PepsiCo reported 2Q24 results today. The company achieved a slight increase in revenue to $22.5 billion (+0.8% y/y). At the operating profit level, the company reported an 11% y/y increase, which translates into a 7% increase at constant exchange rates.

- At the operating profit level, the company recorded $4 billion (+9% y/y, at constant exchange rates +7% y/y), and EPS rose 13% y/y, with a 10% increase at constant exchange rates.

- The company's results turned out to be mixed. Revenues grew weaker than expectations, while net income beat market consensus.

- On a negative note, the company lowered its expectations for organic revenue growth to around 4% (previously the company had assumed at least 4% growth).

When breaking down revenue by segment, it appears that the company is further facing weaker demand in the US. PepsiCo's North American snacks business saw a strong year-on-year decline. Volumes recorded as much as a 17% y/y reduction in Quaker Foods North America (partially reinforced by the company's withdrawal of certain products), and in Frito-Lay North Amercia the company also reported a 4% y/y decline in volumes. Lower demand is also seen in the U.S. for beverages, whose volumes fell 3% y/y. Improved demand, however, can be seen in Europe, where sales volumes rose 5% y/y.

- The sales dynamics caused EPS in the U.S. to decline in the snacks sector by -3% (for the Frito Lay segment) and by -23% (for Quaker Foods) y/y on a constant currency basis.

- In addition to lowering its expected level of organic growth, the company reiterated its earlier projections. It expects to achieve at least 8% EPS growth (on a constant-currency basis), $8.2 billion transferred to shareholders ($7.2 billion in dividends and $1 billion in share buybacks), and a 1% impact from changes in sales and EPS results due to currency fluctuations. This puts the company's 2024 EPS guidance at $8.15 (+7% y/y).

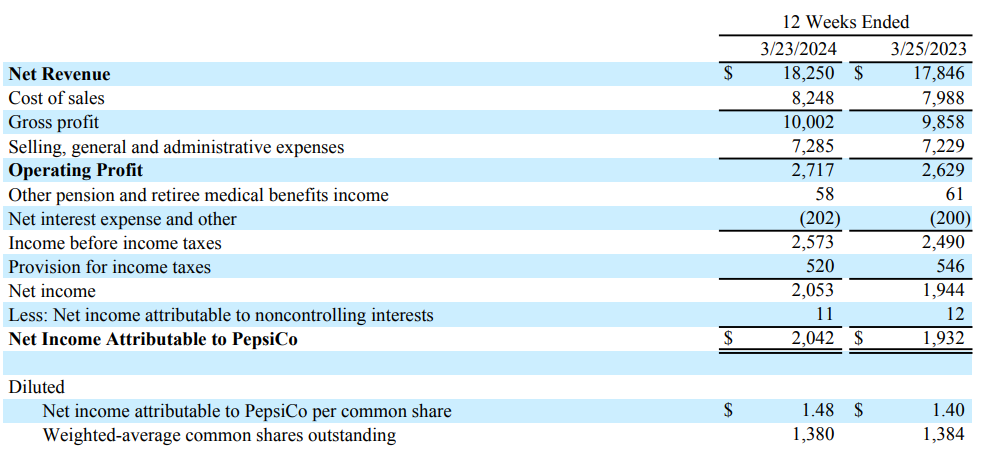

PepsiCo's 2Q24 results. Source: PepsiCo

PepsiCo's 2Q24 results. Source: PepsiCo

In response to deteriorating demand in the company's most important market and lowered revenue projections, PepsiCo's stock price is trading down nearly 3% in pre-opening trading. Pre-opening market quotes suggest the lowest price since October 2023. Source: xStation

Source: xStation5

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.