Salesforce (CRM.US) stock fell over 10.0 % on Thursday as news of the surprise departure of co-CEO Taylor and weak financial outlook overshadowed upbeat quarterly figures.

-

The cloud-software company earned $1.40 per share, easily beating FactSet expectations of $1.22. Revenue of $7.84 billion, slightly topped market estimates of $7.83 billion.

-

For the current quarter, Salesforce expects revenue in the region of $7.93 billion to $8.03 billion, a range whose midpoint is the Wall Street consensus call of $8.02 billion. On the other hand, the company forecast earnings per share in a range of $1.35 to $1.37 per share compared to analysts’ estimates of $1.34 per share.

-

Company noticed that corporate technology purchasing decisions were receiving “greater scrutiny” and there was a high level of uncertainty among customers about the demand environment.

-

Salesforce announced that co-Chief Executive Bret Taylor, who had been co-CEO for about one year, will stay with the company only until Jan. 31, 2023 as he intends to join a startup. Marc Benioff will remain as the sole CEO of the company.

-

" With Taylor leaving we can see Benioff potentially getting more aggressive on M&A in the cloud landscape as more private and public vendors struggle in a softer macro backdrop. This is all about the battle vs. Microsoft (MSFT) for market share in the cloud and collaboration space with CRM in a strong position to further build out its product footprint over the coming years." said Wedbush analyst Daniel Ives in a report.

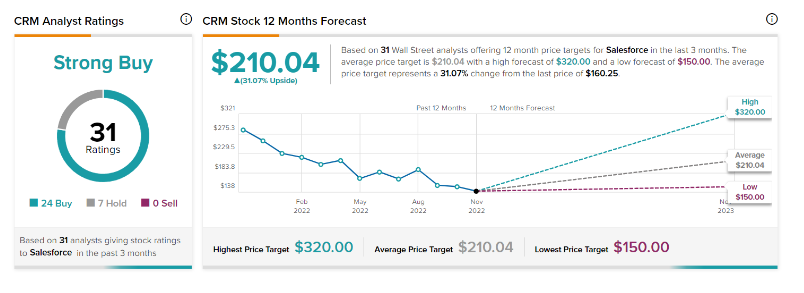

Salesforce stock has a strong buy rating based on 31 analysts’ recommendations with a price target of $210.04, which implies approximately 45.00% upside potential from current price levels. Source: Tipranks

Salesforce stock has a strong buy rating based on 31 analysts’ recommendations with a price target of $210.04, which implies approximately 45.00% upside potential from current price levels. Source: Tipranks

Despite the difficult macroeconomic environment, the company's quarterly results surprised on the upside mainly thanks to rising demand for cloud-based services. Company plans to increase investments and expand its offer in order to increase its market share which should support long-term growth.

Salesforce (CRM.US) stock launched today's session sharply lower as buyers once again failed to break above the major resistance zone around $159.55 which is marked with previous price reactions and 78.6% Fibonacci retracement of the upward wave launched in March 2020. If current sentiment prevails, downward impulse may deepen towards support at $126.00, where the lower limit of the 1:1 structure is located or even to pandemic lows at $116.50. Source: xStation5

US OPEN: Start of the week with mild discounts, amid geopolitical tensions

US OPEN: US500 tests record highs as technology sector leads gains

DE40: Regulatory and diplomatic escalations amid holidays

Novo Nordisk - There Were Risks, Now It's Time for Opportunities.

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.