- McDonald's withstands the storm in the sector

- Traffic from low-income consumers is plummeting

- McDonald's withstands the storm in the sector

- Traffic from low-income consumers is plummeting

McDonald's shares rise 3% after the company reported mixed results for its third quarter of 2025. Investors are viewing the comparable sales performance positively in an environment where the sector is struggling to grow.

Key figures from McDonald's Q3 2025 results

- Total revenue: $7,078 million, +3% year-over-year and -0.36% compared to consensus

- EBIT: $3,357 million, +5% year-on-year

- Adjusted earnings per share: $3.22, 0% year-over-year and -3% compared to consensus

McDonald's holds its own in a challenging market environment

McDonald's shares rose at the start of trading after the company released its third-quarter results. McDonald's reported revenue growth across all segments. Global comparable sales increased 3.6% year-over-year in the third quarter of 2025, primarily driven by a 4.7% increase in revenue from its international franchised business. It's important to note that this metric excludes new store openings, making it a more accurate reflection of revenue growth per store. This demonstrates healthy growth for a mature company in a challenging competitive environment where many industry players are opting for price reductions. Furthermore, both company-owned and franchised international businesses saw growth of 2.4% and 4.3%, respectively. Meanwhile, total sales, including both company-owned and franchised locations, increased 6% at constant exchange rates.

What is McDonald's doing?

As Chipotle noted in its earnings presentation, McDonald's also points out a decline in traffic from lower-income consumers in the United States, falling by double digits according to the company. Meanwhile, traffic from higher-income consumers increased by double digits during the quarter, helping to offset the drop from lower-income consumers. In response, the company is launching special products at lower prices to try to maintain market share. Furthermore, it is also focusing on expanding its beverage segment, launching cold brew coffees and refreshing fruit drinks, directly targeting Starbucks, which is currently experiencing difficulties. It is a way to diversify revenue but also to compensate the weakness of the sector.

Profit growth has been slower than sales due to increased interest expenses and higher taxes, but operationally we can say that McDonald's has had a solid quarter.

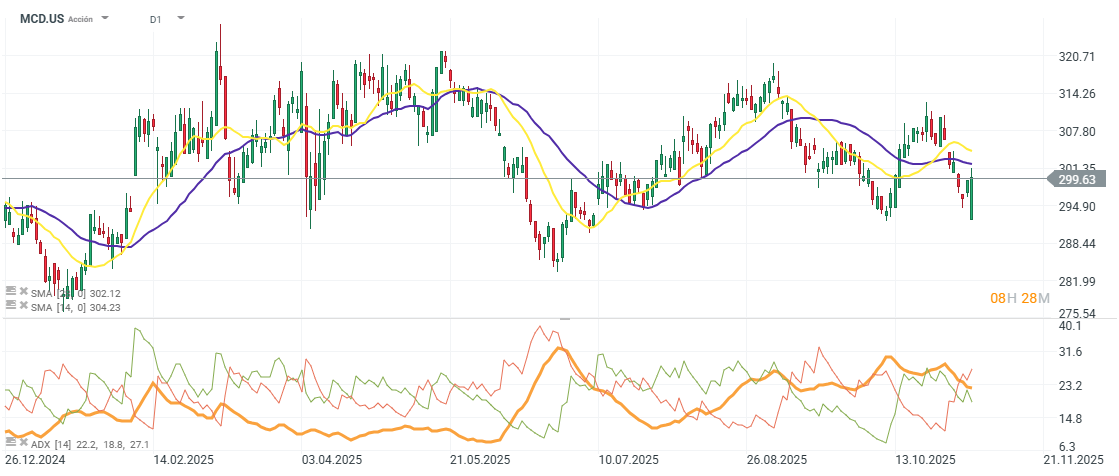

McDonald's shares barely rise 3% in the year, but continue to trade at a multiple above 25 P/E.

Source: xStation5

Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.