The likely nomination of Kevin Warsh to succeed Jerome Powell is a signal the markets are reading clearly: the era of hyper-dovish expectations has come to a close. While his selection gratifies proponents of monetary discipline, it heralds a tighter policy stance in the medium term. It remains to be seen whether Donald Trump will eventually rue his choice should Warsh refuse to pivot toward lower rates. Conversely, Trump’s primary motivation may be less about interest rate policy and more about resolving a personal grievance with Powell.

1. Dollar Response: The End of the Sell-off and a Return to Yields

The mere confirmation of Warsh as the frontrunner was sufficient to halt the decline of the US currency.

-

DXY Rebound and Rising Yields: The dollar is bouncing aggressively from recent lows as Treasury yields climb. Warsh is viewed as a "market-friendly" candidate, yet one significantly more hawkish than rivals such as Hassett or Rieder.

-

Recalibrated Expectations: Investors are now pricing in a decelerated pace of rate cuts. Nevertheless, Warsh himself has frequently argued that the Fed remains too backward-looking rather than anticipating future trends.

-

Market Reaction: EUR/USD responded with an immediate slide following reports that the Trump administration has "locked in" the Warsh candidacy. Precious metals are experiencing their steepest decline in months.

2. A New Chapter for the Fed: Between Hawkish Roots and Political Pressure

Kevin Warsh maintains a reputation as an orthodox hawk who has historically been a vocal critic of excessively loose monetary conditions.

-

Data-Dependent Discipline: His nomination suggests a shift toward a data-dependent strategy, characterized by caution regarding the cost of capital and a priority on the durable suppression of inflation.

-

Mitigating Independence Concerns: As an "institutional" candidate, Warsh provides some reassurance to markets fearing the complete subordination of the central bank to the White House. However, political pressure remains a latent risk, particularly given Trump’s vocal demands for lower rates.

3. Economic and Market Implications: The Shadow of Higher Costs

-

Short Term: A resurgent dollar and higher yields are tightening financial conditions. While this aids the fight against inflation and reinforces the US "safe haven" status, it weighs heavily on American exports and emerging market stability. It has also triggered an extreme sell-off in gold and silver.

-

Medium Term: The "higher for longer" prospect may cool domestic demand, the housing market, and capital expenditure (CAPEX). While this stabilizes price levels, it poses a risk to growth momentum.

-

Risk Assets Under Pressure: For the technology (growth) sector and cryptocurrencies, the Warsh narrative is bearish. Tighter policy translates to diminished liquidity and a higher cost of capital—factors analysts are already flagging as primary risks.

4. Institutional Conflict Risk

The Warsh nomination takes place against a backdrop of unprecedented friction—including the DOJ investigation into Powell and public disputes over Fed autonomy.

-

The Core Conflict: A tangible risk exists of a collision between Trump’s pro-growth, populist agenda and Warsh’s conservative monetary instincts. Should markets perceive that political pressure is eclipsing the mandate for price stability, long-term confidence in the dollar could be severely tested.

