market on Wall Street has been greatly supported by the Fed’s unorthodox measures. Many have started to believe that central banks can bail markets from any trouble. Now that the FOMC has just delivered an emergency 50 bps cut the question is urgent more than ever: can they?

Fed to the rescue

On the last trading day of February the Fed issued a laconic statement saying that the US economy was in a good shape and the Bank was monitoring the virus to see if there’s any impact. On Tuesday , it delivered an emergency, 50 basis point (a standard move is 25 basis points) cut. That’s a major change of heart over just few days, the Fed is suggesting that something could be serious and delivers a serious response. Normally, markets love easing. Last year when the Fed delivered 3 rate cuts and quasi QE on minor economic slowdown, it helped stock markets a lot. Little wonder, the first reaction to the Tuesday move was positive. But what if the emergency cut spells troubles ahead? Doesn’t such a quick change of narrative from the Fed suggest panic at the central bank?

What the history tells us

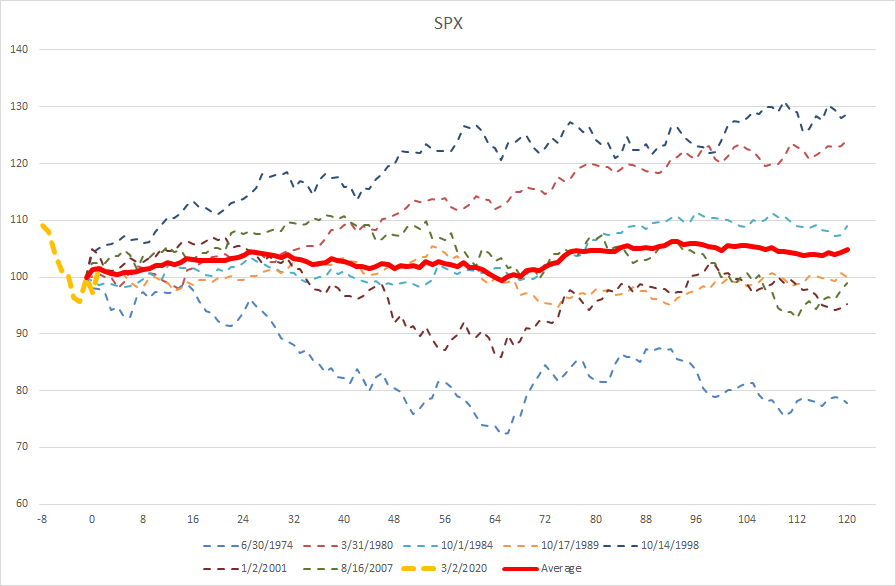

This is not the first time when the Fed delivers an emergency or outsized cut. Dot com burst, LTCM collapse, banking crisis - we saw these actions on many occasions. This allows us to track market responses to these actions. We selected 7 such responses over the past 50 years. There were more, but since some extraordinary moves occurred multiple times during a single crisis (for instances, 3 times during the global financial crisis), we only chose the first response because now it’s also the first time when the Fed makes such decision. What are the results? Quite strange indeed. The first month results in an average gain of 1% for the S&P500 (US500) as traders welcome the stimulus. The first 3 months have a negative return of 1.25% which means that the problem settled and the first reaction was more than reversed. However, the annual return from the cut is more than 5% on average suggesting that the action was successful after all.

Inconclusive: FOMC emergency cut on its own is not a recipe for a bull market. Source: Bloomberg, XTB Research

Inconclusive: FOMC emergency cut on its own is not a recipe for a bull market. Source: Bloomberg, XTB Research

Having said that, one needs to be very careful with such interpretation and study these cases separately. We can see that two big rallies that were also very consistent occurred in 1980 and 1998. The second case is very straightforward – the Fed cut was a response to the LTCM collapse and while there was no fundamental problem in the economy (not yet) the tech rally continued relentlessly. In 1980 where the fundamental situation was disastrous the rally occurred after a big slump from 1979 (not the case at present) and ahead of another tumble in 1981. The biggest culprit is 1974, the oil crisis, while the markets also went down in 2001 and 2007 but in these situations that was only a prelude to the real bear market.

