This afternoon, Congressional leaders will meet with the U.S. president in an effort to avoid a government shutdown. A shutdown happens when lawmakers fail to approve the spending bills that fund federal operations on time.

What is a government shutdown?

Although it is sometimes linked to the debt ceiling, a shutdown is actually a short-term spending authorization problem: the money exists, but legally it cannot be used because Congress has not passed the appropriations bills or continuing resolutions to finance federal agencies.

With both chambers divided and deeply polarized, shutdown threats have become a recurring feature of Washington budget battles. A 2018 impasse during Trump’s first term resulted in a 34-day shutdown, the longest in modern history. At that time, roughly 800,000 of the 2.1 million federal employees went without pay, generating widespread uncertainty—amounting to roughly a quarter to a third of all public employment.

If no deal is reached, many government sectors and federal agencies will stop receiving funding and will be forced to suspend or close all non-essential functions. This time, the impact could be even more severe than usual. The White House has threatened permanent layoffs in the event of a shutdown.

What is causing the fight this time?

The federal government’s new fiscal year begins on October 1, and Congress has yet to reach agreement on a short-term funding bill.

Donald Trump canceled talks with Democratic congressional leaders earlier this week, saying an informal meeting would not be “productive” and calling their demands “unserious.” The move angered Democrats, and Senate Minority Leader Chuck Schumer and House Minority Leader Hakeem Jeffries blamed the president and congressional Republicans, who control both chambers, for a potential shutdown.

Democrats are demanding an extension of subsidies that cap health insurance costs under the Affordable Care Act, which are about to expire. This was one of the measures included in Medicaid cuts enacted in Trump’s One Big Beautiful Bill, passed earlier this year.

What happens during a shutdown?

Among the main consequences of a government shutdown are:

- Suspension of activities deemed “non-essential.”

- Roughly 800,000 federal employees could be furloughed without pay or forced to work without pay until the impasse is resolved.

- Essential services such as national security, air traffic control, military operations, debt payments, and Social Security continue.

- National parks, museums, administrative offices, and processes such as visa or permit applications may be halted or delayed.

Consequences in financial markets

So far, markets have largely shrugged off the threat of an October 1 shutdown, although the risk is rising by the day.

According to Polymarket, there is a 72% chance that a shutdown will occur before December 31 due to lack of a funding agreement, while the probability of a shutdown as early as October 1 stands at 67%.

The most significant market impact of a shutdown is the suspension of government economic data releases. In this case, starting Wednesday morning, no new data would be published, including the unemployment rate report or September’s nonfarm payrolls.

A shutdown matters for many reasons beyond financial markets, but its initial impact on stock prices should be minimal—though much would depend on its duration.

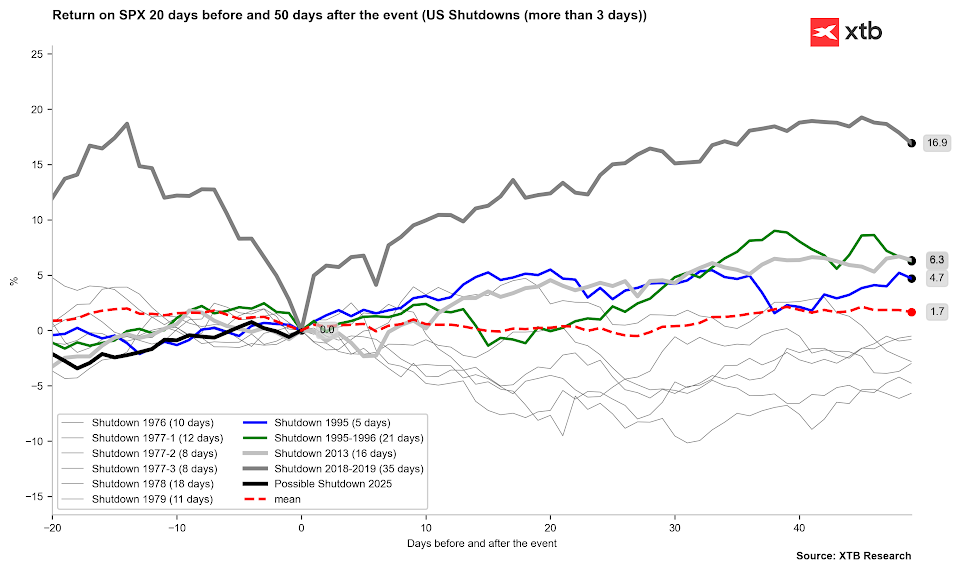

In fact, historically since 1975, for shutdowns lasting more than 3 days, the S&P 500 has averaged a 1.7% gain in the 50 days after the shutdown, with little volatility in that period. For all shutdowns regardless of length, the average gain has been 2.2%.

Performance of the S&P 500 during Government Shutdowns: Source: XTB

So far, the dollar is once again the asset under the most pressure—something that has happened throughout the year during every political episode—driven by uncertainty. This morning, it is following the same pattern ahead of today’s meeting between U.S. congressional leaders and President Donald Trump.

Gold performance

The weaker U.S. dollar has provided fresh support for gold, on top of a year-long rally fueled by monetary and fiscal stimulus, inflation expectations, Trump’s attacks on Federal Reserve independence, and central bank demand led by China.

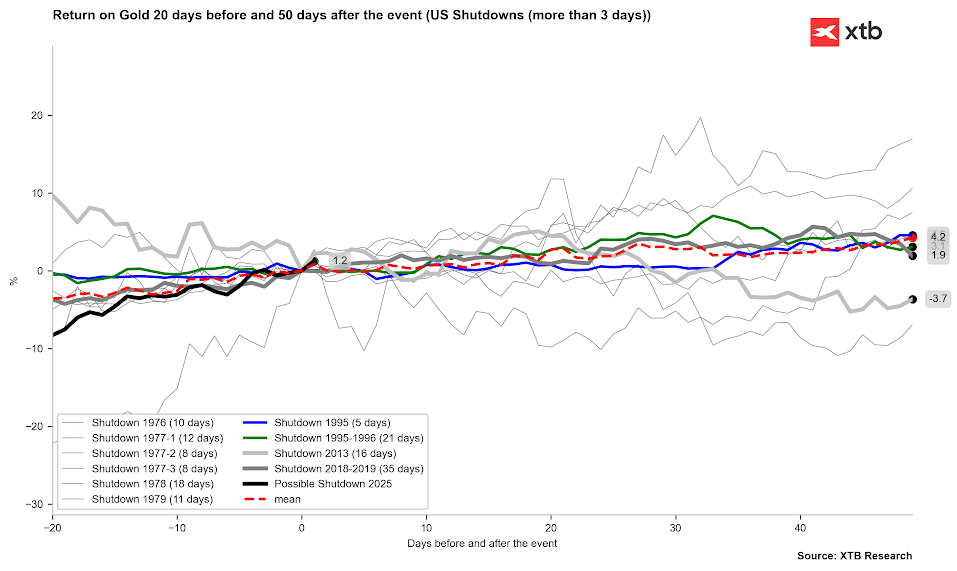

Since 1975, gold has risen an average of 3% in the 50 days following a government shutdown.

Performance of the gold during Government Shutdowns: Source: XTB

Gold has surged 45% so far this year. Prices are on track to close their third consecutive positive quarter, with gold-backed ETFs at their highest holdings since 2022.

Gold D1 inteval. Source: Xstation

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.