PayPal (PYPL.US) shares lose 3.5% today despite better than expected earnings per share and 6% YoY revenue growth, which came in line with expectations. The company reported EPS of $1.20, above $1.07 anticipated on Wall Street, however its profitability (and margins) boost was balanced by quite mixed guidance, signalling profit taking pressure. As for now, shares trim early loses of 8% to 3.5%, signalling that the first market's 'panic' reaction may be too big, as the PayPal Q3 report overall came in strong and signals some major improvements.

- Q3 revenue rose 6% YoY to $7.85B vs $7.88B estimate, below total payment volume (TPV) which surged 9% YoY to above $422 billion. Active accounts number dropped 0.9% YoY to 432 million, but transactions per account were up 9% YoY Payments came in up 6% YoY to $6.6 billion.

- Q4 revenues are expected to increase by a low-single-digit percentage compared to $8.03 billion in the prior year’s period and slightly below the consensus of $7.81 billion. PayPal expects also adjusted EPS between $1.03-$1.07, vs $1.10 anticipated on Wall Street.

- Q3 revenue growth reached 6%, aligning closely with investors expectations and the company’s mid-single-digit previous guidance. However, it's not enough to fuel growth as PayPal stock surged recent months. On a constant currency, revenue growth came in 6% YoY vs 4% estimated by JP Morgan.

- Transaction margin dollars (TMD) increased 8% YoY vs 3% to 4% projected by Wall Street' in line with Q2 growth pace. Transaction take rate came in at 1.67%, slightly below consensus. Transaction expenses were approximately 0.5 bps below expectations. Non-transaction expenses rose 3% vs flat result expected on Wall Street; margins improved by 1.9 percentage point.

- PayPal for Q4 2024 expects low single-digit revenue growth, below 6% dynamic, forecasted by analysts. Adjusted EPS is projected to decline YoY in the low-to-mid single digits. For the full year, PayPal raised its TMD growth outlook to mid-single digits, up from the previous low-to-mid range. Non-transactional operating expenses are expected to grow in the low single digits, with no changes to previous guidance. Also, free cash flow guidance remains steady at $6 billion. Adjusted EPS growth was lifted to the high teens, up from the previous low-to-mid teens.

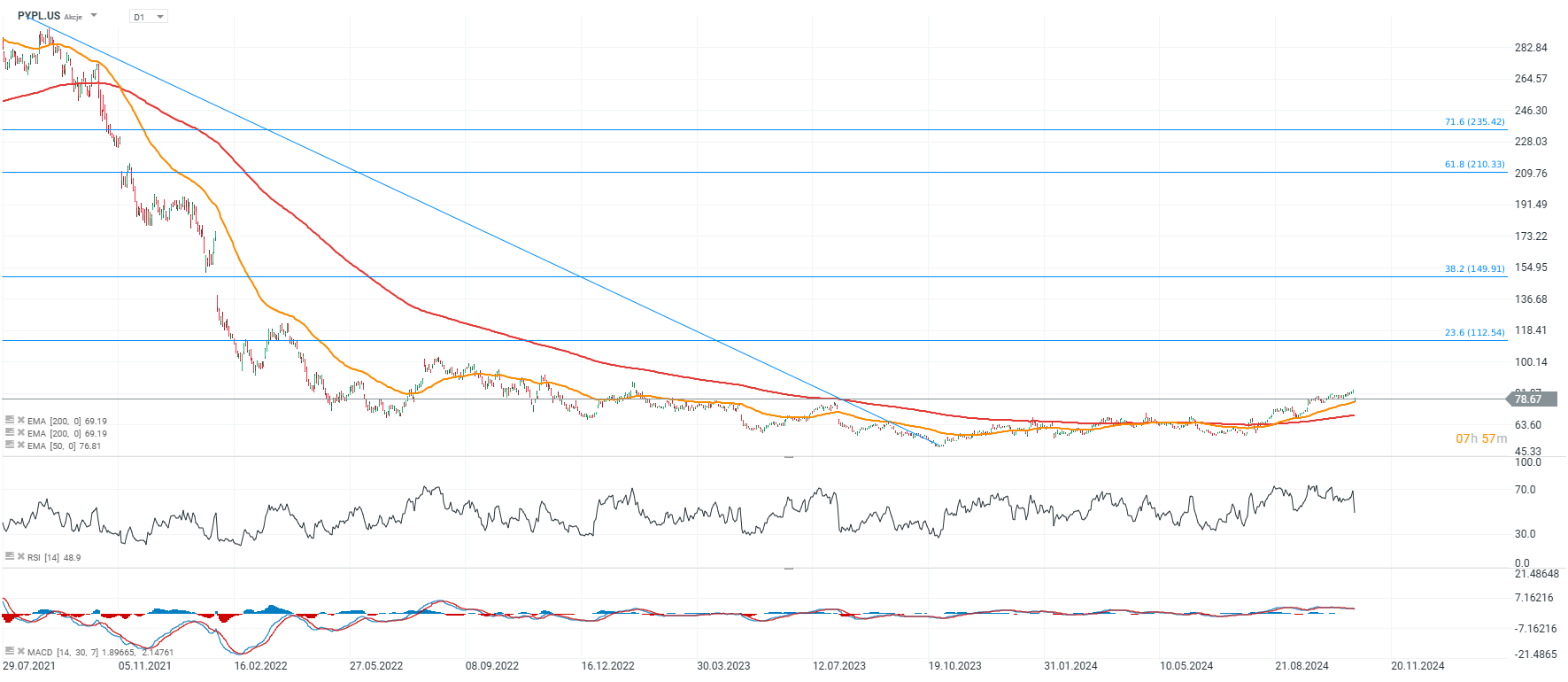

Source: xStation5

_9cfb25f32a.png)

Source: XTB Research, Bloomberg Finance L.P.

_e22aa49af6.png)

Source: XTB Research, Bloomberg Finance L.P.

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.