-

US indices defied global trend and managed to close higher yesterday. S&P 500 gained 0.57%, Dow Jones moved 0.70% higher and Nasdaq gained 1.29%. Russell 2000 added 0.70%

-

Improved moods were presented during the Asian session as well. Nikkei gained 0.5%, Kospi moved 0.4% higher and indices from China traded up to 1.5% higher. S&P/ASX 200 dropped almost 2% (Australian stock exchange was closed yesterday)

-

DAX futures point to a higher opening of the European cash session today

-

Russian Foreign Minister Lavrov said that NATO is fighting proxy war with Russia by arming Ukraine. In spite of recent reports saying that Russia no longer wish to negotiate with Ukraine, Lavrov also said his country will continue to engage in peace talks

-

United Kingdom will remove tariffs on all goods imported from Ukraine

-

Mass testing in Beijing has been extended to a whole city. Previously testing was carried out only in communities that reported local outbreaks

-

IMF sees a risk of bigger slowdown in China and stagflation in the rest of Asia

-

Morgan Stanley lowered China GDP growth forecast for 2022 from 4.6 to 4.2% due to Covid disruptions

-

Japanese unemployment rate dropped from 2.7 to 2.6% in March (exp. 2.7%)

-

Twitter accepted Elon Musk's offer and will be bought for $54.20 per share. Twitter will be taken private once the deal is completed. Stock jumped 5.6% yesterday

-

Scale of moves on the cryptocurrency market is small. Bitcoin gained 1% while Ethereum trades flat

-

Energy commodities trade higher with both Brent and WTI gaining around 1% today

-

Precious metals benefit from USD weakness. Gold trades 0.5% higher while palladium rallies over 3%

-

AUD and CAD are the best performing major currencies while CHF and USD lag the most

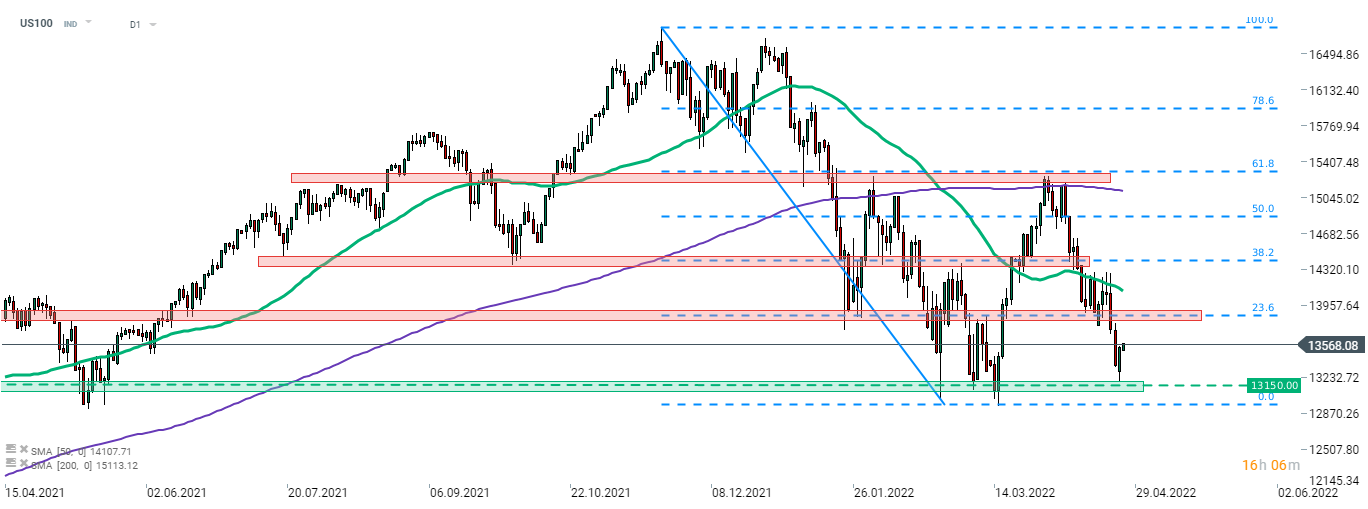

Nasdaq-100 (US100) managed to snap a losing streak after finding a support in the 13,150 pts zone yesterday. However, things may get more volatile for the index as 5 US mega tech companies (Microsoft, Apple, Amazon, Alphabet and Meta) will report Q1 2022 results between today and Thursday. Source: xStation5

Nasdaq-100 (US100) managed to snap a losing streak after finding a support in the 13,150 pts zone yesterday. However, things may get more volatile for the index as 5 US mega tech companies (Microsoft, Apple, Amazon, Alphabet and Meta) will report Q1 2022 results between today and Thursday. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.