Traders should watch the virus spread, not the FOMC

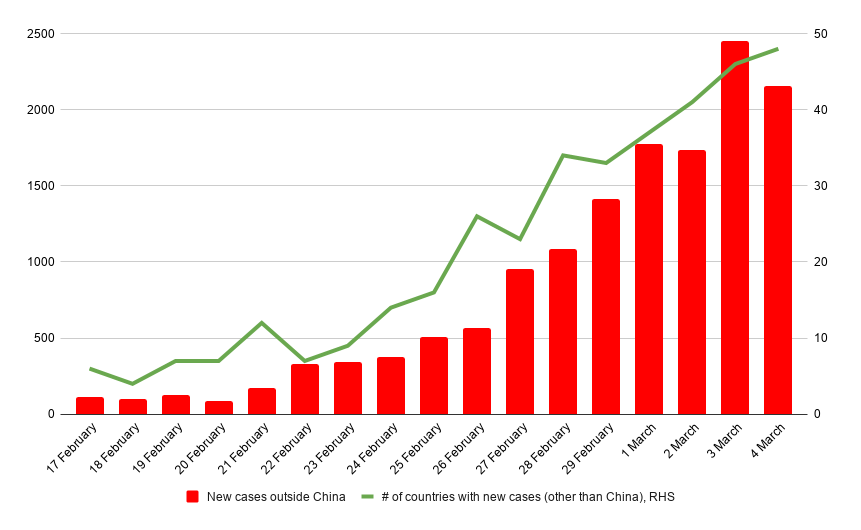

There’s one conclusion from the above – the FOMC cut does not stop the bear market if the underlying problem is really serious. Is it the case right now? We do not know it for sure yet. If US and Europe are forced to implement the Chinese style restrictions (that led to -80% car sales in February – just as an example) the case would be very serious. Which is why traders should track the virus spread data that we share everyday in the “Market Wrap”, the first research post on the xStation platform.

The virus spread has been rapid so far. Source: Worldometers, XTB Research

The virus spread has been rapid so far. Source: Worldometers, XTB Research

Watch out for gold

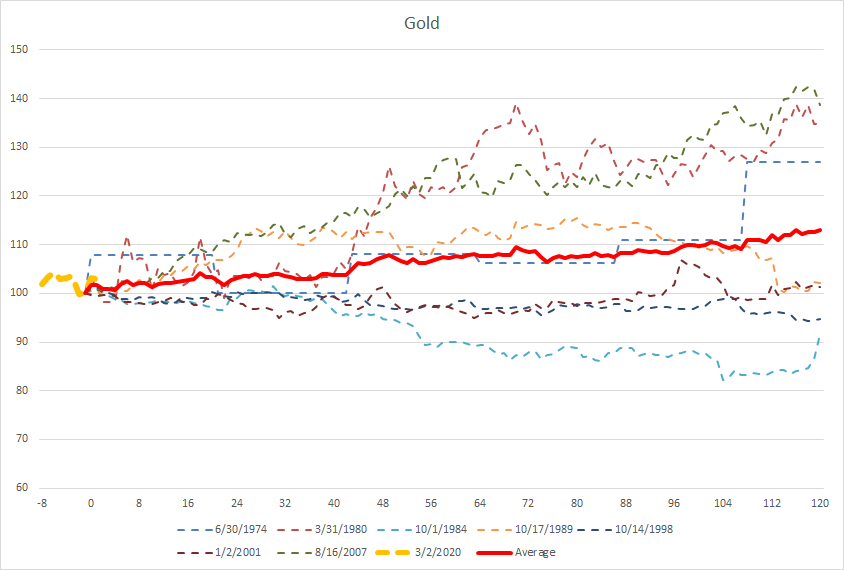

One thing that should be added is that the response of gold prices has been more consistent on average. A factor that should be noted now, when central banks seem to be losing their credibility.

Gold prices rose over 10% in 6 months following 7 past emergency rate cuts. Source: Bloomberg, XTB Research

Gold prices rose over 10% in 6 months following 7 past emergency rate cuts. Source: Bloomberg, XTB Research

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.