The year 2021 was a very bumpy and volatile one for the cryptocurrency market as a whole. Although Bitcoin has risen nearly 70% over the course of the year (a result that, by its scale, doesn't surprise like it used to), investors have also experienced sizable declines that continue to create mixed feelings. In today's laid-back post, we'll give you some interesting On-Chain facts that may illustrate today's situation for the Bitcoin.

Annual Bitcoin price chart and range of major corrections. Source: Bloomberg

Accumulation of long-term addresses

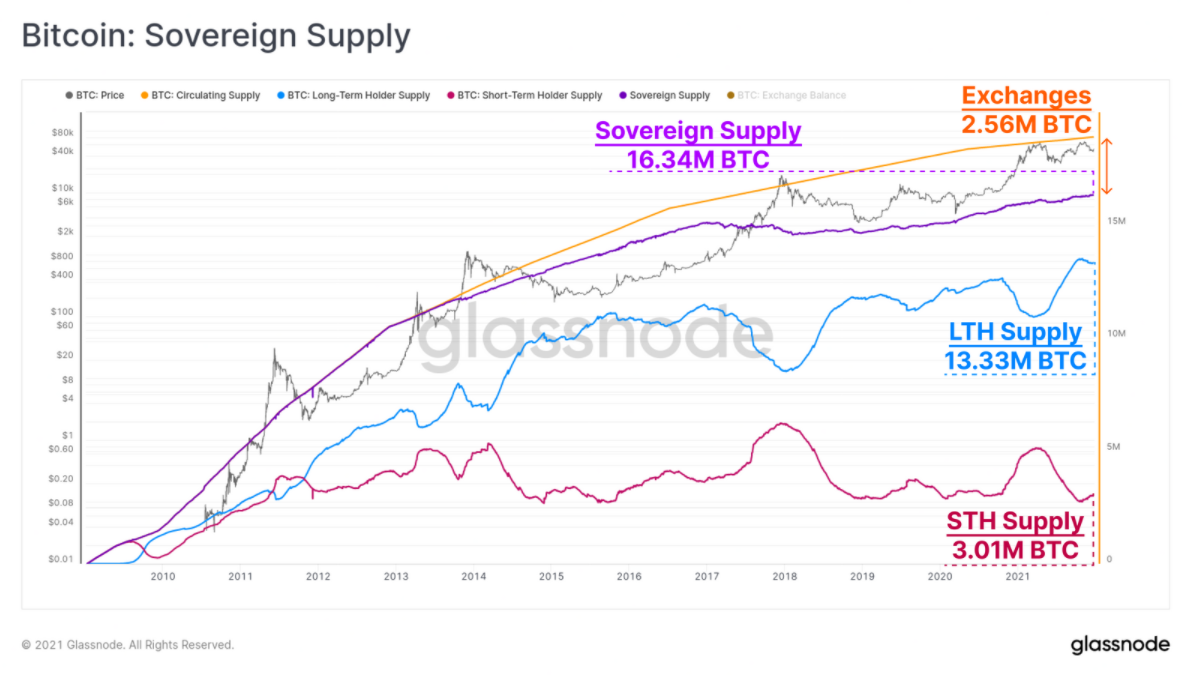

Long-term Bitcoin holders added 1.846 million BTC to their holdings, bringing their total ownership to 13.33 million BTC. This represents a 16% increase over the year. Short-term address supply decreased by 1.428 million BTC and this group now holds 3.01 million BTC. This reflects a decrease of 32% over the year. This data demonstrates the bullish attitude of long-term investors and the buying of Bitcoin from short-term addresses that agree to sell the cryptocurrency at a loss (the total supply of BTC at a loss is now 3.48 million units, or 18.34% of all coins in circulation). The amount of Bitcoin outside of exchange addresses is currently at an all-time high of 13.34 million BTC. The record amount of Bitcoin outside exchanges may indicate that some large holders are not willing to sell the cryptocurrency at current prices and are holding the assets in external wallets.

Fear for new investors and peace of mind for long-term holders. Source: Glassnode

Overleveraging in the market continues

The chart below shows how overleveraging in the Bitcoin market has increased over the past year. This carries the risk of very dynamic downward or upward price movements through the liquidation of stop-losses and mass closing of long or short positions by investors when important information is published that may affect the valuation of the cryptocurrency market.

Overleveraging in the markets has increased over the course of 2021. Overleveraging in the markets has increased by more than 50% through 2021. The chart shows the ratio of open futures contracts to total Bitcoin reserves on exchanges. Source: CryptoQuant

What can investors expect in the current cycle?

Throughout 2021, we haven't seen the euphoria phase that has ended every bull market cycle for Bitcoin so far. Some investors believe that Bitcoin has 'matured' as an asset and that previous dynamic rallies were the result of a smaller market and few institutions able to influence the price of the cryptocurrency.

Other investors believe that the bull market is not over yet and that the phase of the greatest euphoria must come for the cycle to be completed, which could be triggered by such events as the approval by the US SEC of an ETF buying Bitcoin from the market at a spot price. However, with each passing day Bitcoin moves further away from the last halving in 2020 and the number of days since halving so far has been one of the clues to the phase of the 'king of cryptocurrencies' cycle.

Both sides may be wrong, however, as Bitcoin is now an asset bought by large institutions and investment funds, which means that discounts of 80% or even 90% as in previous cycles may no longer occur and blockchain technology is finding more and more practical applications in modern finance. On the other hand, the current capitalization of Bitcoin and institutional capital may 'prevent' the cryptocurrency from spectacular, rapid increases which took place in previous cycles.

Morning wrap: Tech sector sell-off (06.02.2026)

Technical analysis: Bitcoin deepens decline falling to $66.5k 📉

🚨Bitcoin crashes 4% to $69k📉Sell-off on Ethereum and Ripple

Chart of the day: BITCOIN 40% below recent peak 🚨 Eroding fundamentals risk selling spiral 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.