-

Tuesday's session on Wall Street saw declines in US indices. The Nasdaq lost 1.14% and the S&P500 fell 1.16%, closing the session below its 50-day EMA.

-

Asia-Pacific (APAC) markets traded in a weaker mood today, mimicking the momentum of yesterday's US session. Japan's Nikkei 225 is currently losing nearly 1.22%, the Hang Seng index is subtracting more than 1.36% and Korea's KOSPI is down 1.65%.

-

Futures based on the German DAX and the European benchmark Eurostoxx point to a lower opening in today's European cash session.

-

The RBNZ kept interest rates unchanged as expected and reiterated that the OCR rate will need to remain restrictive for the foreseeable future.

-

Zhongrong International Trust Co. has missed payments on dozens of products and has no immediate plan to repay customers, indicating that the troubles of the US$138 billion-plus Chinese financial giant are more serious than previously expected. The corporation has short-term liquidity problems.

-

Tesla is slashing prices for the Model S and Model X in the Chinese market. Yesterday, a similar decision was made for the Y models.

-

JP Morgan has lowered its forecast for China's 2023 GDP after weak macro data this week. The new expectation is +4.8% compared to the last forecast published in May of 6.4%.

-

Wells Fargo forecasts a rise in US inflation in the second half of 2023, which is expected to encourage the FOMC to raise interest rates further

-

Data from Australia - the twelfth consecutive negative reading of the momentum of the leading indicators index.

-

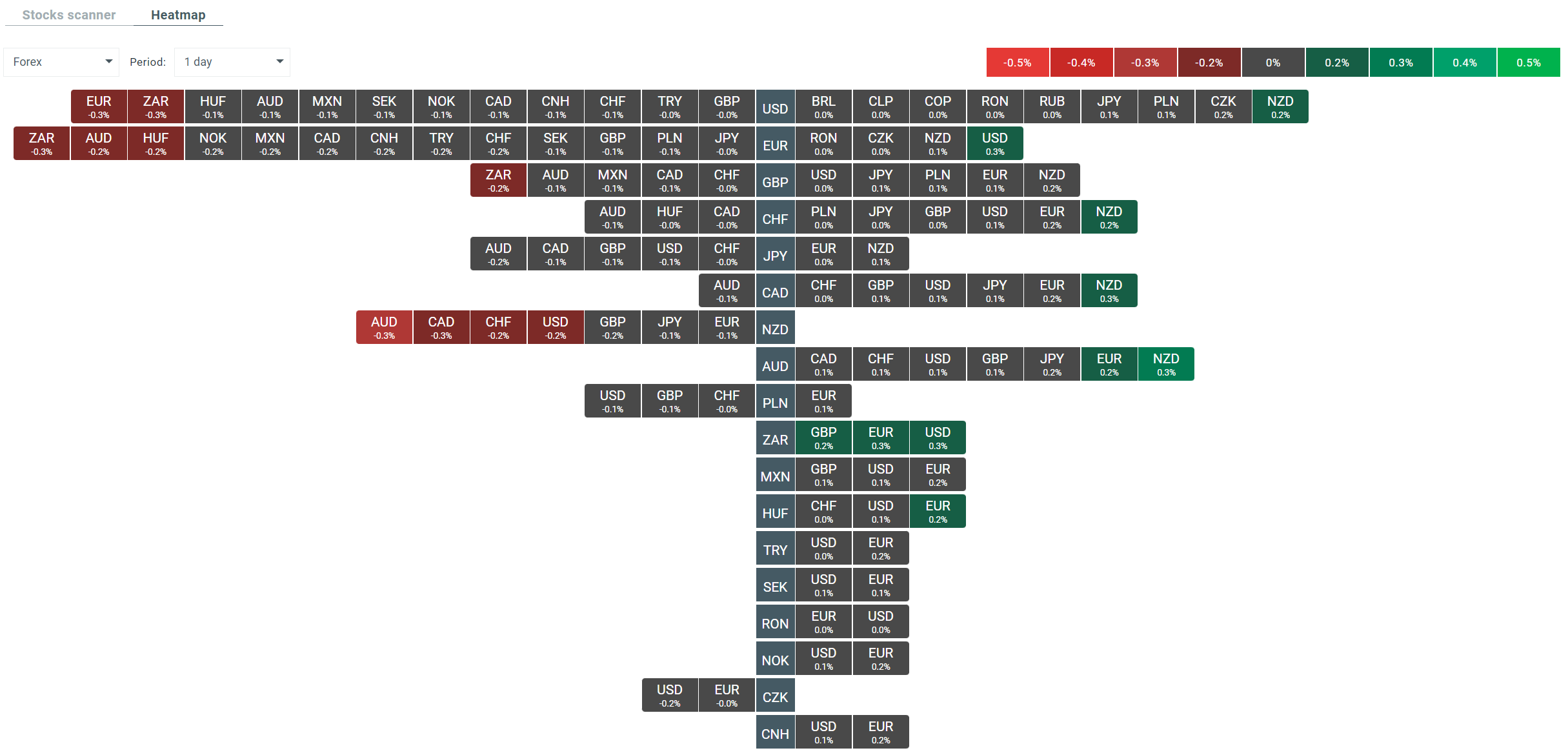

In the FX market, we are currently seeing mild gains in EURUSD, however, the USDIDX index remains above the 103.00 zone. The New Zealand dollar is currently seeing the biggest gains in the broad market, while the Australian dollar is under pressure.

-

Data from the API private oil inventory survey shows a much larger decline in oil stocks than expected. On the other hand, the start of the European session brings declines in energy commodities, with WTI crude oil losing nearly 0.6%.

-

Bitcoin and gold are trading close to important support levels, the $29 000 and $1 900 barriers respectively.

-

The most important macro readings of the day will be the UK inflation report, the GDP and unemployment rate readings in the euro area, as well as the FOMC Minutes

Heatmap showing current volatility in the FX market and specific currency pairs. Source: xStation 5

BREAKING: US100 ticks lower 📊US NFP report much weaker than expected

Economic Calendar - All Eyes on NFP (06.03.2026)

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.