Asian equities, led by Hong Kong, declined due to worsening industrial activity in China and concerns about a potential US government default.

Chineses HKComp declined 0.9% and CHNComp dropped 0.7%. Japanese Nikkei225 fell by 1.0%, Australian S&P/ASX200 dropped by 0.9% and KOSP200 by 0.4%.

China's manufacturing activity declined for the second consecutive month in May, indicating a slowdown in the post-Covid rebound of the world's second-largest economy.

Futures indicate a lower opening for the European market, with the DAX trading around 0.5% lower at approximately 15,870 points and the EU50 showing a similar change.

During the Goldman Sachs Global Semiconductor Conference Goldman Sachs predicts a significant revival of the semiconductor sector next year, which would boost Korean corporate profitability. Low global investor positioning could lead to substantial gains.

Oil prices experienced their largest drop in four weeks due to weaker demand signals and ample supply ahead of the upcoming OPEC+ summit. Energy companies dragged down the S&P 500. OIL.WTI is trading below $70 dollars again.

Yesterday, Nasdaq 100 gained 0.4% but ended below its day's high as investors analyzed the impact of artificial intelligence on the index. Today US100 futures are trading 0.35% lower around 14,355 points.

German and French inflation data and bond yields ahead.

Cleveland Fed Loretta Mester sees no need to wait for more evidence and finds a stronger case for raising rates. The recent debt ceiling deal removes significant uncertainty, but the decision may still be influenced by NFP and the next inflation report in June.

Despite challenges from hard-line Republicans, House Speaker Kevin McCarthy expressed confidence in enacting legislation to prevent a US default, as the House Rules Committee approved the bill.

The debt-limit agreement would reduce spending on federal government programs, but it would have a minimal impact on the anticipated budget deficits of around $20 trillion over the next ten years.

On Tuesday, a small majority of members from the House rules committee moved the bill forward. This paves the way for a crucial vote in the full House, which could happen today.

Cryptocurrencies fell at night with BTC trading 2.0% lower and ETH 1.7% lower as investors kept a close eye on the progress of the US debt ceiling deal. The focus is on the upcoming House vote scheduled for today.

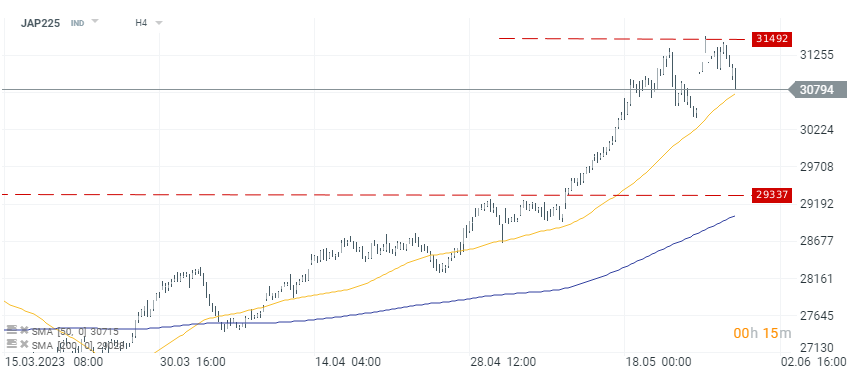

JAP225 experienced a deeper correction after reaching a multi-decade high. Today, the index is trading 1.1% lower, reflecting a weaker Industrial Production reading, H4 timeframe, source: xStation 5

JAP225 experienced a deeper correction after reaching a multi-decade high. Today, the index is trading 1.1% lower, reflecting a weaker Industrial Production reading, H4 timeframe, source: xStation 5

Market overview: PMI shapes European markets🚨

Economic calendar: PMI from Europe and the US in the spotlight (23.01.2026)

Morning wrap (23.01.2026)

Daily summary: Wall Street, precious metals and EURUSD surge📈Bitcoin under pressure

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.