Stitch Fix (SFIX.US) stock plunged more than 26.0% in the premarket after the online personal styling and shopping service issued disappointing sales outlook as it continues to face challenges in getting customers to sign up for its styling service.

- Company reported a net loss of 28 cents per share, compared with 20 cents a share loss, a year earlier. Today's figures came in line with market estimates.

- Revenue increased to $516.7 million from $504.1 million a year earlier, topping analysts’ projections of $514.8 million.

- Number of active clients increased 4.0% from the year-ago period, to slightly above 4 million

- Sales per client jumped to $518, which is an 18% increase year over year. It was the third consecutive quarter that per-client sales were above $500.

- For the current quarter, the company projects net revenue in the region from$485 million to $500 million, which would represent a decline of 10% to 7% from the prior year. Analysts were expecting sales of $560.5 million.

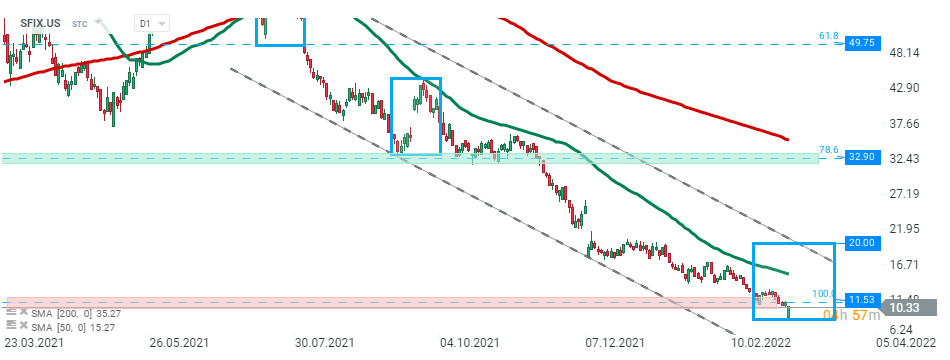

Stitch Fix (SFIX.US) stock launched today’s session with a bearish price gap, below lows from March 2020 at $11.53. Nevertheless risk-on sentiment returned which helped bulls to erase most losses. If current sentiment prevails, an upward move may accelerate towards resistance at $20.00 which is marked with an upper limit of the 1:1 structure and lower limit of the descending channel. Source: xStation5

Stitch Fix (SFIX.US) stock launched today’s session with a bearish price gap, below lows from March 2020 at $11.53. Nevertheless risk-on sentiment returned which helped bulls to erase most losses. If current sentiment prevails, an upward move may accelerate towards resistance at $20.00 which is marked with an upper limit of the 1:1 structure and lower limit of the descending channel. Source: xStation5

Nvidia Faces New H200 Limits in China

US Open: Wall Street in Blood

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.