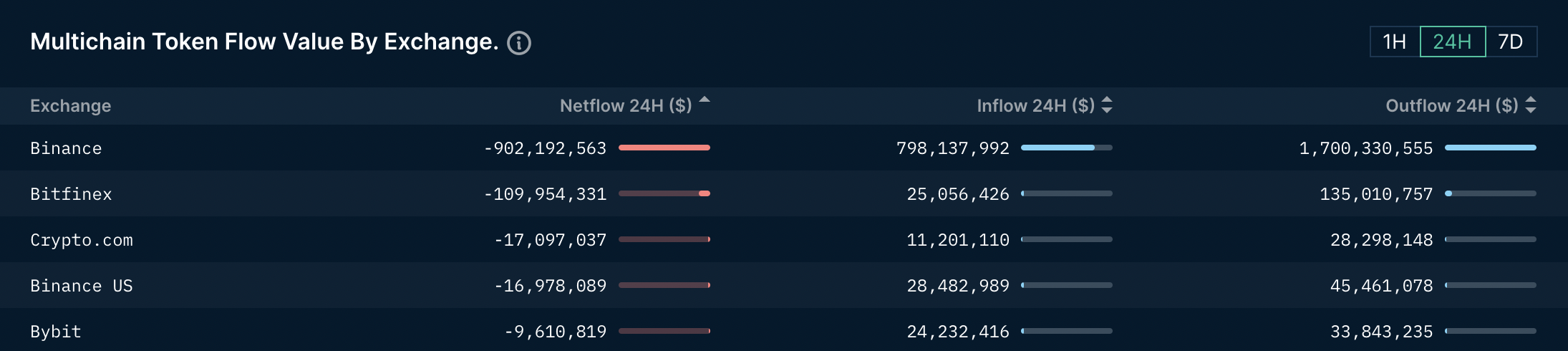

Withdrawals from the Binance exchange are on the rise. According to earlier data from analytics platform Nansen, Binance experienced a record $902 million in net outflows over the past 24 hours. Binance CEO. Chanpeng Zhao referred to market reports updated the data by conveying that withdrawals reached $1.14 billion. Investors fear 'next FTX' event:

- Binance is the world's largest cryptocurrency exchange in terms of trading volume. The value of all assets held there can reach as much as $64 billion;

- The controversy over the reserves report, with which the exchange wanted to reassure the market, and the postponement of the disclosure of liabilities and coverage of other cryptocurrencies besides Bitcoin have caused caution among its users, who have begun to withdraw funds held for safety;

- Over the past 24 hours, Binance's net withdrawals have surpassed those of all other centralized ones and are nearly nine times larger than the second largest outflow from the exchange this year;

- The outflow was the largest for Binance since November 13. The previous record fell two days after FTX filed for bankruptcy protection, according to Arkham Intelligence;

- The decline in Binancecoin's value could pose a systemic threat to the exchange, whose largest part of its portfolio is actually Binancecoin - the third largest cryptocurrency after Bitcoin and Ethereum;

- The decline in Binancecoin's value also results in a decline in the value of assets deposited in the fund meant to secure the exchange (SAFU). After the collapse of FTX, its value in November was increased by the exchange to about $1 billion although Chanpeng Zhao warned of its volatility.

Volume outflow from Binance in USD according to Nansen data. Source: Nansen

Volume outflow from Binance in USD according to Nansen data. Source: Nansen

Binancecoin, M30 interval. The price of the exchange-traded token Binance has come under pressure showing bearish divergence with Bitcoin, which has been rising over the past several hours. While BTC has approached $18,000, Binancecoin is still struggling to break through $270 after investor sentiment toward the largest cryptocurrency exchange turned more negative. The sentiment was further weighed down by a Reuters report that revealed information on the investigation targeting Binance by the US Department of Justice. Source: xStation5

Binancecoin, M30 interval. The price of the exchange-traded token Binance has come under pressure showing bearish divergence with Bitcoin, which has been rising over the past several hours. While BTC has approached $18,000, Binancecoin is still struggling to break through $270 after investor sentiment toward the largest cryptocurrency exchange turned more negative. The sentiment was further weighed down by a Reuters report that revealed information on the investigation targeting Binance by the US Department of Justice. Source: xStation5

BITCOIN: Is Kevin Warsh the final nail in the bulls’ coffin? 🔨

🚨Bitcoin slides 5% testing local lows near $84k level

Cosmic increases in precious metals, yen in turbo mode! 🚀

Crypto news: Bitcoin slips back to $87k 📉 Bear market signal?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.