-

Coronavirus vaccines brighten outlook for aviation sector

-

US and Brazil regulators approve return of 737 MAX planes to service

-

European approval may be issued for early-January

-

737 MAX makes up a majority of order backlog

-

Stock price approached post-pandemic highs

Boeing (BA.US), the biggest US planemaker, had a hard time past year. Not only it had to deal with depressed demand for planes due to the coronavirus pandemic but also with a backlash following fatal crashes of its flagship 737 MAX jets. However, light can be spotted at the end of a tunnel and both issues could be resolved soon.

Coronavirus vaccine brightens outlook for airlines and planemakers

Airlines have been hit particularly hard by the coronavirus pandemic as governments of numerous countries banned air travel to and from Covid-19 hotspots. Even as restrictions began to be lifted, passengers remain reluctant as being locked in a limited space with dozens of other people for a few hours greatly increases risk of contracting coronavirus. However, as more and more vaccine candidates show promising results there is a high chance that vaccination will begin in 2021. Demand for air travel should start to pick-up along.

As airlines will start to see increased demand for their services, they may start expanding their fleet once again. Of course, it will take time to return to pre-pandemic traffic levels but recovering air travel volumes should at least incentivize airlines not to cancel more orders for new planes.

Commercial Airplanes was the biggest business segment for Boeing for years. However, following 737 MAX grounding in late-Q1 2019 its revenue slumped. Source: Bloomberg, XTB Research

Commercial Airplanes was the biggest business segment for Boeing for years. However, following 737 MAX grounding in late-Q1 2019 its revenue slumped. Source: Bloomberg, XTB Research

737 MAX ungrounding

Demand for Boeing planes was hit even before the coronavirus pandemic arrived, as aviation regulators around the world grounded its 737 MAX planes, following two fatal crashes with combined death toll of 346, in March 2019. However, after a year and a half of being out of service, the Federal Aviation Administration announced on Nov. 18 that 737 MAX will be able to return to commercial flights. Moreover, European regulators published a report on Nov. 24 hinting that 737 MAX planes may be cleared for take-off by early-January 2021. Approval to return to service was also issued by Brazilian aviation watchdog.

This is great news for Boeing. Why? Company had a backlog of 5,146 planes by the end of Q3 2020, out of which 4,114 were 737 MAX planes! Boeing said that grounding costs will be split across 3,100 planes meaning that the programme is likely to have a lower profit margin compared to pre-grounding times. Nevertheless, as the US planemaker will start to realize orders, the chance of them being cancelled will shrink and, more importantly, it may stop losing market share to its main rival, Airbus.

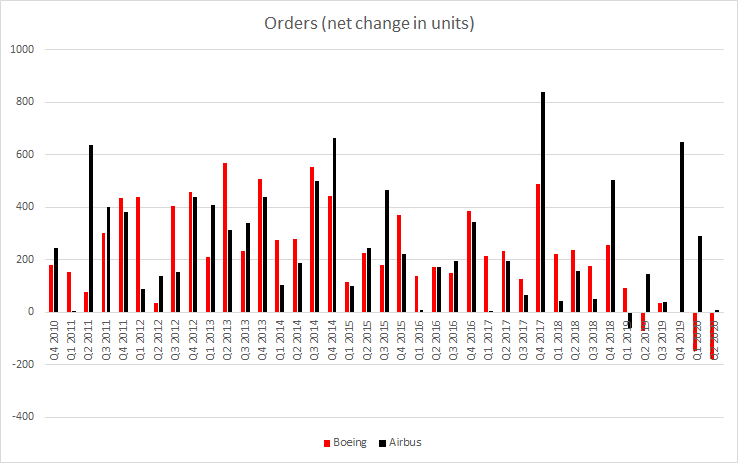

Boeing saw negative net orders change in the aftermath of 737 MAX grounding. At the same time, its main rival Airbus continued to book new orders for its planes, often at the expense of Boeing order cancellations. Source: Bloomberg, XTB

Boeing saw negative net orders change in the aftermath of 737 MAX grounding. At the same time, its main rival Airbus continued to book new orders for its planes, often at the expense of Boeing order cancellations. Source: Bloomberg, XTB

Stock approaches post-pandemic highs

Of course, it will take time until Boeing operations recover to pre-grounding levels. However, stock started to benefit from some positive price action as of late. Stock price broke above the upper limit of the upward channel earlier this month. News of 737 MAX ungrounding allowed stock to reapproach post-pandemic highs at 38.2% retracement of a drop from the all-time highs. Return of 737 MAX to service may prompt a decision to restore dividend payments (they were suspended after Q1 2020) and this could attract additional demand from income investors. Breaking above the resistance at 38.2% would pave the way towards the next major resistance zone marked by 61.2% retracement ($310 area).

Source: xStation5

Source: xStation5

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.