Source: BoJ

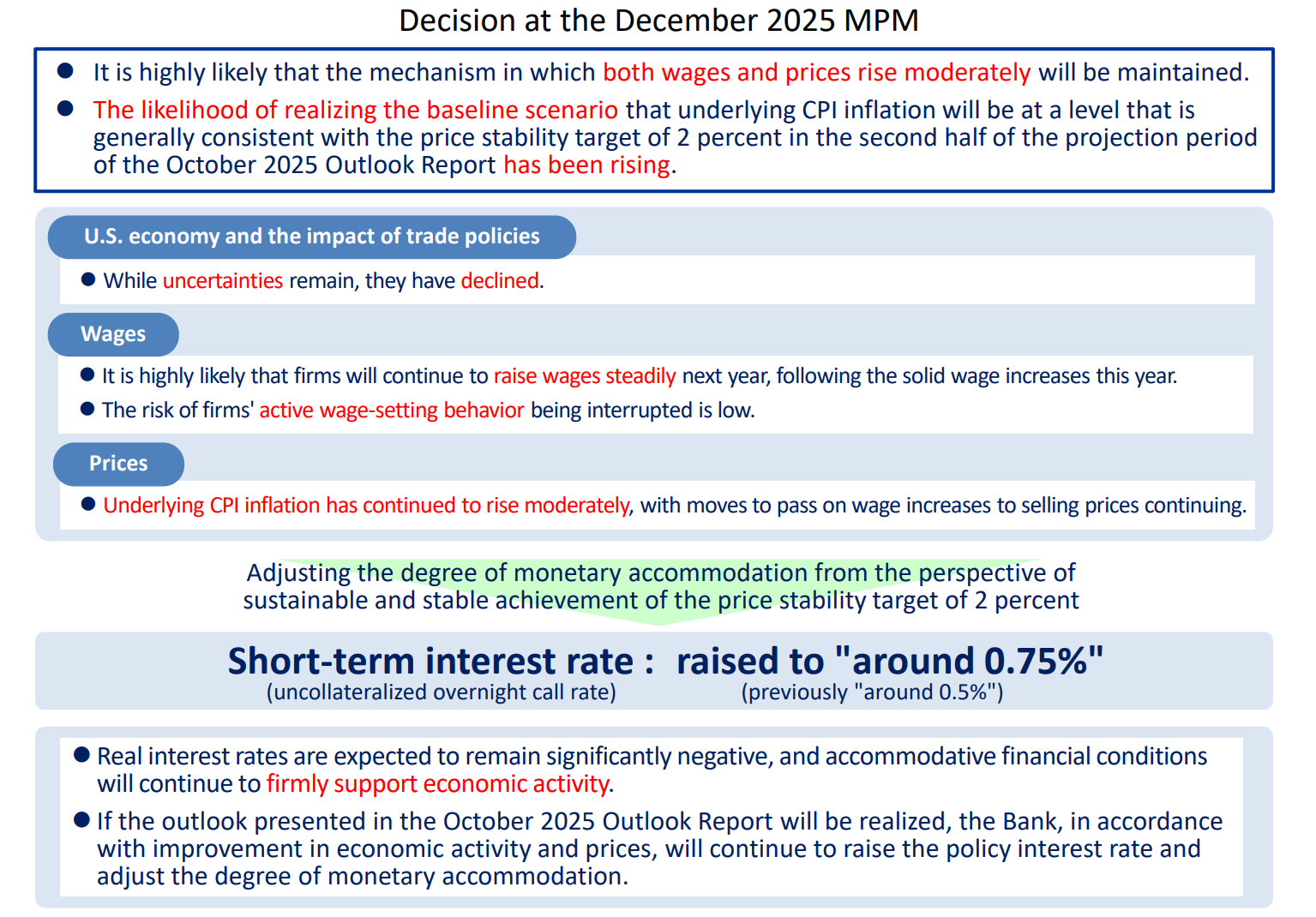

- The Japanese central bank raised its short-term interest rate by 25 basis points to 0.75% (the highest level since 1995). This decision was in line with expectations, hence the relatively limited reaction on the Japanese yen, which, however, lost ground to the dollar immediately after the decision. The USDJPY pair is currently trading in the 156.00 range, its highest level since December 12. At the same time, the JP225 contract is up 0.85%.

-

However, the Bank of Japan stated in its announcement that real interest rates would remain "significantly negative," adding that favorable financial conditions would continue to strongly support economic activity.

-

Japan's nationwide inflation data for November showed persistent price pressures, reinforcing expectations that the Bank of Japan will continue its gradual normalization of monetary policy. November, consumer prices rose 3.0% year-on-year, in line with market expectations and marking another month of inflation well above the Bank of Japan's 2% target. The index excludes fresh food prices but includes energy, making it one of the most closely watched indicators of underlying inflation trends.

-

The decision was unanimous, although the statement revealed divergent views on inflation dynamics. The bank reiterated that it would continue to raise interest rates if the economy and prices developed in line with forecasts.

-

A press conference with BoJ Governor Kazuo Ueda is scheduled to begin at 7:30 a.m., during which he will comment on today's decision. Below are the most important comments from bankers included in the communication following the decision.

- At the same time, the Trump administration is initiating a review to allow the potential sale of advanced Nvidia H200 chips to China, with the US government receiving 25% of the sales revenue to reduce China's incentive to develop the technology independently. The decision marks a significant departure from previous export restrictions and aims to maintain US technological superiority by preventing China's inclination to develop domestic chips.

- Futures contracts indicate positive sentiment during today's session. Contracts on European and US indices are recording significant gains (DE40 +0.6%; US100 +0.28%).

- Precious metals are experiencing mixed sentiment. GOLD is currently losing 0.15% in value, while SILVER is resuming its upward momentum.

- We are also seeing a market rebound in Bitcoin, whose prices are currently rising by 1.66%.

Daily Summary: Oil at new local highs; Iran and Trump dampen market sentiment 💡

BREAKING: Stronger-than-expected decline in US gas inventories

ECB Minutes: Peak Impact of Euro Strength on Inflation Yet to Come 🇪🇺

Chart of the day: EURUSD fights to defend key support before ECB minutes 💶 🇪🇺 (05.03.2026)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.