- Concerns about the health of China's economy and demand structure put bearish pressure on oil prices

- Investors are pricing in the impact of higher crude supply in US and lower oil demand in China, which has built up significant crude inventories this year

- The geopolitical premium is slowly disappearing because the conflict in Gaza has not spread to Arabic countries. Israeli Defense Minister Galant informed that IDF army gained operational control over Western Gaza

It is unclear whether the decline in contracts is a real harbinger of lower demand in the physical market, but traders are maintaining bearish positioning. Prices did not react today to reports from JP Morgan, which indicated that OPEC+ may increase production cuts. Both OPEC countries and the International Energy Agency (IEA) had predicted a supply cut in the fourth quarter of the year but yesterday's data from the US showed high inventory levels. The U.S. Energy Agency (EIA) reported that U.S. crude oil inventories rose by 3.6 million barrels last week to 421.9 million, significantly beating analysts' forecasts. At the same time, U.S. domestic oil production remained at a record 13.2 million barrels per day (bpd).

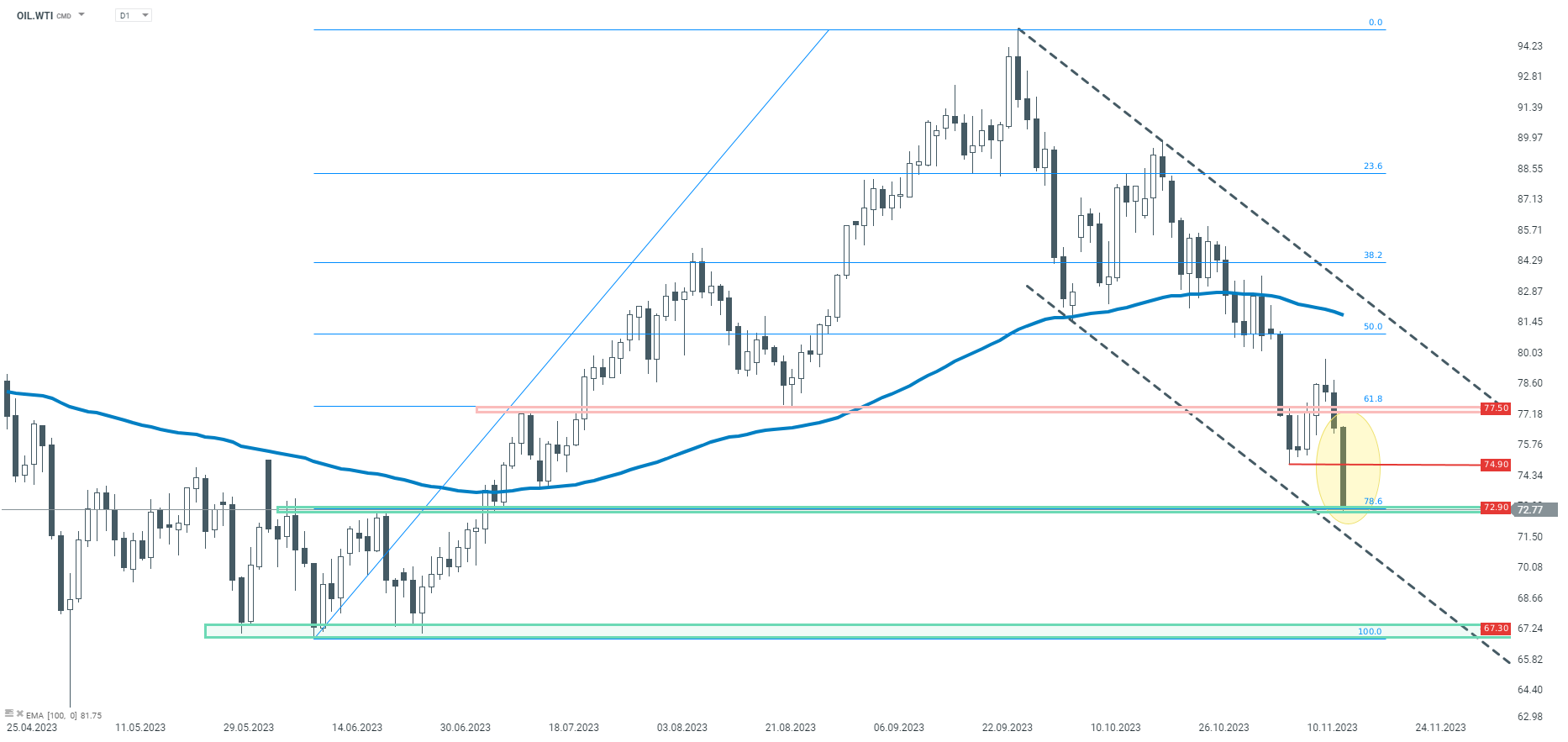

OIL.WTI D1 interval.

From the September highs, the discount on OIL.WTI has already reached more than 23%. Today the price has dived by 5%! Looking at the technical situation, the quotes are moving in a steep downward channel. Currently, the price is testing support at the level of $72.90 resulting from previous price reactions and measuring 78.6% of the last upward Fibo wave, which began in June this year. In the event of a downward breakout, even testing the lows at $67.30 will not be excluded.

Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

Cocoa falls 2.5% to the lowest level since October 2023 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.