-

Revenue Shift Confirmed: Q1 miss was offset by a $10–$11B Q2 revenue guide, signaling a timing deferral and strong sequential growth.

-

Margin Headwinds Persist: Q2 EPS guidance came in low, confirming investor concerns about profitability and margin pressure.

-

FY Outlook Raised: SMCI increased its full-year guidance to $36B, underscoring confidence in long-term AI execution.

-

Revenue Shift Confirmed: Q1 miss was offset by a $10–$11B Q2 revenue guide, signaling a timing deferral and strong sequential growth.

-

Margin Headwinds Persist: Q2 EPS guidance came in low, confirming investor concerns about profitability and margin pressure.

-

FY Outlook Raised: SMCI increased its full-year guidance to $36B, underscoring confidence in long-term AI execution.

Super Micro Computer (SMCI) reported significantly disappointing results for Q1 FY2026, though forward guidance points to a robust recovery and sequential growth surge.

Key Q1 FY2026 Misses

-

Revenue came in at $5.02 billion, falling short of the $6.09 billion consensus, representing a 17.5% miss.

-

Adjusted Earnings Per Share (EPS) was $0.35, a 14.6% disappointment against the expected $0.41.

-

The Adjusted Gross Margin was 9.5%, narrowly missing the 9.63% expectation.

Forward Guidance Signals Volatility and Margin Pressure

-

Q2 Revenue guidance was set between $10 and $11 billion, significantly exceeding the consensus of $8.05 billion and implying a substantial 24% to 37% sequential increase.

-

However, Q2 EPS guidance of $0.46–$0.54 fell well below the $0.62 consensus, suggesting continued margin compression despite the revenue acceleration.

-

SMCI raised its full-year FY2025 revenue guidance to at least $36 billion, up from the previous at least $33 billion.

Analysis: Timing Shift Over Fundamental Disappointment

-

The company's poor Q1 performance was attributed to a clear revenue deferral into Q2, caused by customers awaiting "design win upgrades" related to new NVIDIA and AMD chip generations.

-

This backlog suggests the Q1 result is primarily a timing issue rather than a fundamental demand deterioration. The Q2 revenue forecast, implying a potential 100% sequential jump, reinforces this view.

-

Crucially, the company's decision to increase its ambitious full-year target to $36 billion underpins management's confidence in execution, even as the lower-than-expected Q2 EPS guidance highlights ongoing concerns about profitability and margins.

-

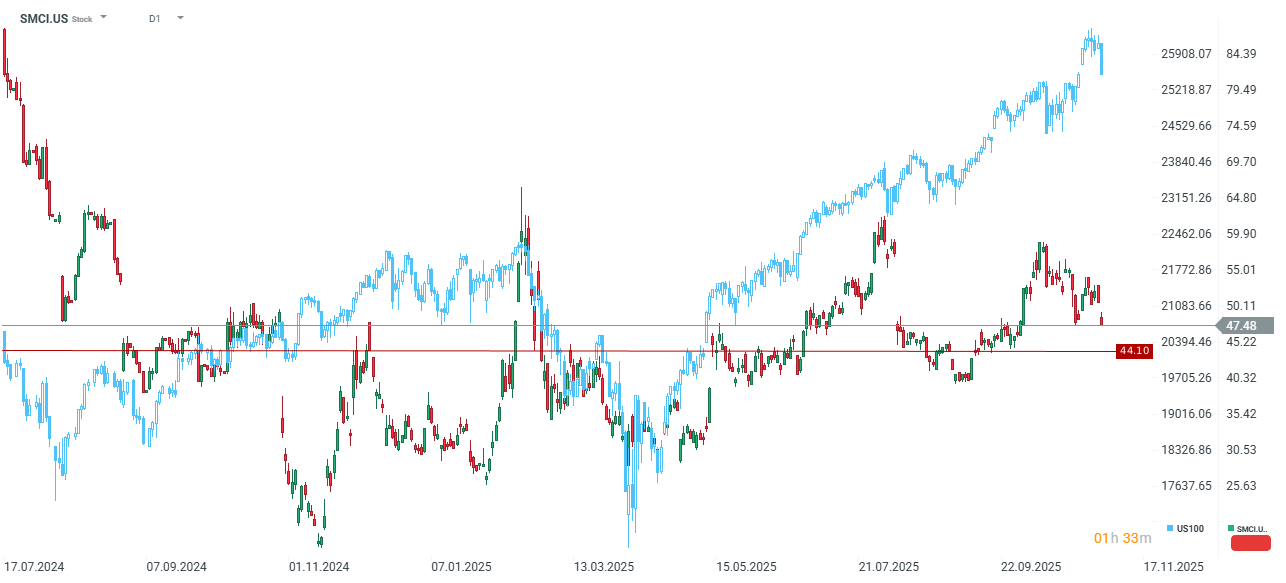

The 8% drop in after-hours trading reflects typical market asymmetry, where investors prioritize the quarterly miss over the optimistic long-term revenue forecast, while also reacting to the weak profitability outlook.

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.