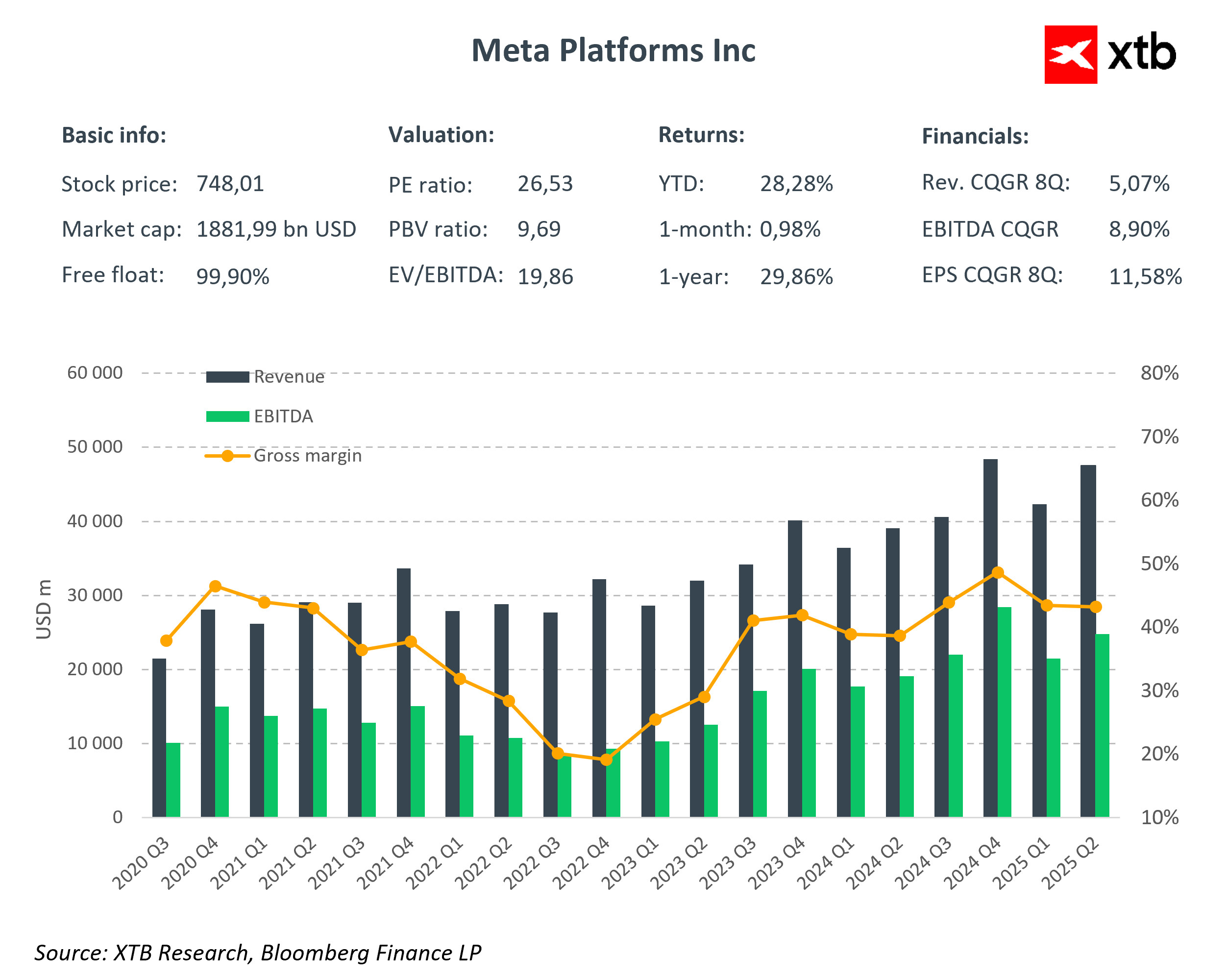

Meta Platforms (META.US) will publish its Q3 FY2025 earnings report today. The stock has seen a solid two-week rally of over 6%, though it is trading flat today. Year to date, Meta shares are up 27.41%, and since the early-April lows, they have surged 54.80%.

The company’s advertising business remains the key growth driver. The market expects double-digit increases in both volume and revenue. FactSet and Bloomberg consensus forecasts point to $49.5 billion in quarterly revenue. Investors will also be paying close attention to capital expenditures (capex). Meta traditionally provides updated capex guidance in Q3, and this time, the market expects a ~40% jump in spending next year, driven by heavy investments in data centers and AI infrastructure.

Key financial expectations

- Revenue (Q3): $49.5B, +22% y/y – the fastest growth rate this year.

- EPS: $6.72, +11% y/y.

- Ad impressions: +10.8%; average ad price: +10.5%.

- Operating margin: estimated at 39%.

- Capex 2025: around $69B, with potential guidance of $97–103B for 2026.

- Daily active users across Meta’s ecosystem: 3.48 billion.

AI investments under scrutiny

Meta’s ongoing transformation toward artificial intelligence is having an increasing impact on its balance sheet. This year’s capex of around $70 billion, combined with private financing of $27–30 billion from Blue Owl Capital and PIMCO, highlights the scale of the company’s ambitions. The funds will support the expansion of Hyperion data centers and long-term AI development projects. Unlike Microsoft or Amazon, Meta is building computing capacity solely for its own ecosystem, making these investments strategic but also riskier in the event of a slowdown in advertising revenue growth.

What the market is watching

Investors currently accept the rising capital expenditures, viewing them as justified by the potential benefits of greater user engagement and ad efficiency. However, the 2026 guidance could test that optimism. Analysts expect around $72 billion in capex for 2025, and possibly over $100 billion for 2026.

Outlook

Meta’s results are likely to confirm strong cash flow driven by advertising, but the balance between aggressive AI investment and profit growth will determine the market’s reaction. If the company signals excessive 2026 spending or shows signs of advertising slowdown, shares could correct after recent gains. Conversely, progress in AI initiatives or higher user engagement could strengthen Meta’s market position and justify its elevated valuation.

Live Nation climbs on antitrust deal

Is the FDA sabotaging medical companies? UniQure’s valuation rollercoaster

US Open: Oil too expensive for Wall Street!

Further cracks in the private credit market: BlackRock limits withdrawals

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.