-

US indices finished yesterday's trading mostly lower. S&P 500 dropped 0.03%, Nasdaq declined 0.58% and Russell closed 0.74% lower. Dow Jones gained 0.29%

-

Stocks in Asia declined. Nikkei closed 0.19% lower while S&P/ASX 200 finished flat. Kospi trades 1.2% lower and indices from China decline during the first trading session after Lunar New Year

-

DAX futures point to a flat opening of the European session

-

FOMC minutes showed that central bankers think it will take some time to meet conditions to taper QE

-

Pfizer said that new data showed 1 dose of its coronavirus vaccine to be 93% effective after 2 weeks and urged countries to switch to single dosing. Moderna said that its vaccine works against all variants of the virus but results for South African strain are not clear

-

White House said it is engaged in addressing chip shortages on the automotive market

-

Draghi's government won confidence vote at the Italian Senate

-

Brent jumped above $65 as the energy crisis in the United States worsens. Texas authorities banned natural gas companies from exporting fuel outside of the state. US oil has dropped by almost 40% amid temporary shutdowns

-

Australian dollar gained following release of employment report for January. Employment increased 29.1k (exp. 40k) while unemployment rate dropped to 6.4% (exp. 6.5%)

-

API data showed 5.8 million barrel decline in the US oil inventories (exp. -2.2 mb)

-

Bitcoin trades slightly below $52,000 mark

-

Precious metals gain with silver being the exception

-

AUD and EUR are top performing major currencies while NZD and CHF lag the most

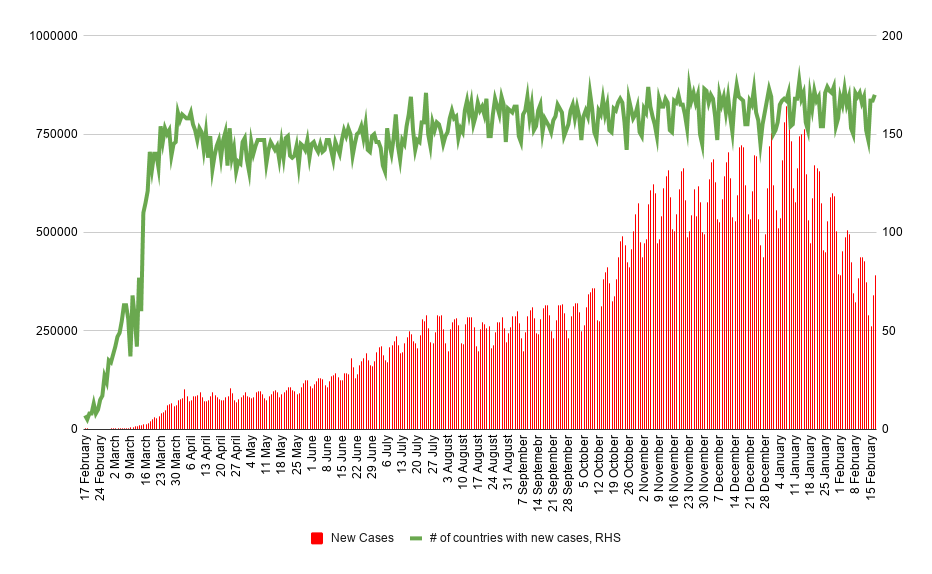

Over 390 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Over 390 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.