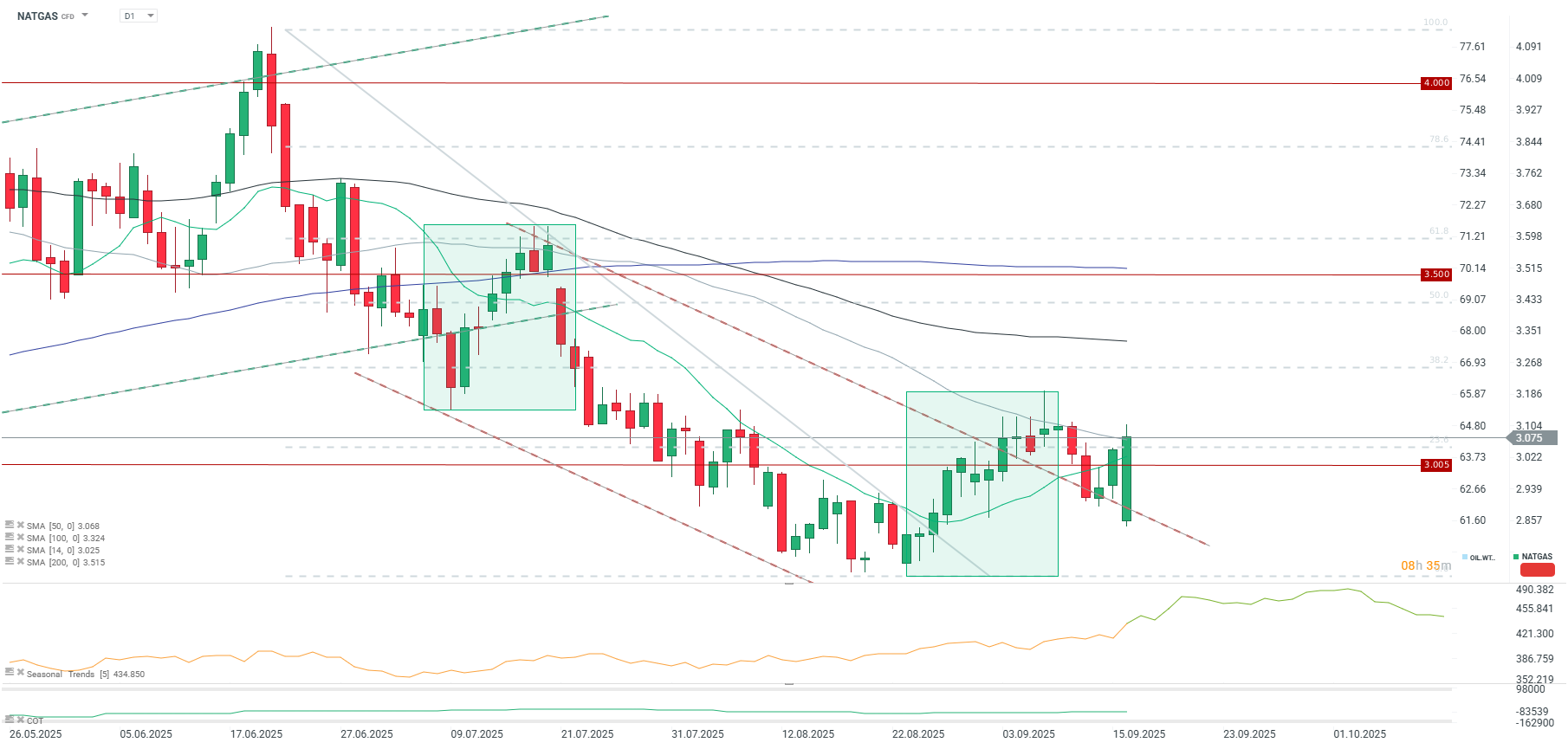

Today’s volatility in US natural gas markets appears highly perplexing. Following yesterday’s strong price rally, the market opened below $2.9, but quickly recovered above $3.0, once again breaching its 50-period moving average. The recent price increases have been driven by concerns over heightened demand due to anticipated "heat waves," yet prices opened lower today amid confusion surrounding the US pipeline system and overproduction. What is happening in the US gas market?

Negative Prices in Texas

Natural gas prices at the West Texas Waha Hub have plunged into negative territory, reaching as low as -$3.00/MMBtu, the lowest level in 14 months. This situation is the result of significant local oversupply and constraints on pipeline capacity. Negative pricing means that producers are paying consumers to take the gas, as they lack sufficient storage options. They prefer to pay for its removal rather than process it or resort to flaring. Kinder Morgan is currently conducting maintenance on several pipelines, which is preventing gas from being transported from the Permian Basin to key demand centres in the Gulf Coast and California. The Permian region is currently experiencing a strong overproduction that cannot be absorbed by the existing transmission infrastructure. The Henry Hub price reacted to the negative prices in the Waha Hub due to partial arbitrage, but quickly resumed its upward trend, given the reduced availability of gas from Texas and the increasing likelihood of a demand rebound in the coming weeks.

Waha Hub prices fell below -$3.00/MMBtu. Source: Bloomberg Finance LP, XTB

Waha Hub prices fell below -$3.00/MMBtu. Source: Bloomberg Finance LP, XTB

Weather Points to a Possible Demand Rebound

We are currently in a transitional period, between demand for cooling and demand for heating. Nevertheless, gas consumption for cooling has recently seen an uptick, which is also delaying the start of the heating season. However, prices are reacting primarily to the former factor. On Monday, gas production reached 108.7 bcfd, a 7% increase year-on-year, while demand was 71.8 bcfd, up 2.0% year-on-year. Last week, the EIA raised its forecast for average US production to 106.63 bcfd.

