Microsoft (MSFT.US) traded 3% lower yesterday in the after-market session following the release of fiscal-Q4 2023 earnings (calendar Q2 2023). Results were not that bad but have hinted that growth in some key parts of Microsoft's business is slowing. Let's take a closer look at earnings release from Microsoft!

Results mostly in-line, cloud growth slows

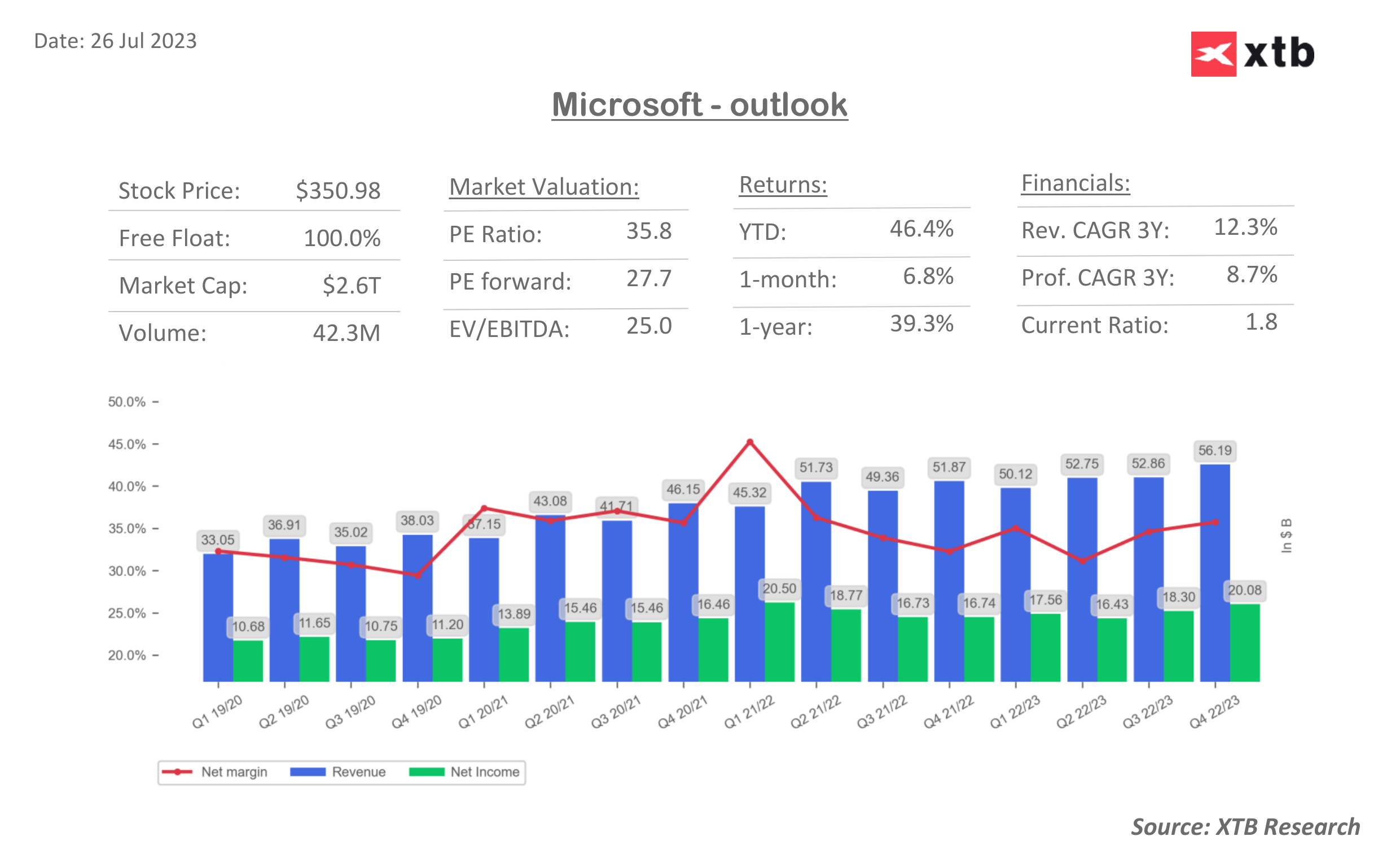

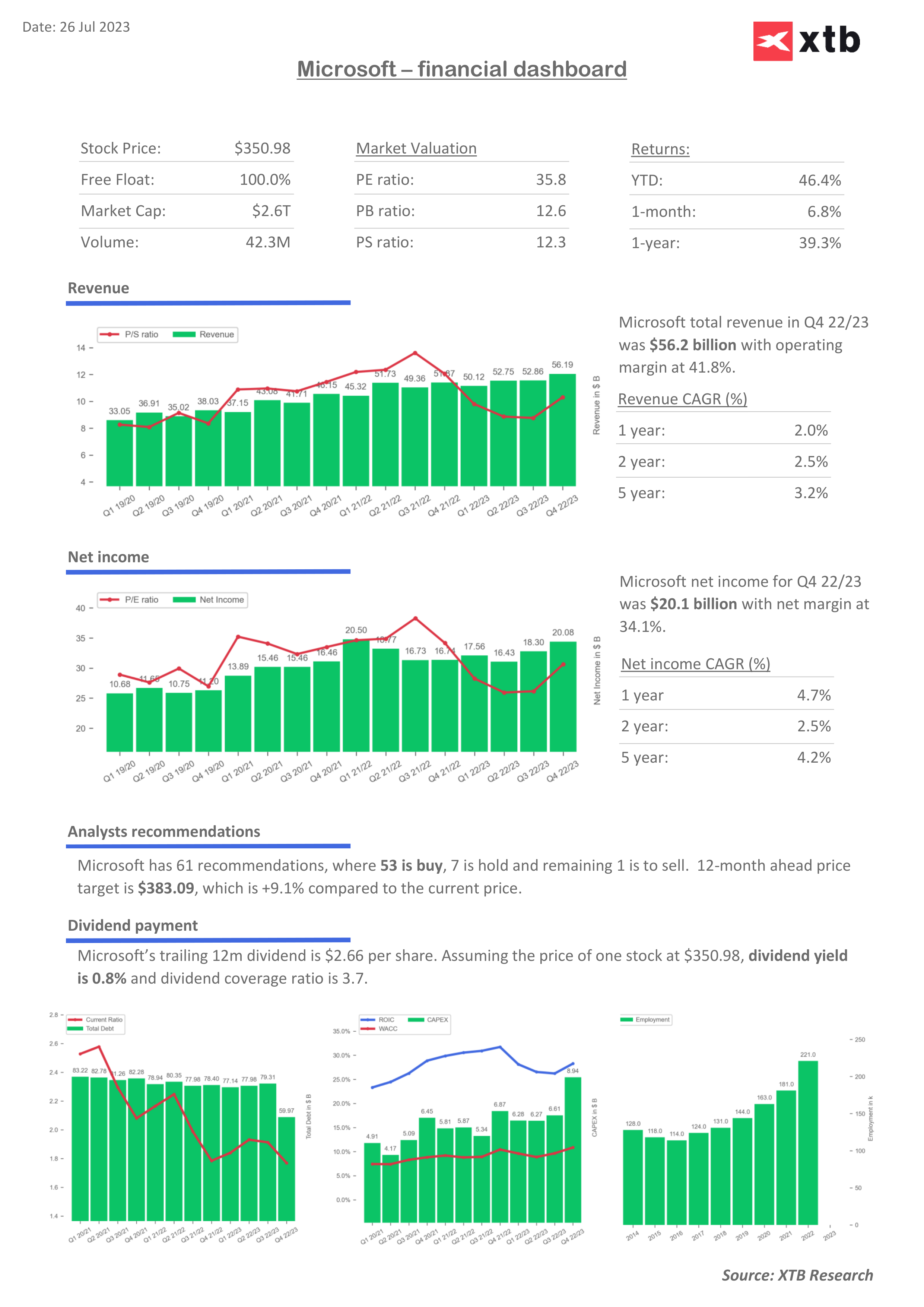

Microsoft results for fiscal-Q4 2023 (April - June 2023) were mostly in-line with market expectations. Total revenue grew by 8.3% YoY, slightly more than expected. This was driven by solid performance of the Intelligent Cloud segment. Total cloud sales reached $30.3 billion during the quarter and were 21% YoY higher. Growth in Microsoft's Azure Cloud at constant currency reached 27% during the quarter. While this is a slowdown, pace of deceleration begins to moderate and it is seen as a positive. Capital expenditure was much higher than expected during the quarter but it is expected to ease after a few years of rising investments, in spite of Microsoft rolling out and boosting its AI offering.

Fiscal-Q4 2023 results

-

Revenue: $56.19 billion vs $55.49 billion expected (+8.3% YoY)

-

Productivity and Business Processes: $18.29 billion vs $18.1 billion expected (+10% YoY)

-

Intelligent Cloud: $23.99 billion vs $23.8 billion expected (+15% YoY)

-

More Personal Computing: $13.91 billion vs $13.58 billion expected (-4% YoY)

-

-

Microsoft Cloud revenue: $30.3 billion vs $30.05 billion expected (+21% YoY)

-

EPS $2.69 vs $2.56 expected ($2.23 in fiscal-Q4 2022)

-

Operating income: $24.25 billion vs $23.28 billion expected (+18% YoY)

-

Net income: $20.1 billion (+20% YoY)

-

Capital expenditure: $8.94 billion vs $7.85 billion expected

-

Revenue at constant currency: +10% vs +8.52% expected

