Summary:

-

GBP sliding lower as Labour look to close the gap

-

2 polls point to narrowing Tory lead

-

FTSE runs into resistance above 7400 once more

A couple of polls showing a narrowing in the lead for the Conservatives over Labour has seen a little bit of downward pressure in the pound, as sellers step back in. The shift in the polls is far from dramatic and given their inherently volatile nature it would be presumptuous to believe that this is the beginning of a major shift, but it could at least start to raise a little doubt on the notion that a Conservative majority is a strong probability and in doing so weigh on the pound.

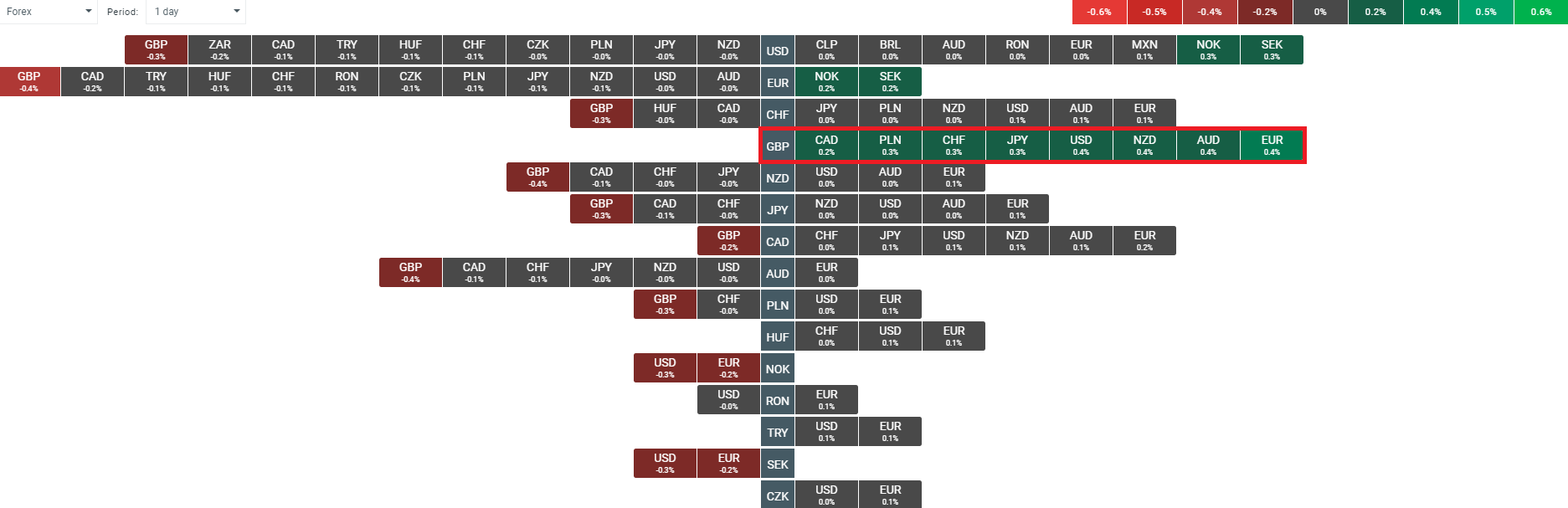

After making a move higher at the start of the week, the pound is now sliding lower with the narrowing of the Tory/Labour lead weighing on the currency a little. Source: xStation

The 2017 election saw a significant gain from Labour between the date is was called and polling day and given how far adrift they have been in the early polling this time around, just the increased prospect of a potential swing could serve to ramp up uncertainty and weigh on the pound. As is widely stated, popular opinion polls should be taken as containing a sizable margin of error, given the variable correlation seen between popular support and seats in parliament. The release of an MRP forecast by YouGov tomorrow night will be the most significant poll yet, with this model not only accurately predicting a hung parliament last time out but also correctly forecasting Labour victories in tightly contested seats such as Canterbury and Kensington & Chelsea.

GBPNZD is drifting back to test prior support around the 2.00 handle - a level which also coincides with the 50 day SMA. Price remains in a consolidation triangle but is coming under a bit of pressure this morning. Source: xStation

FTSE attempts to break 7400 handle

UK stocks continue to struggle in their attempt to break higher with another foray above 7400 in the FTSE this morning failing to gain traction. The market was trading not far from its highest level since early August shortly after the open but these gains have since been pared back with the benchmark falling back to trade little changed from Monday’s closing level at the time of writing. Attempts at the end of September and also the start of the current month to make a move above 7400 stick have come up short and UK blue-chips continue to lag behind their peers in their recovery from the summer swoon. Elsewhere, the backdrop for equities remains favourable with US futures pointing to Wall Street starting near its highest ever level this afternoon after ending yesterday at an all-time closing high.

The FTSE is once more attempting to make a move higher but the region below 7455 is offering some resistance. Source: xStation

The FTSE is once more attempting to make a move higher but the region below 7455 is offering some resistance. Source: xStation

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.