Summary:

-

Last-ditch talks fail to save Thomas Cook

-

Soft European data weighs on Stocks and EUR

-

Saudi Oil repairs could take longer than anticipated

The world’s oldest tour operator has entered compulsory liquidation with immediate effect after last-minute talks with lenders, shareholders and even the UK government failed to save Thomas Cook. The 178-year-old travel company has been struggling for some time with the firm reporting a £1.5B loss for the first half of 2019 and sadly the end comes as no real surprise to those who have followed the company’s travails in recent years. Estimates of the number of tourists on holiday with the firm are in the range of 600,000, with roughly 1 in 4 of these being British, meaning the collapse could lead to the biggest-ever peacetime repatriation. 16,000 of these UK tourists were booked onto Thomas Cook flights today, with the majority (14-15,000) expected to be home by tonight.

As many as 9,000 British jobs are in very real danger of being lost out of a global staff of 21,000. The failure to scrape together the requisite £200m owed to creditors means that the Civil Aviation Authority (CAA) will foot the bill estimated to be around £100M to get stranded holidaymakers home. A failure for the government to plug this shortfall may seem illogical in the short-term but a rescue package would likely have amounted to little more than delaying the inevitable and simply throwing good money after bad, with the prospect of Thomas Cook having been able to turn this around given the massive debt pile and struggling core business operations extremely faint to say the least.

European shares tumble after more soft data

Stock benchmarks on the continent have gotten off on the wrong foot at the start of the week with some fairly significant selling seen after a raft of weak economic data releases. Leading industry surveys from both the manufacturing and services sector paint a pretty bleak picture of the European economy with the latest PMI readings disappointing on both fronts. The levels of activity seen in German manufacturing in particular are worrisome and reflective of a global slowdown in this area with the print of 41.4 for September coming in at the lowest level in over a decade while the composite PMI has fallen to levels not seen since the country was in the throes of the Eurozone debt crisis back in October 2012. The German Dax has tumbled over 150 points in response to the data to trade at its lowest level in a fortnight and there are some growing concerns that the recent rally is perhaps coming to an end.