-

Capital distribution: $97 billion

Full fiscal-2023 highlights

-

Total revenue: $211.9 billion (+7%)

-

Operating income: $89.7 billion (+8%)

-

Net Income: $73.3 billion (+6%)

-

EPS: $9.81 (+7%)

-

Microsoft Cloud revenue above $110, up 27% at constant currency

Bleak forecast for fiscal-Q1 2024

While analysts are upbeat that deceleration in cloud is moderating, turnaround may still be some time away. Company expects total revenue in fiscal-Q1 2024 (July - September 2023) to grow around 8% YoY, to $53.8-54.8 billion. While this is in-line with fiscal-Q4 2023 revenue growth, the market's forecast of $54.94 was above the top range of the company-provided forecast. Microsoft expects growth in Azure cloud to slow further this quarter, to 25-26%. That's down from 27% in fiscal-Q4 2023 and 42% in fiscal-Q1 2023. While Microsoft said that it has over 11,000 clients for its Azure OpenAI product already (an increase from 4,500 in mid-May), increase in revenue from AI products are likely to materialize gradually.

Fiscal-Q1 2024 forecasts

-

Revenue: $53.8-54.8 billion vs $54.94 billion expected (+8~% YoY)

-

Azure growth at constant currency: 25-26% YoY

A look at the chart

Shares of Microsoft (MSFT.US) trade around 3.5% lower in premarket today. Stock reached the $350 resistance zone yesterday but failed to break above. Shares currently trade near $339 in pre-market - below 200-hour moving average (purple line) but above a short-term uptrend line. A support zone to watch can be found in the $335 area, where previous price reactions as well as the aforementioned trendline can be found.

Source: xStation5

Source: xStation5

Microsoft - financial dashboard

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Economic calendar: NFP data and US oil inventory report 💡

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.