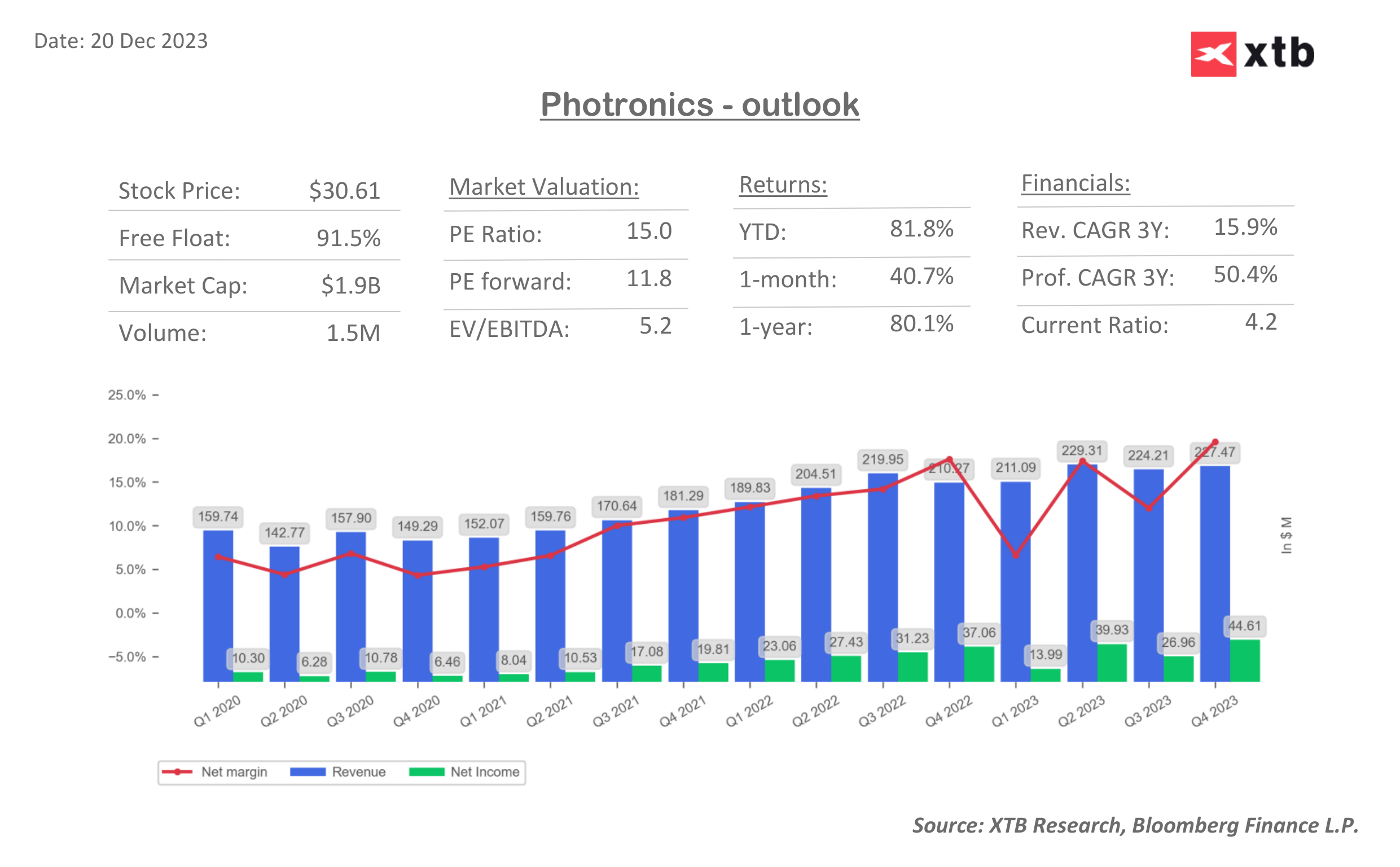

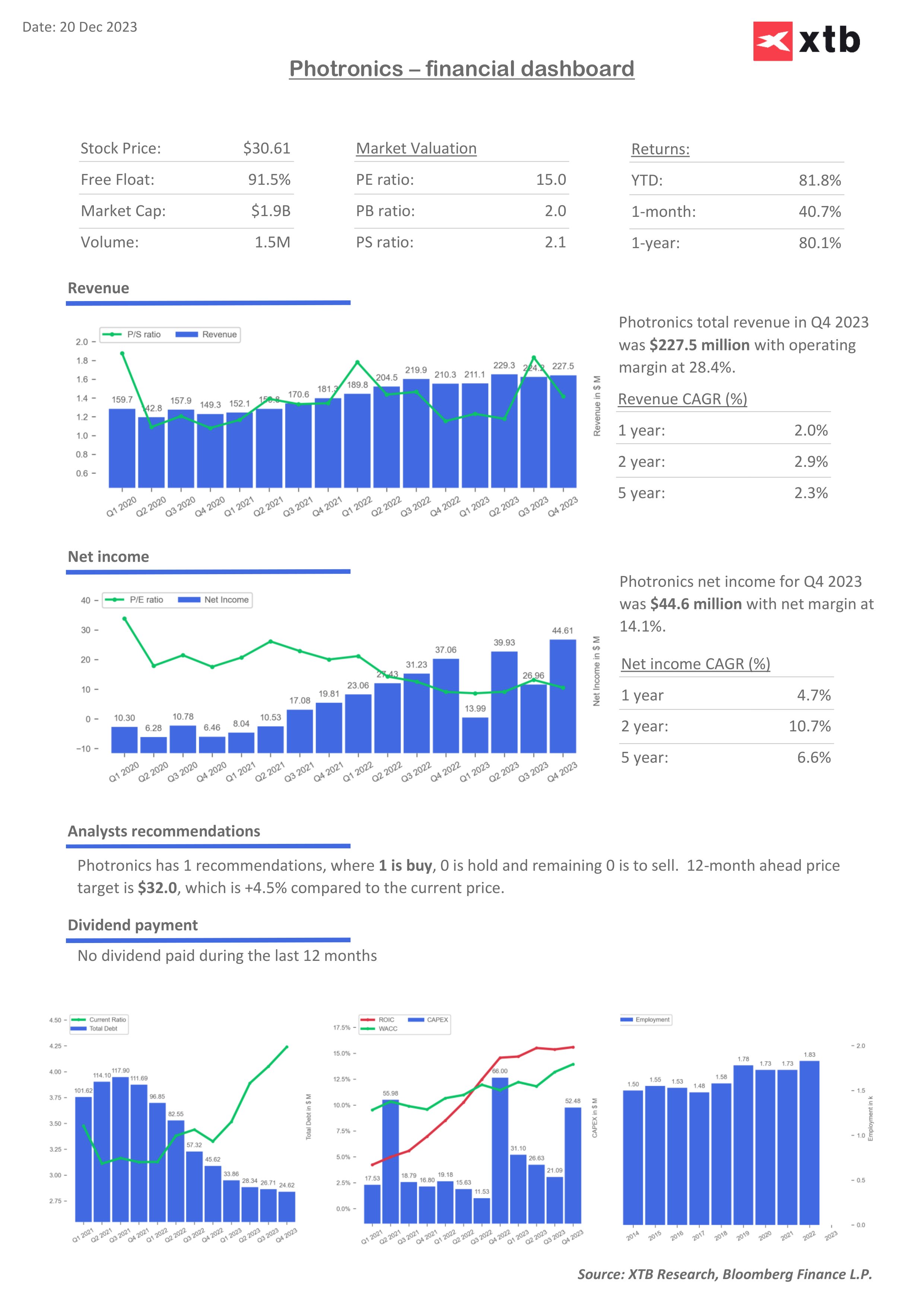

Shares of U.S. Photronics (PLAB.US), which specializes in photomasks and integrated circuits (ICs) production, rose, up more than 40% during the month. The company reported record revenues for the sixth consecutive year, posting 8% year-on-year growth, at a time when the photomasks market remained virtually flat this year. The company reported financial results, including earnings per share ($0.6 vs. $0.53 forecasts) well above projections, reporting an all-time record operating margin of 28.5%.

- The company cut operating expenses, which accounted for less than 9% of revenue, in Q4 Net income was $37.2 million. During the year, Photronics' total revenues amounted to $892.1 million, 8% higher than the $824.5 million reported in fiscal 2022 (an average annual growth rate of 12% over the past six years). Revenues in fiscal 2023 were almost double those of fiscal 2017, when the company began implementing a focused growth strategy to emerge from the doldrums;

- Photronics expects the overall semiconductor industry to contract by up to 12%, but the company's year-on-year sales growth confirms that the photomask market is less cyclical than the industry as a whole. According to management comments, signals from industry leaders and customers indicate that the current decline in the semiconductor cycle should transition to the next phase of growth around the middle of next year. Taking cyclical and manufacturing observations as a guide, the company forecasts that broader demand for photomasks should return to a more robust growth phase in the second or third fiscal quarter

China slowdown didn't hit Photronics

