PayPal (PYPL.US) shares have been on a dismal streak since 2021 and yesterday dived below the psychological $60 level.

- Despite fairly good Q2 results, a share buyback program and management's belief in the company's long-term success, the market has been steadfastly selling shares amid concerns about margins, market share, growing competition and the recession as a sizable threat to the company's business growth. Yesterday, the stock was losing ground after news of a share sale by Elliot Capital Management.

- The activist fund took $2 billion worth of PayPal shares in the summer of 2022 - the company announced this when it raised full-year forecasts and approved a $15 billion share repurchase program - and the market received the news euphorically at the time;

- Such a swift departure of Elliott from the shareholding was taken by investors as a sign of lack of faith in a broader rebound of declines from current price levels by which PayPal shares discounted by 6% yesterday. Do financials justify such a scale of correction?

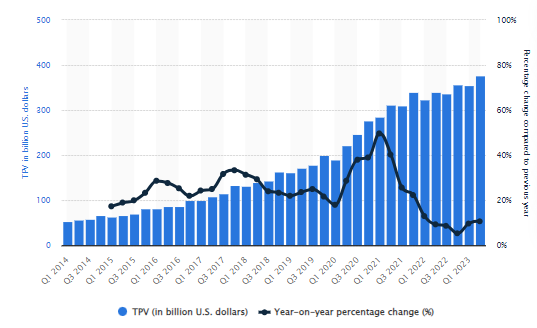

The value of payments processed by PayPal (TPV) recorded record levels in Q2 2023, approaching $400 billion, but the market considers the dynamics of this growth more important. This one was declining y/y from 2021 until Q4 2022 - we are now seeing a rebound again. The 'lows' now may support a possible 'favorable' base effect in subsequent quarters, but it's worth noting that PayPal is starting to get a bit weighed down by scale - it's hard to expect the dynamics at $400 billion in processed payments to be anywhere near that when it was two or three times less. The market downgraded the valuation - it saw the risk of PayPal becoming a 'stagnant' company - not a 'growth' business. Source: Statista

Growing competition from ApplePay, GooglePay and the huge market shares of Visa or Mastercard make the market see PayPal's revenue growth environment as increasingly challenging. In China, users are using other payment intermediaries more frequently. Source: Reuters

Revenue and margins - is it really that bad?

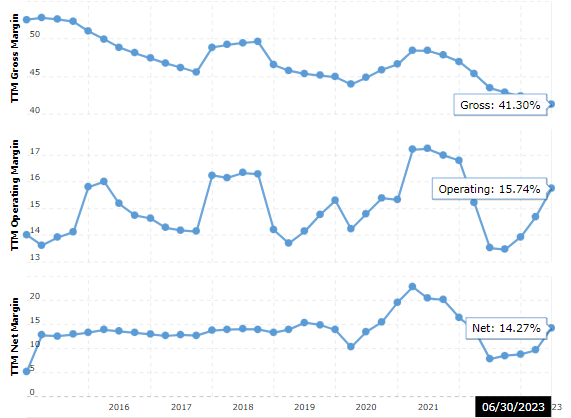

The market sees a problem on PayPal's margin side. Although the gross margin (41.3%) has fallen to its lowest levels in nearly eight years, it is still relatively high, and the net margin result is still close to the historical average before the pandemic with a more than satisfactory result on the operating margin side. Source: Macrotrends

The company's revenues, although registering a slowdown in y/y growth (no significant catalysts), recorded a record high in Q2, rising from $12 billion to $28.5 billion or nearly 150% from 2017. However, some stagnation is visible on a quarterly basis. At the same time, negative y/y growth is not visible, which could justify the reluctance with which the market treats the company. Source: Macrotrends

- It seems that the company needs to look for new ways to scale its business, which should be helped by excellent free cash flow and relatively low debt. At the same time, the magnitude of the sell-off in recent quarters may create a 'contrarian' environment for aggressive bulls to emotionlessly consider whether PayPal has deserved to fall from nearly $310 to $59 in 2 years.

- A potential macro risk, of course, is a recession, which could exacerbate the slowdown. The company has appointed a new CEO, Alex Chriss, who will take office on September 27. Investors hope he will break the 'stagnant' tenure of incumbent Dan Schulman. The company has begun to get more involved in the crypto market and has teamed up with Paxos to create the stablecoin PYUSD, which is the equivalent of a digital dollar in the blockchain world.

PayPal shares (PYPL.US). The SMA200 average on the D1 interval is consistently a key resistance level for bulls and currently runs at $73 per share. Source: xStation5

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.