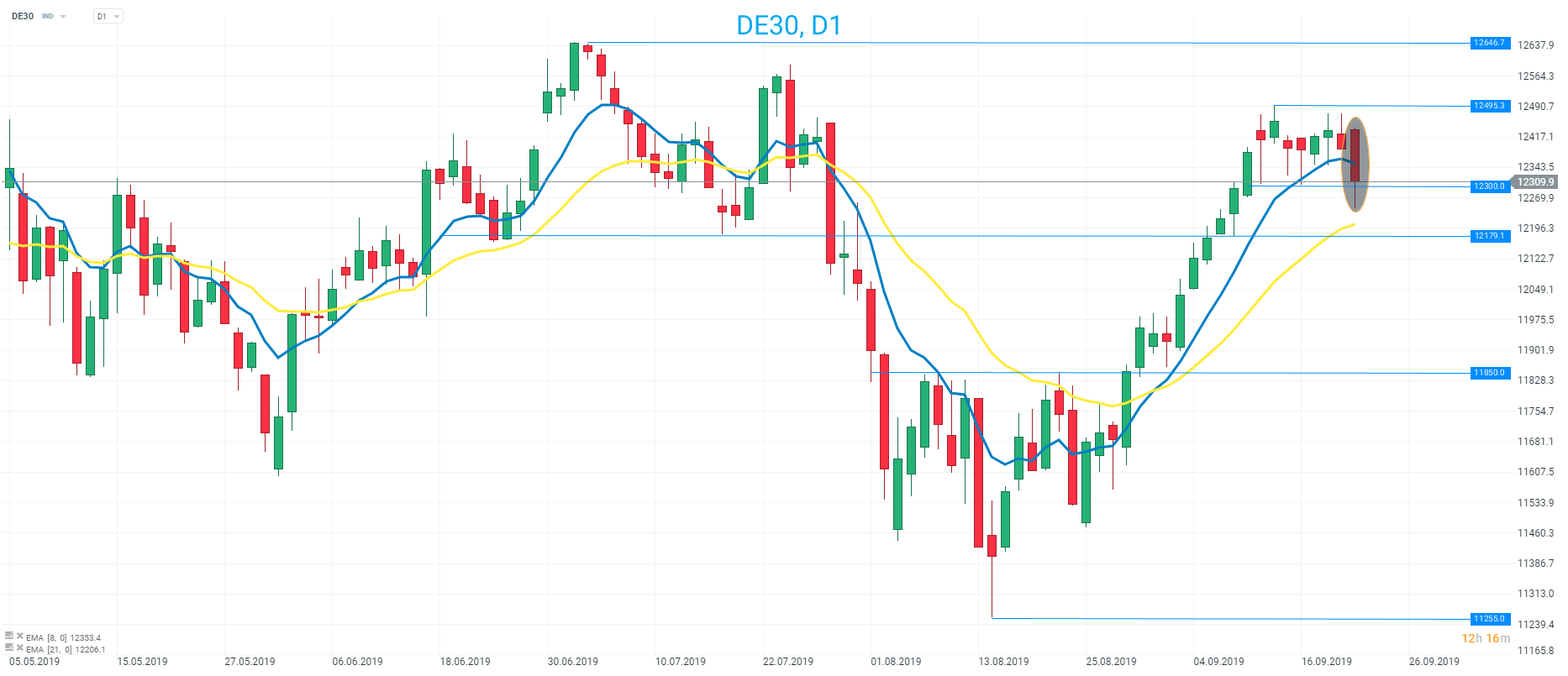

The German Dax has tumbled since the data was released and fallen clearly below its 8 EMA (blue line) for the first time in almost a month. The 8 EMA remains above the 21 (yellow line) but a daily close below 12300 could be seen to confirm a break lower after the recent consolidation in the 12300-12495 range. Source: xStation

The German Dax has tumbled since the data was released and fallen clearly below its 8 EMA (blue line) for the first time in almost a month. The 8 EMA remains above the 21 (yellow line) but a daily close below 12300 could be seen to confirm a break lower after the recent consolidation in the 12300-12495 range. Source: xStation

A flow of supportive news in the past month has caused European equities to move firmly higher with the Dax adding almost 10% from the low seen at the end of August, with positive developments on the trade front, a new large scale stimulus package from the ECB unveiled and improving economic data all contributing to the recovery. However, the final tenet listed above now looks misplaced while the belief of an improvement in US-China trade tensions is more based on rhetoric rather than actions and the failure for equities to rise further on additional rate cuts and the announcement of the resumption of the Asset Purchase Programme could prove particularly telling. The Euro is also unsurprisingly coming under pressure following the releases with the EUR/USD rate dropping below the psychological 1.10 handle to trade not far from its lowest level in a couple of years.

Aramco repairs could take months longer

Following the recent attacks on Saudi production facilities, crude oil remains of keen interest for many traders with heightened levels of volatility and some wild swings seen in the past week. Hopes that the damage was not as bad as first feared are starting to look a little misplaced with the official line from Saudi officials and executives of the state-owned Oil company Aramco that output will recover quickly looking just a touch wishful. Contractors are reportedly of the belief that it may take many months, rather than the maximum 10 weeks that Aramco executives have promised to return all operations to their pre-attack levels. Brent crude began the week higher after the reports but has since turned down to trade lower on the day with the weak European data perhaps raising questions as to the demand side of the equation.

Oil has drifted lower today after starting higher, with price drifting back towards the level where it gapped higher from after the Saudi attacks at 60.25. Source: xStation

Oil has drifted lower today after starting higher, with price drifting back towards the level where it gapped higher from after the Saudi attacks at 60.25. Source: xStation

Chart of the day: JP225 (27.10.2025)

BREAKING: Ifo Index Slightly Above Expectations. DE40 limits jump from the session start

Morning wrap (27.10.2025)

Daily Summary: CPI down, Markets Up

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.