Tesla reported third quarter earnings on Wednesday after the end of the Wall Street session. Stock jumped in the after-hours trading as release showed the fifth profitable quarter in a row. US electric vehicles manufacturer also confirmed its full-year guidance. Take a look at our market alert and find out about the details!

Another profitable quarter

Tesla managed to generate $809 million in Q3 net income. Adjustment for a stock-based compensation leaves Tesla with a net income of $331 million. This figure came slightly below the median estimate of $394 million. Adjusted EPS of $0.76 was higher than expected $0.57. It has marked the fifth straight profitable quarter for Tesla, showing that the company is no longer the cash-burning machine it used to be. Cash at hand increased by $5.9 billion during the quarter and the company achieved positive free cash flow of $1.4 billion.

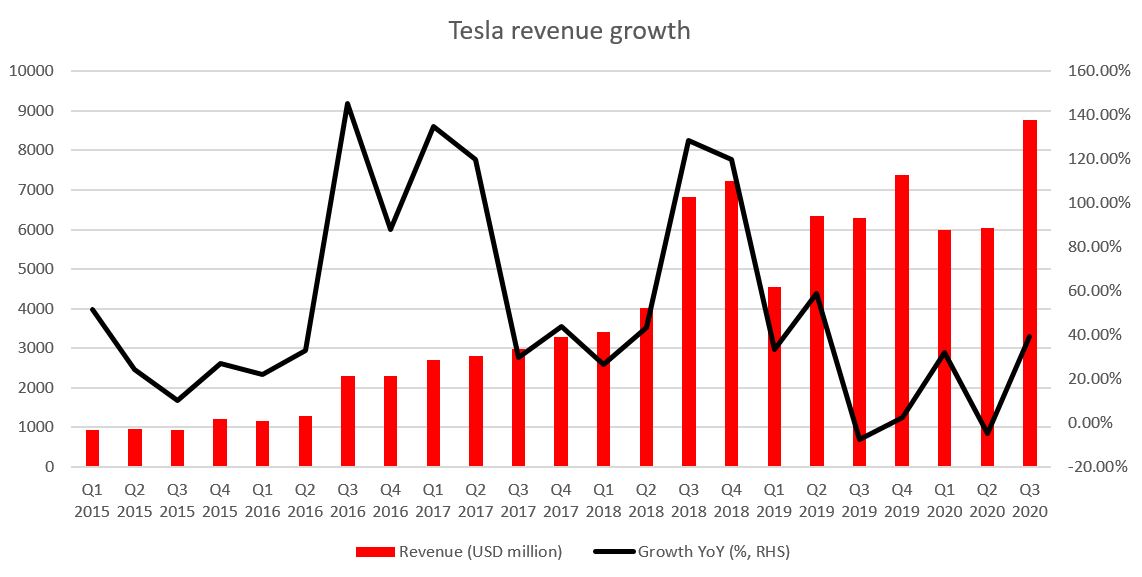

Tesla continues to enjoy robust revenue growth. Nevertheless, it has slowed considerably compared to previous years. Source: Bloomberg, XTB

Tesla continues to enjoy robust revenue growth. Nevertheless, it has slowed considerably compared to previous years. Source: Bloomberg, XTB

