-

Yesterday's session on Wall Street ended with slight gains in the major indices. The S&P 500 gained 0.38%, Nasdaq 0.56%, and the Russell 2000 was up 0.40%.

-

The session in Asia-Pacific was more mixed. Indices from China decreased slightly, Hang Seng was down 0.50%, Nifty lost 0.11%, the Australian index S&P/ASX 200 was down 0.10%, and the Korean Kospi was 0.40% lower.

-

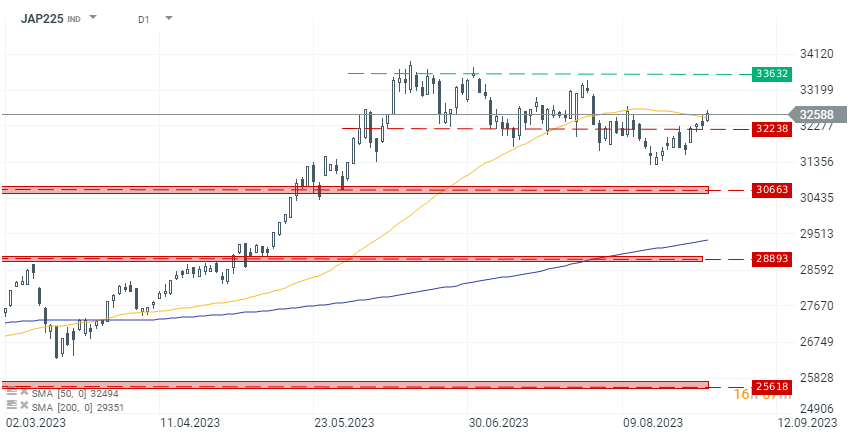

The only market gaining during the Asian session was the Japanese Nikkei 225, which rose by 0.20% after better retail sales.

-

Retail sales in Japan increased by 6.8% year-over-year in July, compared to forecasted 5.4% year-over-year and 5.6% year-over-year a month earlier in June. A drop in sales was forecasted, but the data turned out much better.

-

On the contrary, the data on industrial production was worse than expected. Industrial production in July was -2.5% year-over-year and -2.0% month-over-month, compared to expected -1.3% month-over-month and -2.4% month-over-month a month earlier in June.

-

A member of the board at the Bank of Japan (BoJ), Toyoaki Nakamura, stated that Japan's economic recovery requires the central bank to consider ending its negative interest rate policy.

-

Toyoaki Nakamura noted that inflation in Japan is not yet demand-driven, so the demand gap remains negative. Nakamura emphasized that he was not opposed to the flexibility in Yield Curve Control (YCC); his only objection was about the timing when it was being considered.

-

The PMI data from China showed that the actual NBS Manufacturing PMI was 49.7 in August compared to a forecast of 49.2 and previously 49.3. The PMI for services was 51, compared to expected 51.2.

-

The President of the People's Bank of China (PBoC) stated that the central bank would increase stimulus resources for businesses and credit support for private enterprises.

-

Precious metals are relatively flat. Gold and Palladium are gaining 0.15% and 0.30%, respectively, while silver and platinum are down 0.15% and 0.30%, respectively.

-

Not much was happening in the cryptocurrency market. Major projects are flat. Bitcoin is losing 0.20% and is trading around 27,250 dollars, and Ethereum is down 0.15% and is trading at around 1,700 dollars.

Japanese index Nikkei 225 was the only one to gain among the countries in the Asia-Pacific session, following better macroeconomic data and comments from member of the BoJ (Bank of Japan)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

BREAKING: US jobless claims slightly higher than expected

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.