- In a commentary on the results, management pointed out that while the company, like other semiconductor companies, derives a significant portion of its revenues from China, its operations in that market remain unique in their resilience to revenue cyclicality. In a conference call with analysts, the company acknowledged that there are a significant number of new projects and factories in China that are driving demand for photomasks, despite the economic downturn. The bulk of photomasks production is supplied by private manufacturers.

- Revenues from integrated circuits rose 9.8% year-on-year and were an all-time high. By major category, IC revenue of $164.5 million in the fourth quarter rose 1% sequentially and 5% year-on-year. Revenues from the high-end segment, defined as chip masks using 28-nanometer or smaller technology, contributed 27% year-on-year growth in k/k terms, more than offsetting a decline in revenues from the main business segment. High-end revenues were strong in the US, as well as in Asia. The 9% decline in core segment revenue was largely due to lower delivery premiums due to somewhat moderate demand and normalized lead times for new products

Akche Photronics (PLAB.US)![]()

Looking at the scale of recent increases, a correction toward the 23.6 or 38.2 Fibonacci retracement of the upward wave from the fall of 2022, at $24 or $26 per share, is not out of the question. The company's shares are still about 50% short of their historical highs, dating back to 2000. Source: xStation5

Photronics valuation forecasts and indicators

The company has almost zero debt, with strong cash reserves and margins. What's very interesting, is the fact that P/E ratio is falling for year, but the net income and revenues are growing.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.