Gold and silver prices are rising sharply today, reaching their highest levels in many years, driven by expectations of imminent interest rate cuts by the Fed, strong demand for ETFs, and growing geopolitical risk. Silver has exceeded $40 per ounce for the first time since 2011, gaining about 40% this year, while gold has approached a record high of over $3,500 per ounce, up 31% since the beginning of the year. Over the past three years, prices for both metals have more than doubled amid ongoing market and political uncertainty. Today alone, SILVER is up 2.2% while GOLD is adding 0.8%.

Expectations regarding interest rate cuts by the Fed

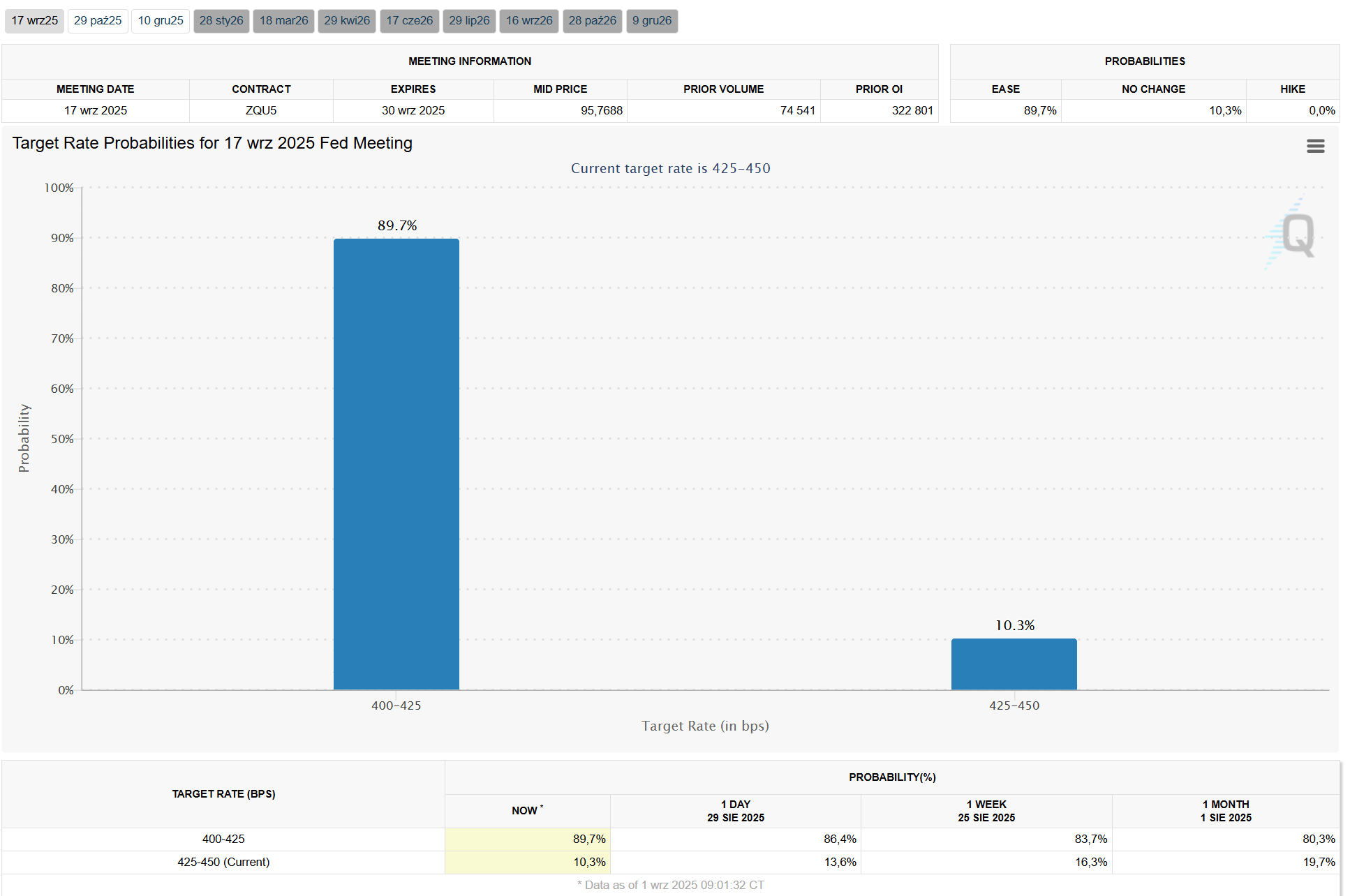

Growing consensus that the Federal Reserve will soon cut interest rates (now a nearly 90% chance) has caused gold and silver prices to rise. Lower interest rates reduce the opportunity cost of holding non-yielding assets such as gold and silver, making them more attractive to investors seeking protection against monetary easing and currency devaluation.

