-

US indices finished yesterday's trading lower as higher-than-expected US PPI reading for January added to inflation concerns. S&P 500 dropped 1.38%, Dow Jones moved 1.26%, Nasdaq plunged 1.78% and Russell 2000 dropped 0.98%

-

Indices from Asia-Pacific followed into footsteps of US peers and traded lower today. Nikkei dropped 0.7%, S&P/ASX 200 traded 0.9% lower, Kospi declined 1% and Nifty 50 traded 0.3% down. Indices from China traded up to 1% lower

-

DAX futures point to a lower opening of the European cash session

-

US President Biden said that he expects to speak with Chinese counterpart, Xi Jinping, soon. However, relations between China and the United States are strained following the shooting down of a Chinese balloon. Moreover, Financial Times reports that senior Pentagon official will make a trip to Taiwan what is unlikely to brighten up relations between China and the US

-

Fed Mester said that recent data shows demand not softening as expected. She also said that Fed will have to go above 5% and keep rates there for a while

-

RBA Governor Lowe said that if "things go right" rate cuts could come as soon as 2024. However, Lowe also said that rate hike cycle in Australia is not over yet as inflation remains high and damaging

-

Shinichi Uchida, Bank of Japan official, said that BoJ decided to launch a pilot central bank digital currency (CBDC) this April. Program will be aimed at testing technical feasibility of such solutions

-

New Zealand Finance Minister Robertson say that there is evidence suggesting that inflation has peaked already

-

Saudi Energy Minister bin Salman said that the output deal struck in October will remain in place for the full 2023. He also said that he is skeptical about quick pick-up in Chinese demand following economic reopening

-

While decent gains can be spotted on most altcoins, major cryptocurrencies are lagging behind. Bitcoin drops 1.5%, Ethereum trades 0.5% higher, Litecoin declined 0.4% and Ripple trades 0.5% down

-

Energy commodities trade mixed - oil drops around 0.5% while US natural gas rallies 4%

-

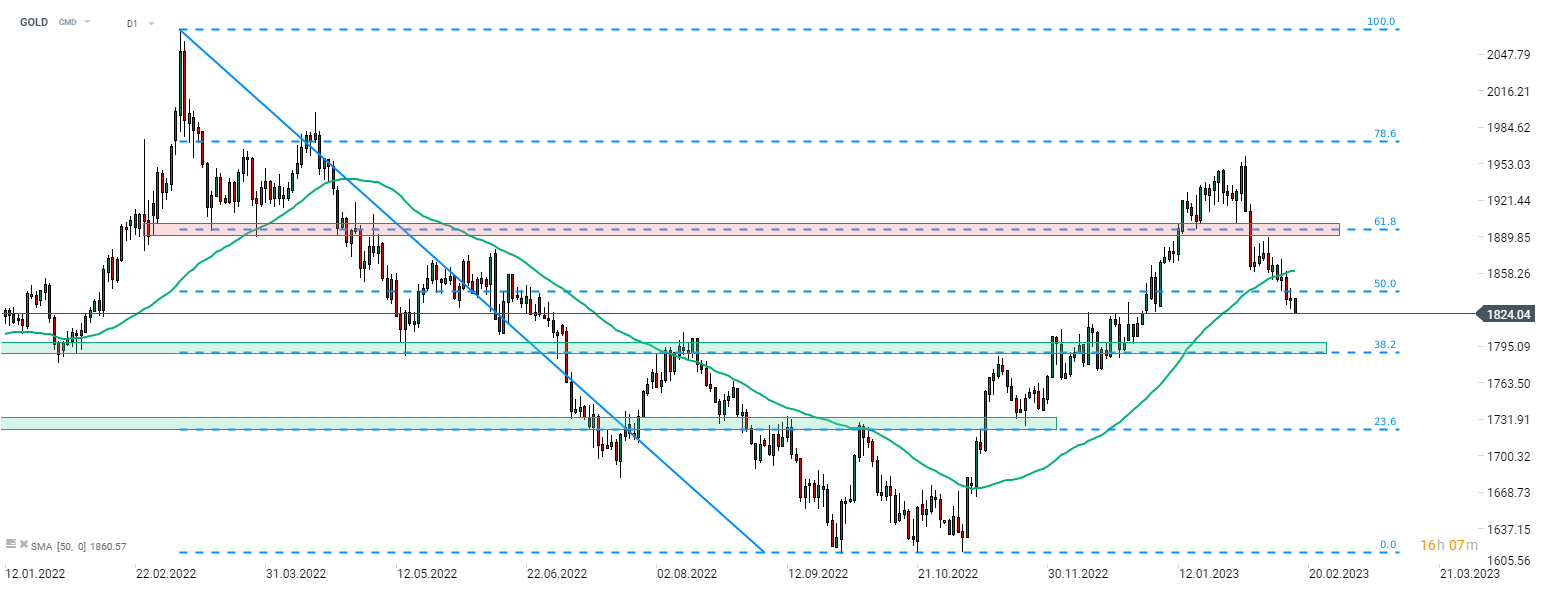

Precious metals are pulling back as USD strengthens - gold drops 0.6% and silver trades 0.8% down

-

USD and CAD are the best performing major currencies while JPY and NZD lag the most

Strong USD, driven by hawkish Fed speakers, is putting a break on the recent gold market rally. GOLD has already pulled back around 7% off a recent high. Source: xStation5

Strong USD, driven by hawkish Fed speakers, is putting a break on the recent gold market rally. GOLD has already pulled back around 7% off a recent high. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

NATGAS muted amid EIA inventories change report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.