-

Wall Street indices finished yesterday's trading lower but off the session lows. S&P 500 and Nasdaq dropped 0.8%, Dow Jones declined 1.1% and Russell 2000 plunged almost 1.8%

-

Sell-off was triggered by jump in US yields and strengthening of USD following release of solid data from the US yesterday, especially blockbuster ADP report

-

Indices from Asia-Pacific traded lower today - Nikkei dropped 0.8%, S&P/ASX 200 moved 1.6% lower, Kospi declined 1.3% and Nifty dropped 0.4%. Indices from China traded slightly lower

-

DAX futures point to a more or less flat opening of the European cash session today

-

ECB President Lagarde said that inflation began to decline and it is the initial impact of monetary policy decisions. Nevertheless, she stress that there is still work to do as inflation remains above 2% target

-

Uchida, Bank of Japan Deputy Governor, said that yield curve control programme will be continued for the time being as it helps continue easy monetary conditions

-

World Gold Council said that it expects gold to be solid performer in H2 2023 as well as central banks in developed countries are nearing the end of the tightening cycle and USD weakens

-

According to UBS, investors are overestimating Fed's ability to achieve soft landing for US economy and because of that risk-reward outlook is more promising in fixed income over equities

-

Japanese household spending dropped 4% YoY in May (exp. -2.5% YoY)

-

Threads, Twitter-rival app developed by Meta Platforms, attracted over 50 million users within the first day after launch

-

Major cryptocurrencies are trading mixed - Bitcoin gains 0.1%, Dogecoin drops 0.1%, Ethereum declines 0.7% and Ripple adds 0.5%

-

Energy commodities are trading higher - oil gains 0.5% while US natural gas prices rise 0.1%

-

Precious metals benefit from today's USD weakening - gold gains 0.2%, silver trades 0.1% higher and platinum jumps 0.5%

-

NZD and JPY are the best performing major currencies while CAD and USD lag the most

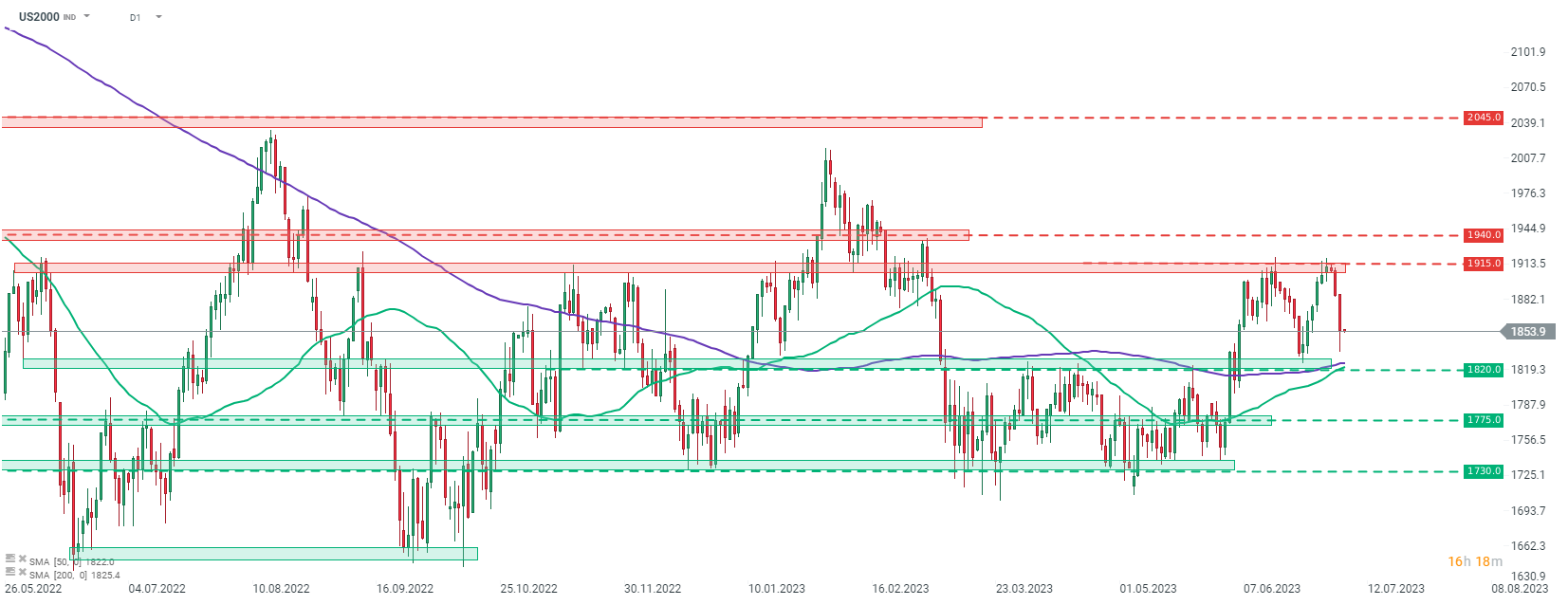

Small-cap Russell 2000 (US2000) was the worst performing major Wall Street index yesterday. Index deepened recently launched pullback and moved close to the 1,820 pts support zone, which is a neckline of the double top pattern. Source: xStation5

Small-cap Russell 2000 (US2000) was the worst performing major Wall Street index yesterday. Index deepened recently launched pullback and moved close to the 1,820 pts support zone, which is a neckline of the double top pattern. Source: xStation5

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

📈Wall Street rebounds, VIX slips 5% 🗽What does US earnings season show us?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.