Silver continues its strong rebound for the second week in a row and is on track to close above $30 per ounce barrier, the highest point since February 2013. Metals continue to rise, despite China's mixed data, although at the same time the promise of more support for consumers and the real estate market is creating a positive impact on the overall metals market.

Source: xStation5

Silver and other precious metals are moving in pursuit of gold, and sustained high levels in the price of gold bullion should provide chances for a continuation of the bull market in the other precious metals. Where to look for important levels?

The ratio of gold and silver prices has already fallen to the 10-year moving average, which can be considered the first important milestone. The next could be the 20-year static average, which is close to the 2017 and 2021 lows. This average is located at level 68. Assuming a gold price of $2,400, this would give a valuation for silver of $35.3 per ounce, or more than 15% of the implied move from current levels. It would also mean a test of the local peaks of September 2012. Source: Bloomberg Finance LP, XTB

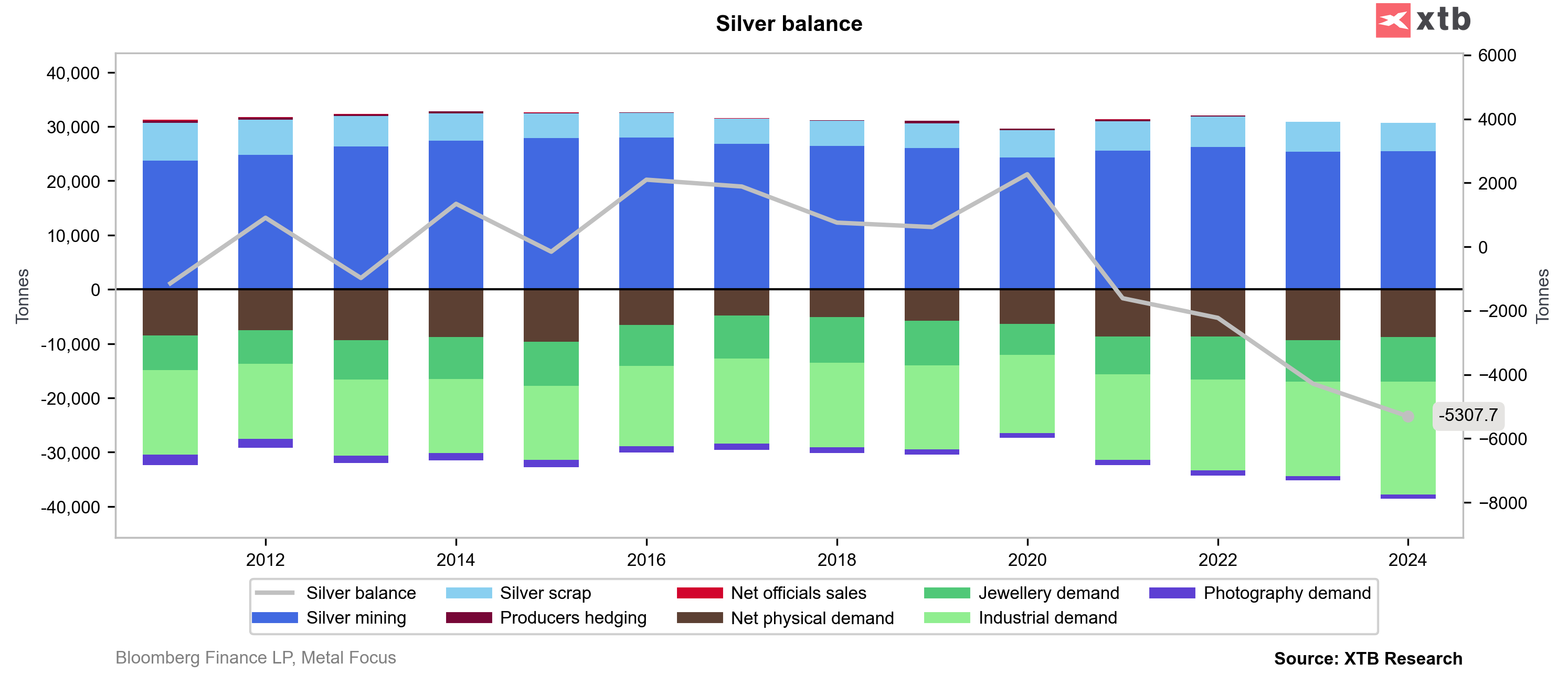

However, it is worth remembering that silver, in addition to the sheer pressure from gold, also has a fundamental basis in terms of growth. It is preparing for the 4th consecutive major shortage in the market, and the metal is used in new technologies, primarily related to energy.

Source: Bloomberg Finance LP, XTB

Daily Summary: Middle East Sparks Oil Market

Oil Under Pressure as G7 Decision Remains Pending

US Open: Oil too expensive for Wall Street!

OIL: Prices soar to $120 a barrel; Israel bombs Iran's oil facilities 📌

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.