Record revenue, deliveries and production

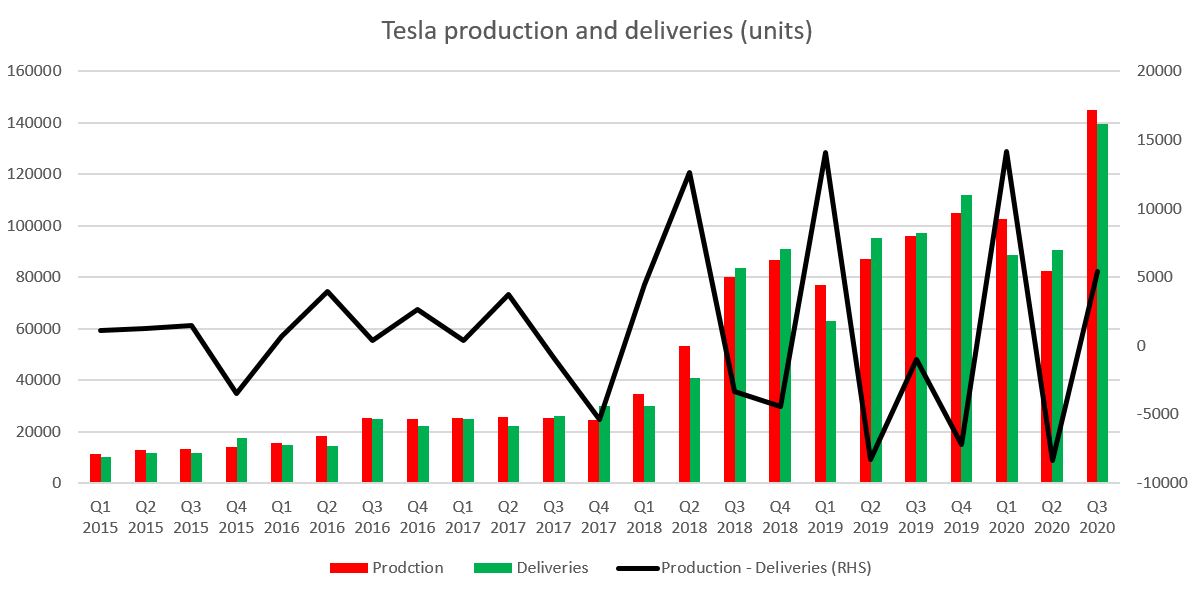

Tesla also managed to generate record quarterly revenue as deliveries reached record. The US electric vehicle manufacturer generated $8.77 billion (exp. $8.36 billion) as quarterly deliveries jumped to 139,300 vehicles. Deliveries increased 44% year-over-year while revenue was 39% YoY higher. Not only deliveries hit a new record but the company also managed to produce a record number of vehicles in the quarter (145,000) as production lines were launched. Tesla confirmed its full-year target of delivering half a million vehicles this year in spite of a risk of new lockdowns hitting demand. Moreover, asked about next-year's goal, Elon Musk said that deliveries are aimed to be in the vicinity of maximum production capacity (840,000 - 1,000,000 vehicles).

Both deliveries and production was at a record level in Q3 2020. However, it was the first Q3 since 2016 when inventory increased instead of shrinking. Source: Bloomberg, XTB

Both deliveries and production was at a record level in Q3 2020. However, it was the first Q3 since 2016 when inventory increased instead of shrinking. Source: Bloomberg, XTB

Regulatory credits remain a concern

However, not everything is as rosy as it seems. Tesla has once again managed to get an enormous amount of money from sales of regulatory credits - $397 million in Q3 2020. Regulatory credits are given out to the US carmakers for free and they are required to have a certain level of them at the end of the year. This level is dependent on how much electric and conventional vehicles they produce. As Tesla produces only electric vehicles, it has a surplus of credits and sells them regularly to companies that have less EVs in their mix. Comparing $397 million from credit sales with $331 million in adjusted net income shows that automotive production at Tesla is still losing money. Tesla managed to generate $451 million in adjusted net income in Q1-Q3 2020 while making $1.18 billion profit from credit sales in the same period.

Tesla has pulled back after painting at double top near $460 handle. Stock has been sliding towards the $400 area this week, where 23.6% retracement and upward trendline can be found. However, solid Q3 revenue beat may help bulls halt declines and look towards $460 once again. Source: xStation5

Tesla has pulled back after painting at double top near $460 handle. Stock has been sliding towards the $400 area this week, where 23.6% retracement and upward trendline can be found. However, solid Q3 revenue beat may help bulls halt declines and look towards $460 once again. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.