Declines in the shares of electric car maker Nikola (NKLA.US) have accelerated since the open on Wall Street today and are already above 14% as the company announced an additional USD 325 million bond issue and a recall of all 209 'semi-truck' EVs produced due to a potential design flaw.

- The company intends to correct their battery pack design flaw (risk of internal coolant leakage) after a fire broke out at the company's headquarters resulting in the burning of five cars (in June). The company said that the recall of battery-powered trucks will not affect newer models, based on hydrogen fuel cells.

- Nikola is hoping for a quick fix and a change or modification from the supplier of the small part probably responsible for the situation.

- The company is still not profitable and investors do not like the vision of further dilution of the shareholding and the 'overhang' of a large number of shares as debt is converted into company capital.The company will sell convertible bonds through a direct offering, in tranches. The first tranche will be for $124.5m at an interest rate of 5%.

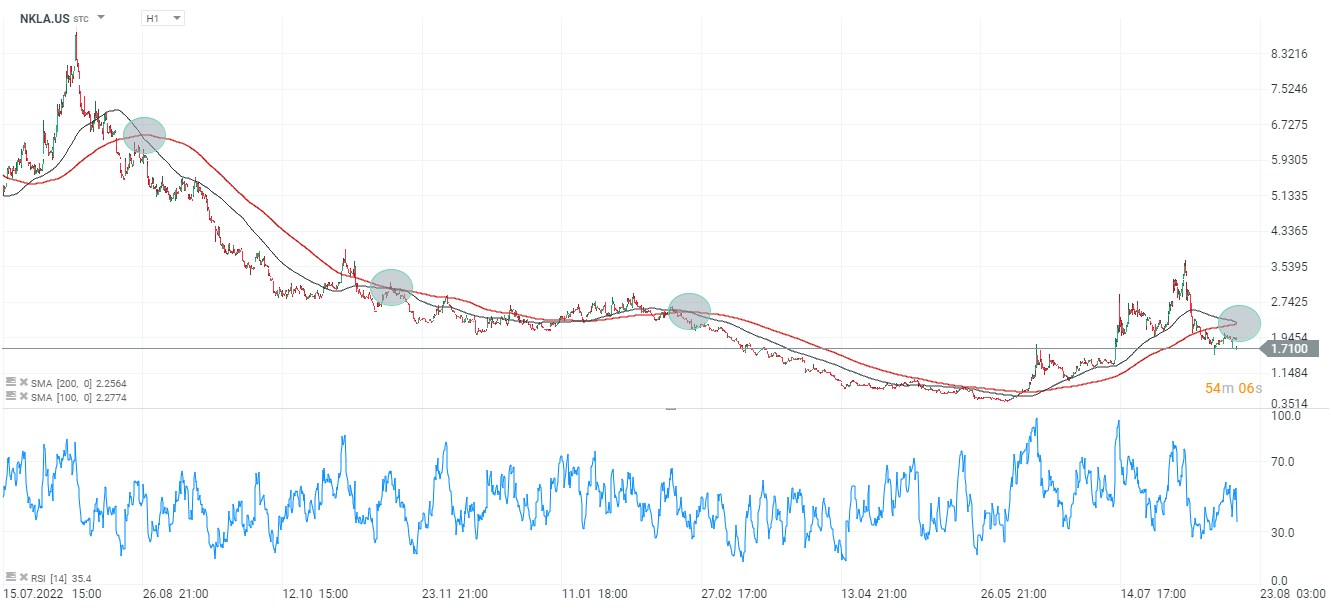

Nikola shares (NKLA.US), H1 interval. The SMA100 and SMA200 averages are approaching the intersection known as the 'cross of death' 0 looking previously similar situations usually precede a prolonged overbought stock. Source: xStation5

Nikola shares (NKLA.US), H1 interval. The SMA100 and SMA200 averages are approaching the intersection known as the 'cross of death' 0 looking previously similar situations usually precede a prolonged overbought stock. Source: xStation5

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.