Source: CME

Political and geopolitical tensions

Uncertainty about the independence of the Federal Reserve, exemplified by President Trump's attempts to dismiss Fed board member Lisa Cook, has heightened concerns in global markets. A federal court recently ruled that most of the tariffs imposed during the Trump era are unlawful, but left existing tariffs in place pending further proceedings, leaving trade policy in limbo and further reinforcing defensive market strategies. Furthermore, the addition of silver to the US list of critical minerals increases its strategic importance, raising the prospect of future policy-driven price volatility.

Precious metals on the rise

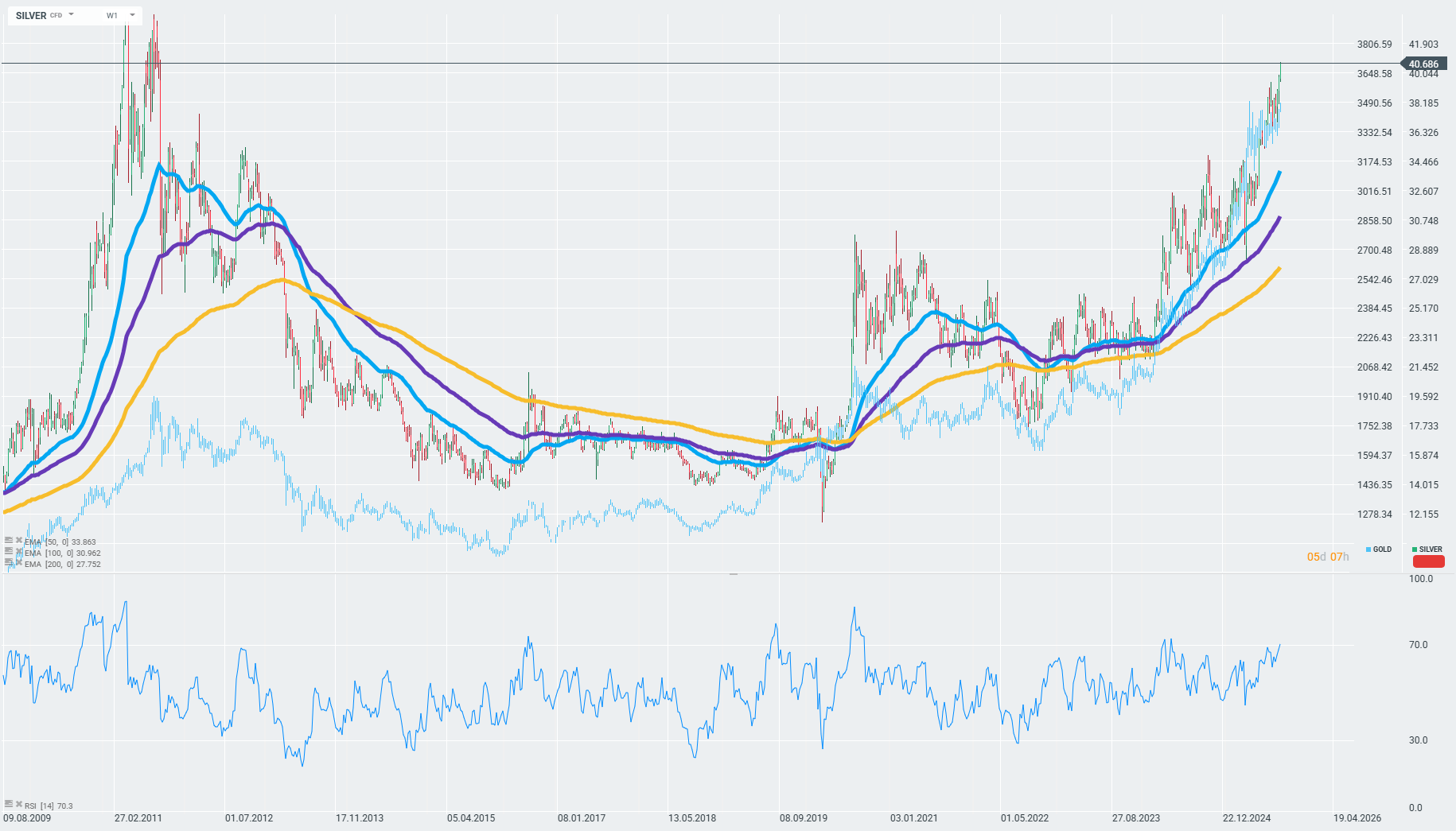

Both gold and silver have broken through key resistance levels ($3,450 for gold, $40 for silver), triggering a surge in demand and reinforcing the upward trend. Overall, the precious metals sector is experiencing a unique combination of favorable factors, rarely seen in such a synchronized form, resulting in record high prices, sustained demand for ETFs (since the beginning of the year, gold stocks in ETFs have increased by 12%, while for silver it is 13%) and structural changes in investors' approach to risk and hedging. Technically, both commodities are maintaining their long-term upward trends.

GOLD is approaching its historic highs, while SILVER is trading near its 2011 highs. Source: xStation

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.