-

US indices experienced a big turnaround yesterday after Joe Biden announced a new sanction package on Russia. S&P 500 gained 1.50%, Dow Jones moved 0.28% higher and Nasdaq rallied 3.35%. Russell 2000 added 2.67%

-

Stocks in Asia gained following a late turnaround on Wall Street. Nikkei gained almost 2%, Kospi moved 1% higher and S&P/ASX 200 finished 0.1% higher

-

DAX futures point to a big bullish price gap at the opening of today's cash session in Europe

-

Biden announced a sanction package that turned out to be much softer than feared. Package included sanctions on major Russian banks but stayed short of banning them from SWIFT system

-

Biden said that US forces will not be deployed in Ukraine

-

The West warned Russia that if aggression in the Ukraine continues to escalate, even more sanctions will be imposed

-

US House Speaker Pelosi said that she wants to provide Ukraine with defense weapons worth $600 million. France will offer €300 million in aid and military equipment to Ukraine

-

Russian military actions in Ukraine continue. Reports of explosions, missile and airborne attacks are surfacing in media but not as often as yesterday

-

According to Sky News report, anywhere between 30 and 60 thousand Russian soldiers are in Ukraine right now

-

Ukraine President Zelensky said that today will be the hardest day and that he believes Putin will us tanks to capture Kyiv

-

Ukrainian Foreign Minister confirmed that rockets have been already fired at Kyiv

-

Hacker collective Anonymous announced that it is now in cyber war with Russia and has taken down the website of Russian propaganda media Russia Today. Annonymous also warned that Russians plan large-scale bombings of Ukrainian capital today

-

Oil and natural gas trade higher

-

Precious metals also advance with gold regaining part of evening drop

-

AUD and NZD are the best performing major currencies while USD and EUR lag the most

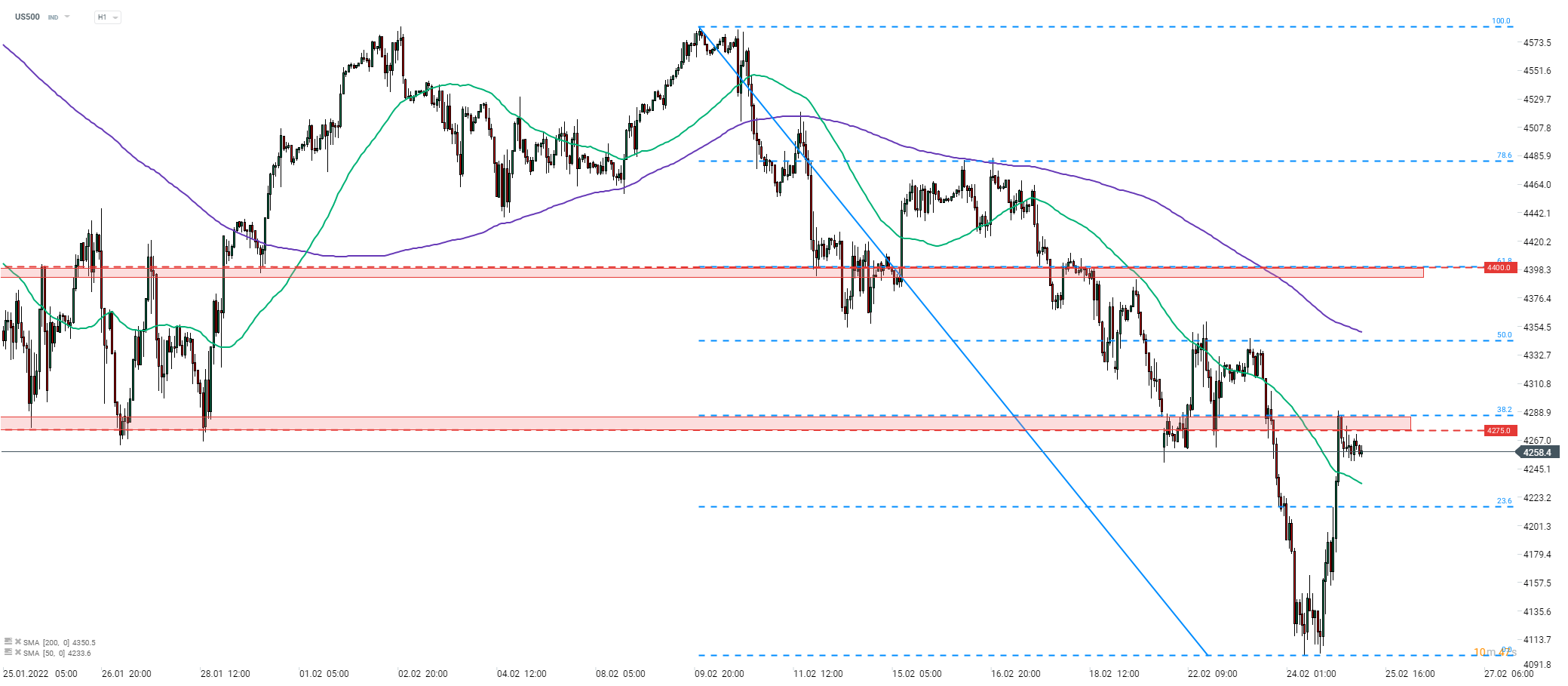

S&P 500 (US500) experienced massive turnaround yesterday in the evening. Sanctions announced by the West turned out to be less severe than feared and it has led to some relief in the markets. US500 bounced off the 4,100 pts area and has climbed to 4,275 pts resistance zone today, marked with 38.2% retracement of recent downward impulse. Source: xStation5

S&P 500 (US500) experienced massive turnaround yesterday in the evening. Sanctions announced by the West turned out to be less severe than feared and it has led to some relief in the markets. US500 bounced off the 4,100 pts area and has climbed to 4,275 pts resistance zone today, marked with 38.2% retracement of recent downward impulse. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.