- Nvidia’s market capitalization is nearing $5 trillion, reaffirming its leading role in the global AI sector.

- President Trump’s remarks on talks with Xi Jinping about AI chip exports have raised hopes for easing U.S.–China trade restrictions.

- Surging demand for Blackwell processors and new research and supercomputing projects strengthen Nvidia’s position as a global innovation leader.

- Nvidia’s market capitalization is nearing $5 trillion, reaffirming its leading role in the global AI sector.

- President Trump’s remarks on talks with Xi Jinping about AI chip exports have raised hopes for easing U.S.–China trade restrictions.

- Surging demand for Blackwell processors and new research and supercomputing projects strengthen Nvidia’s position as a global innovation leader.

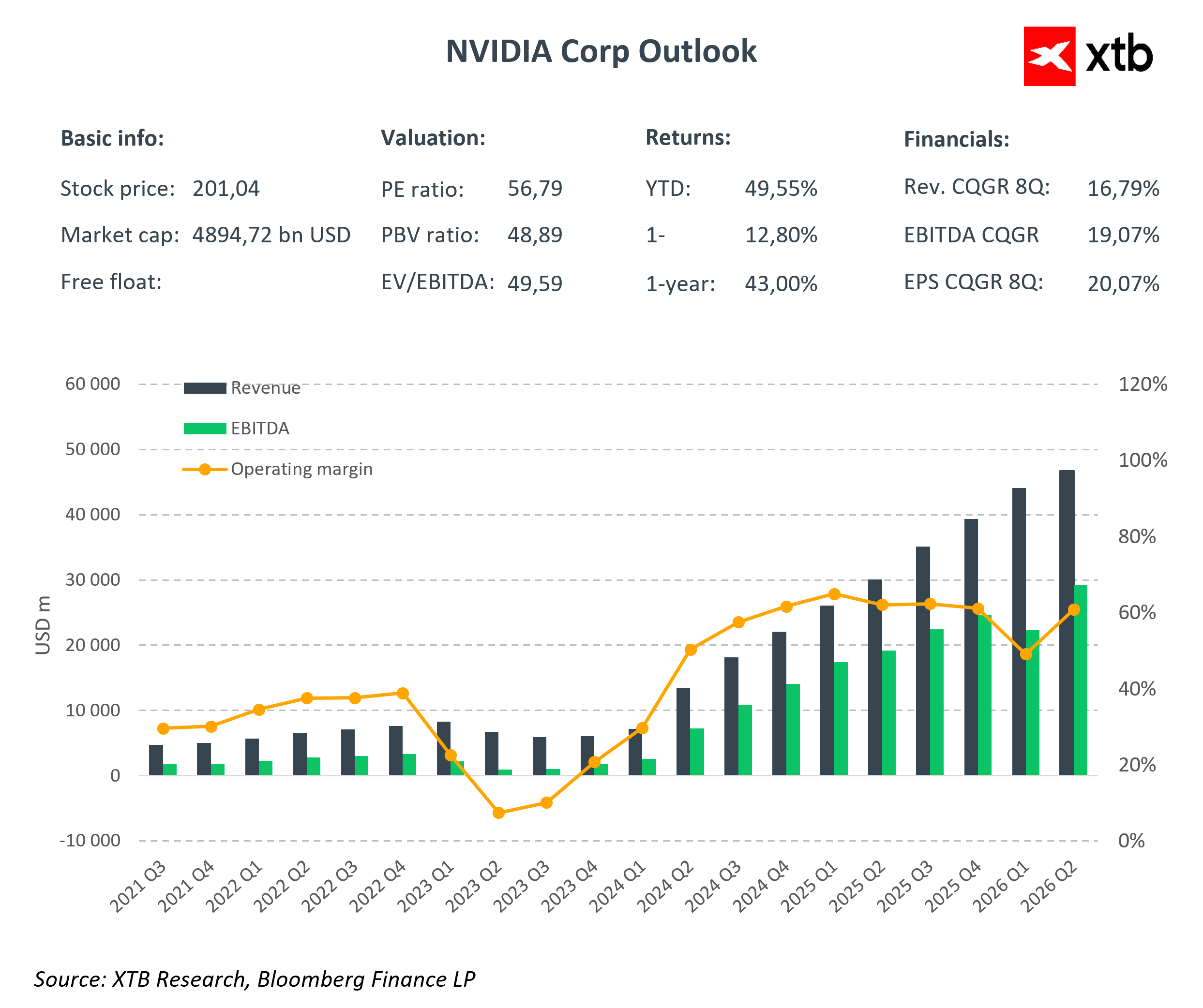

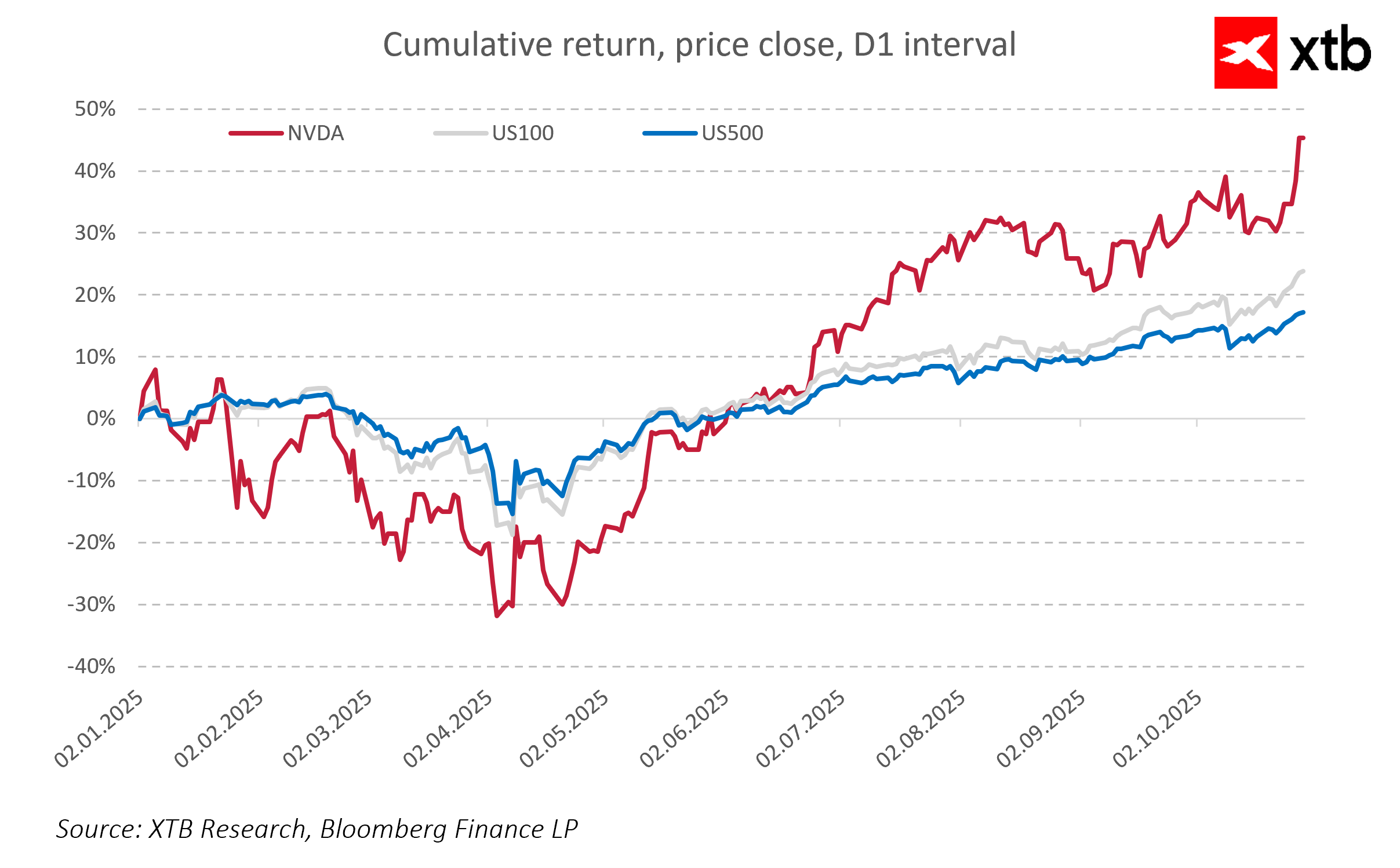

Nvidia has recorded an impressive surge in market value, approaching the $5 trillion mark and solidifying its position among the world’s most valuable companies. In recent days, the company’s stock has risen by around 5 percent, significantly boosting its capitalization and reaffirming its dominance in the global artificial intelligence sector. Investors’ attention has been drawn to both Nvidia’s strong technological foundation and recent political signals that could influence the future of the AI chip market.

A key factor behind this rally was the statement from U.S. President Donald Trump, who announced planned talks with Chinese leader Xi Jinping regarding the export of Nvidia’s Blackwell AI processors. The comments sparked optimism about a potential easing of U.S. export restrictions on China, which could open a vast and strategic market for the company. Such a development would mark a major breakthrough in the technological relations between the world’s two largest economies and could significantly impact the global semiconductor industry.

Nvidia’s rising valuation also stems from the growing demand for its advanced technologies. The company reported a substantial number of orders for its AI processors, with total bookings estimated in the hundreds of billions of dollars. At the same time, Nvidia continues to expand its research initiatives and partnerships, including collaboration with the U.S. Department of Energy on the construction of supercomputers powered by its latest Blackwell chips. This broad range of projects demonstrates that Nvidia is not only responding to market demand but actively shaping the direction of global technological development.

The combination of favorable geopolitical factors, strong business fundamentals, and innovative projects places Nvidia in an exceptionally strong position. A potential relaxation of export restrictions between the U.S. and China could further enhance its dominance in the semiconductor and AI industries. All signs suggest that Nvidia will maintain its competitive edge and remain one of the key players driving the growth of the global digital economy in the years ahead.

Daily summary: Indices and crypto decline amid rising oil prices 🚩 Gold and the US dollar move higher

Boeing gains amid news about potential huge 737 MAX order from China 📈

Oil surges 11% amid escalating Middle-East conflict 📈VIX gains driven by fear on Wall Street

Bitcoin loses the momentum again 📉Ethereum slides 5%

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.