Electrification is a very popular theme among stock market investors as of late. Companies focusing on products that use alternative energy sources, like for example electric vehicle manufacturers, have caught investors' attention and their shares soared in 2020. Trend continues at the beginning of 2021 with some stocks, like for example Plug Power, almost doubling their valuations. Interest in green stocks soared following the US presidential elections as Biden's win signalled a push for a clean-energy agenda in the United States. In our short report we present 5 most popular electrification stocks.

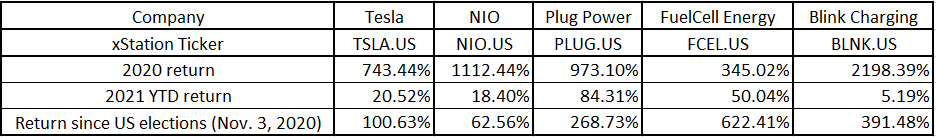

Electrification stocks are very popular among investors as of late. Democrat win in the US presidential elections has boosted odds for an environmentally friendly agenda and provided more fuel for rally. Data based on January 20 closing prices. Source: Bloomberg, XTB

Electrification stocks are very popular among investors as of late. Democrat win in the US presidential elections has boosted odds for an environmentally friendly agenda and provided more fuel for rally. Data based on January 20 closing prices. Source: Bloomberg, XTB

Tesla (TSLA.US)

Tesla is a company that needs no introduction. Probably the most famous electric vehicle car manufacturer and one of the pioneers in the field has rallied over 700% last year to become one of the largest companies in the world. While Tesla has been subject to speculative frenzy for years, this time is different as the company started to deliver more cars and turn in profits. Blown-out valuation and extremely high stock multiples did not discourage investors as they keep seeing it as a driver of a new era. While other big name companies in the automotive sector are also developing electric vehicles, Tesla had a head start. On the other hand, in spite of having smaller market capitalization, many traditional carmakers have bigger resources to compete than Tesla.

Tesla (TSLA.US) is starting to look more and more like a mature company as it is able not only to meet its delivery targets but is also beginning to make profits. Investors do not seem to be frightened by very high valuation and continue to bet on future share price gains of world's leading EV company. Source: xStation5

Tesla (TSLA.US) is starting to look more and more like a mature company as it is able not only to meet its delivery targets but is also beginning to make profits. Investors do not seem to be frightened by very high valuation and continue to bet on future share price gains of world's leading EV company. Source: xStation5

NIO (NIO.US)

NIO is the Chinese electric vehicle manufacturer. The company is seen as the Tesla of China and is an EV leader in the country. It has been recently struggling with supply shortages as it has been managing to sell all the vehicles it produced. However, a decision was made to boost production capacity in order to meet high demand. NIO has managed to increase its sales this year and lower net loss, showing that economies of scale start to work. Its share price increased over 1100% during the pandemic-hit 2020 and the stock is trading almost 20% year-to-date higher in 2021.

NIO (NIO.US) is a very popular stock among retail investors thanks to high volatility. Share price has recovered from late-November decline and the beginning of 2021 and reached a fresh all-time high near $66.50. Source: xStation5

NIO (NIO.US) is a very popular stock among retail investors thanks to high volatility. Share price has recovered from late-November decline and the beginning of 2021 and reached a fresh all-time high near $66.50. Source: xStation5

Plug Power (PLUG.US)

Plug Power is very popular among investors lately. The company is developing hydrogen fuel cell solutions and has struck two major deals recently. It has partnered with South Korean SK Group and later on with French Renault. The former has made a big investment in the company while the latter decided to form a joint venture with Plug aimed at dominating European market for fuel cell light commercial vehicles. Both partnerships have been well received by analysts, who said that they may be big drivers of future earnings. While the company has relatively small size of operations currently, this is expected to change over the next few years as benefits of partnership start to materialize.

Plug Power (PLUG.US) rallied to an almost 15-year high at the start of 2021, thanks to two major partnerships it has struck. Despite recent weakness, share price of Plug Power remains over 80% higher compared the close of 2020. Source: xStation5

Plug Power (PLUG.US) rallied to an almost 15-year high at the start of 2021, thanks to two major partnerships it has struck. Despite recent weakness, share price of Plug Power remains over 80% higher compared the close of 2020. Source: xStation5

FuelCell Energy (FCEL.US)

FuelCell Energy is a provider of fuel cell solutions with history going as far back as to 1969. However, the company did not generate a single dollar of profit for the past 20 years. Moreover, the company was nearly bankrupt in 2019! However, thanks to a deal struck with ExxonMobil it has managed to survive and started to present quarterly reports showing rising revenue. FuelCell Energy has also reached agreements with companies like Pfizer and Toyota. Transition towards a more environmentally friendly economy signalled by Joe Biden and Democrats has led investors to believe that this might be the time to give the company a closer look and has triggered an over 600% share price increase since the US presidential elections.

FuelCell Energy (FCEL.US) has started a strong upward move following the US presidential elections. Stock reached a 2.5-year high near $21 at the beginning of 2021. While part of this gains has been erased already, the company still trades 50% higher year-to-date! Source: xStation5

FuelCell Energy (FCEL.US) has started a strong upward move following the US presidential elections. Stock reached a 2.5-year high near $21 at the beginning of 2021. While part of this gains has been erased already, the company still trades 50% higher year-to-date! Source: xStation5

Blink Charging (BLNK.US)

Blink Charging is a company designing and manufacturing charging stations for electric vehicles. Apart from that, the company is also operating its own network of charging stations. Blink Charging has managed to increase its revenue by over 80% year-over-year in Q1-Q3 2020 period. However, the company's size remains very small as its annual 2020 sales are still expected to be in single-digit millions. Nevertheless, investors saw an opportunity for the company with growing electric vehicle adoption and possible regulatory incentives supporting clean energy coming after Democrats won the White House and Congress. Blink Charging stock has surged over 2000% throughout 2020 and is trading almost 400% higher since the US elections.

Blink Charging (BLNK.US) has managed to paint a fresh intraday all-time high in the $57 area last week. However, bulls failed to hold onto these gains and the stock pulled back, painting a double top pattern near $55 in the process. Source: xStation5

Blink Charging (BLNK.US) has managed to paint a fresh intraday all-time high in the $57 area last week. However, bulls failed to hold onto these gains and the stock pulled back, painting a double top pattern near $55 in the process. Source: xStation5

Stock of the Week: Broadcom Driven by AI Sets Records

Market wrap: Indices try to maintain rebound despite rising oil price🗽Broadcom shares surge

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks

US OPEN: Wall Street buoyed by robust data and shifting sentiment

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.