Oracle is trading +8.40% higher at US$130.40 per share in trading ahead of the opening of the US cash session following the release of Q4 and full year 2024 results. Despite mixed Q4 2024 report, missing consensus attention is driven by record-breaking sales contracts related to the AI language model demand in its cloud services segment.

Summary of Oracle's Q4 and FY 2024 Earnings Release

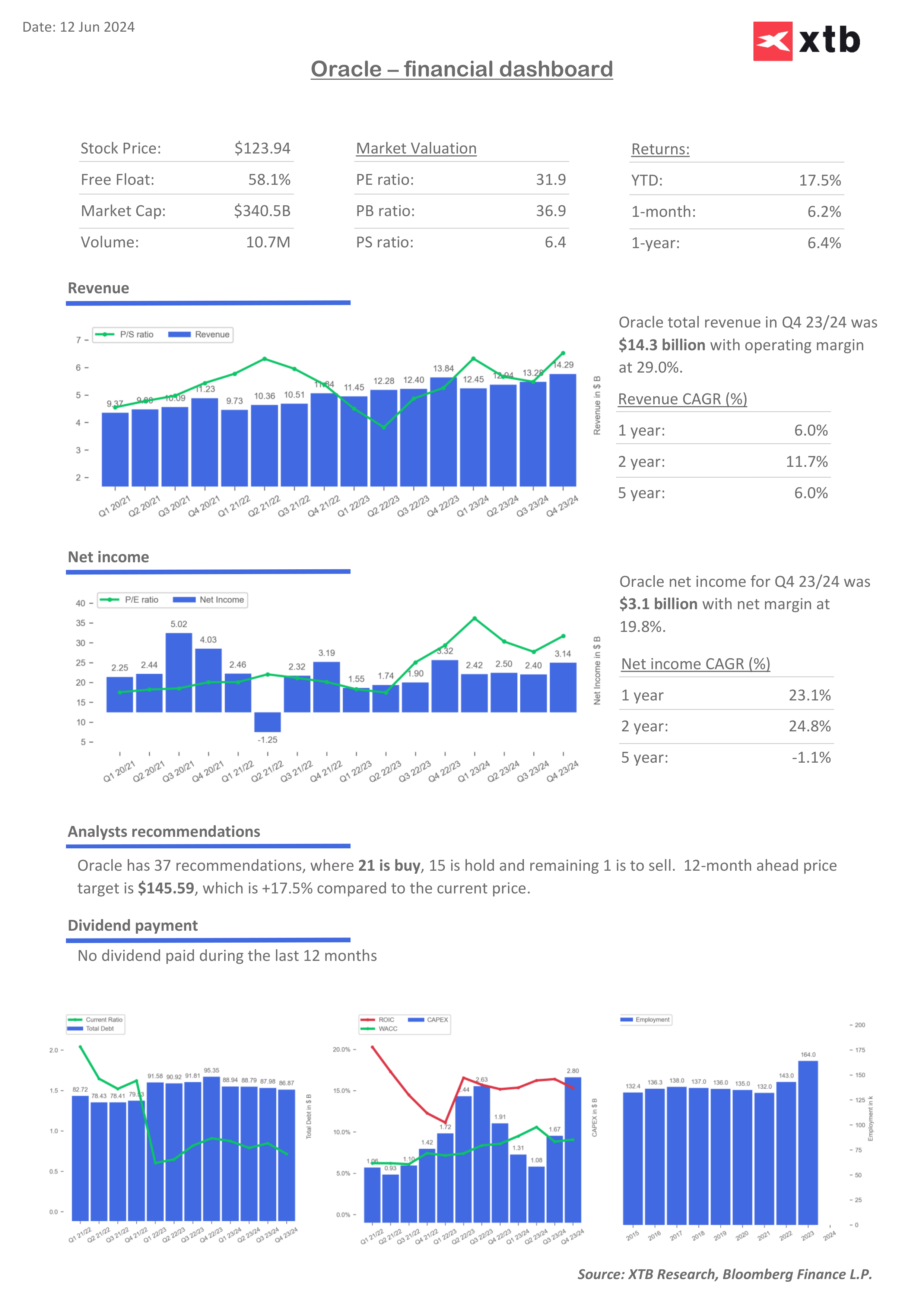

Q4 revenues rose 3% year-over-year to $14.3 billion, with cloud revenues up 20% to $5.3 billion. CEO Safra Catz emphasized strong AI demand, forecasting continued sales and RPO growth in 2025. Oracle's strategic partnerships, including those with OpenAI and Google, are set to bolster its cloud capabilities and drive further growth.

For the full fiscal year 2024, Oracle reported total revenues of $53.0 billion, a 6% increase. Cloud services and license support revenues grew by 12% to $39.4 billion, while cloud infrastructure revenues surged 42% in Q4 alone. Despite a decline in cloud license and on-premise license revenues, Oracle's operating income and margins remained robust, with non-GAAP operating income rising 8% to $6.7 billion in Q4, and operating cash flow reaching $18.7 billion for the year, up 9%.

Looking ahead, Oracle anticipates sustained AI-driven growth and a positive trajectory for fiscal year 2025, expecting each quarter to outpace the previous one. The company's multicloud partnerships with Microsoft and Google, alongside expanding datacenter infrastructure, are poised to enhance cloud database growth and service capabilities. The board declared a quarterly cash dividend of $0.40 per share, reflecting continued shareholder returns.

Earnings Summary of Key Metrics:

Q4 Quarter

- Q4 Total Revenue: $14.3 billion, up 3% in USD, up 4% in constant currency

- Q4 Cloud Revenue: $5.3 billion, up 20%

- Cloud Infrastructure (IaaS) Revenue: $2.0 billion, up 42%

- Cloud Application (SaaS) Revenue: $3.3 billion, up 10%

- Q4 Fusion Cloud ERP Revenue: $0.8 billion, up 14%

- Q4 NetSuite Cloud ERP Revenue: $0.8 billion, up 19%

- Q4 Cloud Revenue: $5.3 billion, up 20%

- Q4 GAAP Operating Income: $4.7 billion, Non-GAAP Operating Income: $6.7 billion

- Q4 GAAP Earnings per Share: $1.11, Non-GAAP Earnings per Share: $1.63

FY 2024

- FY 2024 Total Revenue: $53.0 billion, up 6%

- FY 2024 Operating Cash Flow: $18.7 billion, up 9%

- FY 2024 GAAP Net Income: $10.5 billion, Non-GAAP Net Income: $15.7 billion

Source: xStation 5

Source: xStation 5

Arista Networks closes 2025 with record results!

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.