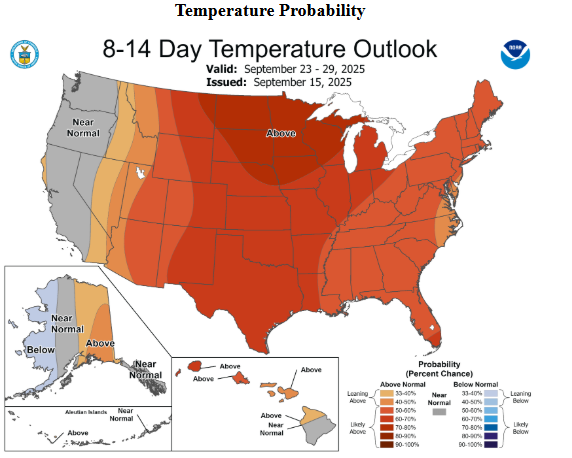

US temperatures are once again expected to be above normal. Source: Bloomberg Finance LP, XTB

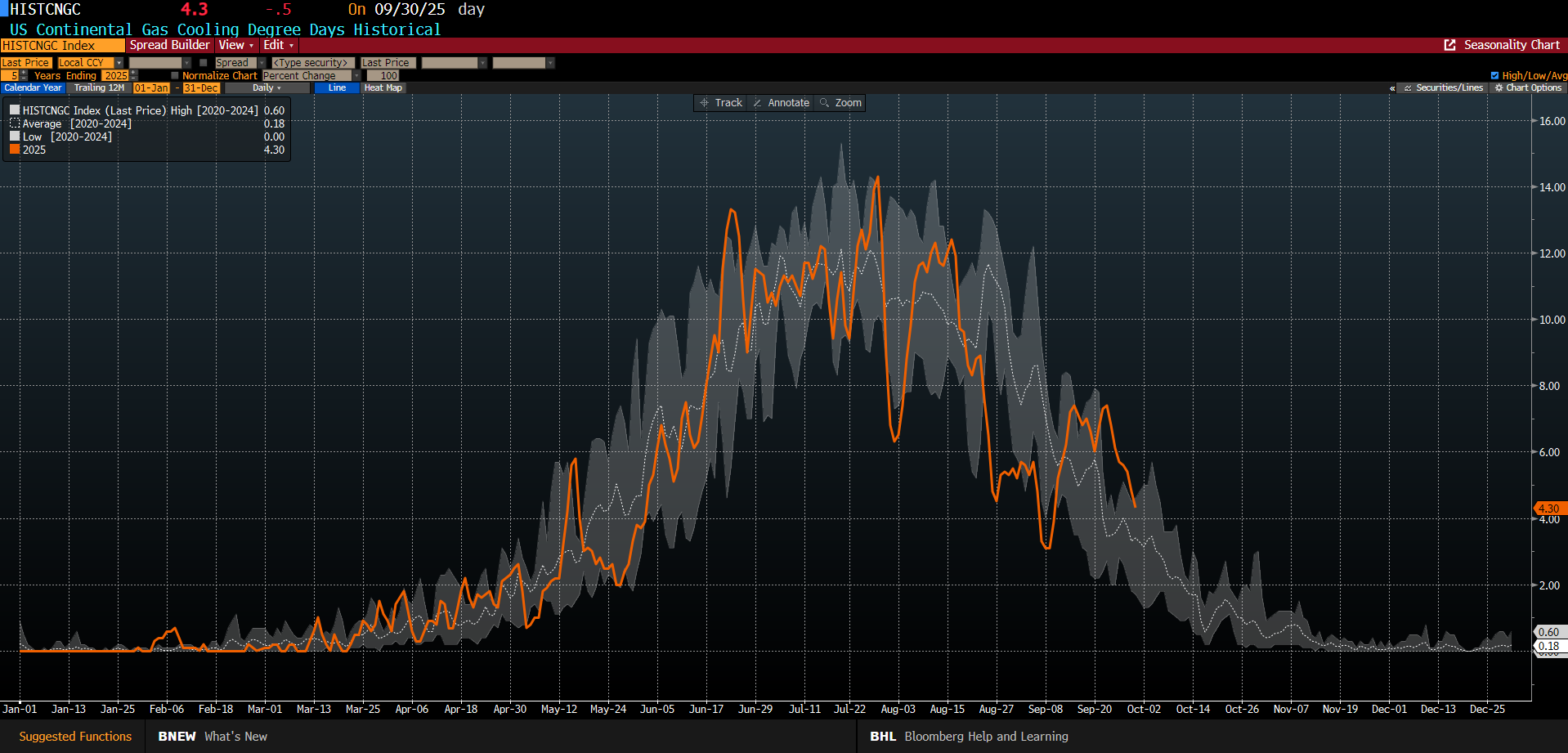

Cooling degree days have recently rebounded significantly and stay above 5-year average, but the overall trajectory remains downward. Source: Bloomberg Finance LP, XTB

Cooling degree days have recently rebounded significantly and stay above 5-year average, but the overall trajectory remains downward. Source: Bloomberg Finance LP, XTB

Price at a Key Technical Point

The price surged yesterday to around $3.00/MMBtu, and today it is breaking through the 50-period moving average, also returning above the 23.6% retracement of the last downward wave. If the price remains above this level during today's session, it could attempt to test the $3.1-$3.2/MMBtu range. However, if it closes below, downward pressure could re-emerge, particularly ahead of Thursday’s inventory report, which is expected to show another strong build that could bring inventory levels closer to last year's. Current inventories are only 1.3% lower than a year ago.

Daily Summary - Powerful NFP report could delay Fed rate cuts

BREAKING: Massive increase in US oil reserves!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.