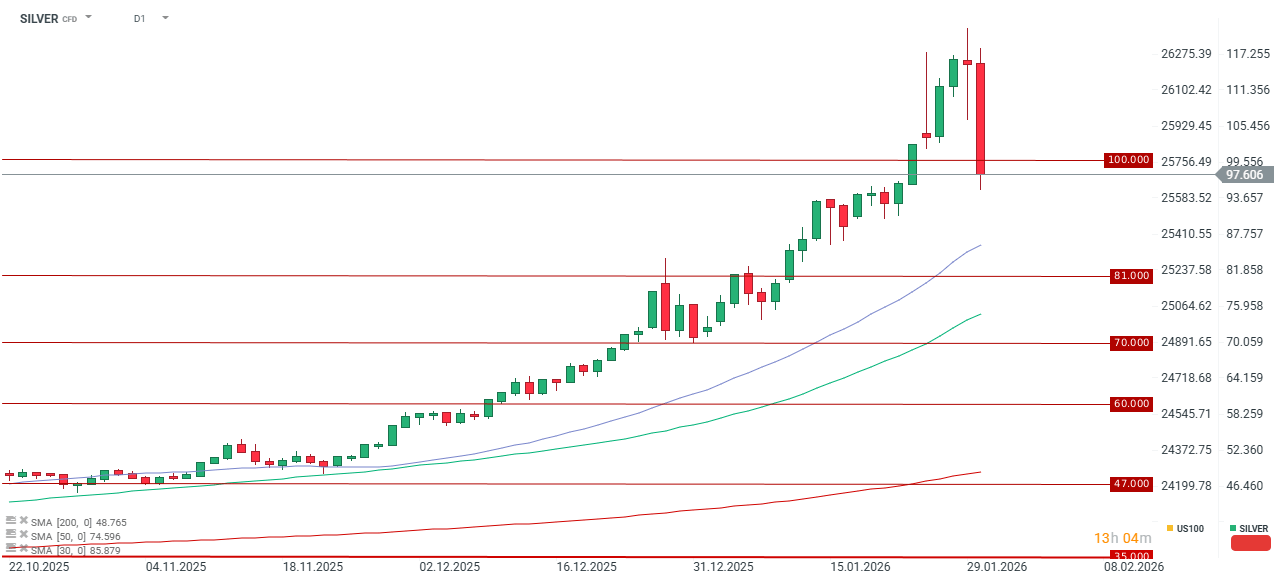

Silver has retreated by as much as 15%, falling below the $100 mark. The next significant support levels are situated within the $80 to $90 per ounce range. Source: xStation5

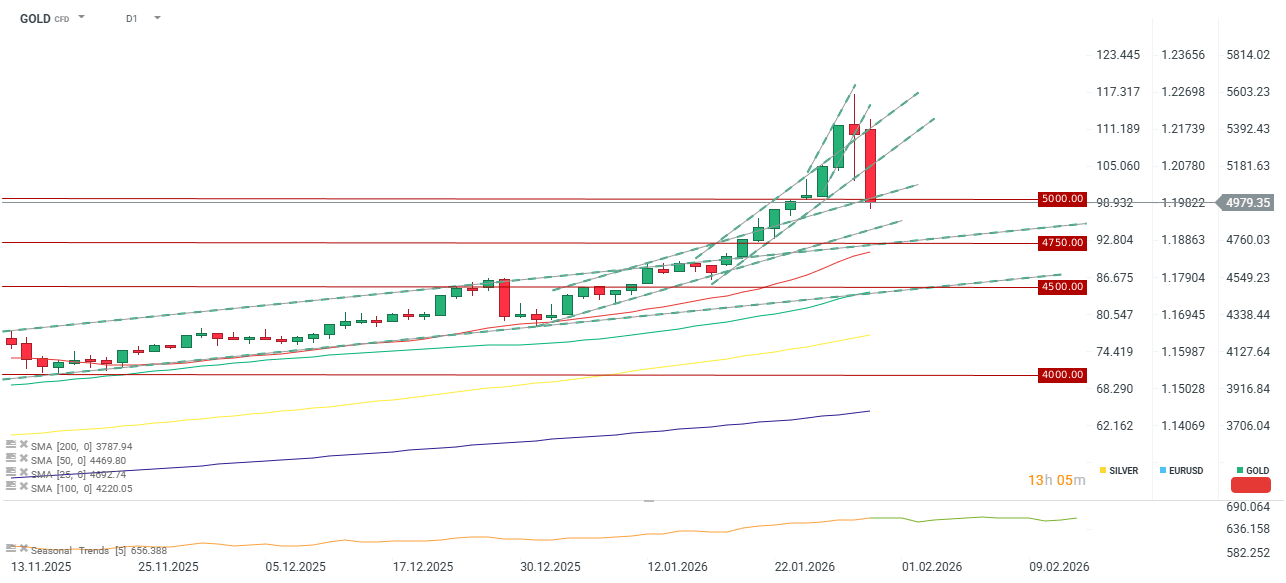

Gold has slipped below $5,000 today. This 7% decline represents a volatility rarely seen in this asset class. The next key support levels are $4,750 and $4,500. Source: xStation5

🚨 EURUSD deepens decline, falls to key support zone

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.