The global uranium market is on the edge of a potentially unprecedented expansion, driven by the mounting demand for nuclear power as a solution to climate change concerns. With uranium prices soaring to their highest in over a year, investors are eying a gold rush in this once-overshadowed sector. But with the world's hunger for clean energy intensifying, is the uranium market truly poised for a long-term boom?

The global uranium market is witnessing significant interest due to the rising demand for nuclear power as a clean energy source. Recent developments indicate the potential for the most substantial expansion of nuclear power in decades. Prices for uranium have surged to their highest in over a year, with the weekly spot price of uranium reaching more than $58 marking an approximate increase of 23% year to date. This surge is attributed to the combination of heightened demand and a production deficit resulting from reduced investments after Japan's Fukushima nuclear disaster in 2011. The total world uranium production was 49,000 metric tons in 2022, showcasing a slow recovery from past curtailments due to oversupply and impacts of the COVID pandemic. With current uranium production lagging behind global consumption by more than 50 million pounds annually, there is a pressing need for new mines.

Top Uranium companies operating in the mining sector or related industry.

Nuclear power is now perceived differently in global energy markets, especially in light of the ongoing concerns over climate change and the need for clean energy. The United States recently witnessed the operational commencement of its first newly-constructed nuclear unit in over 30 years. There's also a budding interest in innovative technologies such as small modular reactors in North America. Eastern European countries are progressively turning to nuclear power, with Poland planning a significant nuclear energy program and nations like Czech Republic and Romania aiming to expand their existing nuclear initiatives. At present, nuclear power contributes to around 10% of global electricity, with projections indicating potential growth in nuclear power capacity by at least 40% by 2040. In the investment sphere, uranium stocks and ETFs have observed remarkable growth, with some like Cameco Corp. witnessing an increase of nearly 60% year to date. However, despite these gains, there's a belief that the uranium market is still in its early stages of recovery.

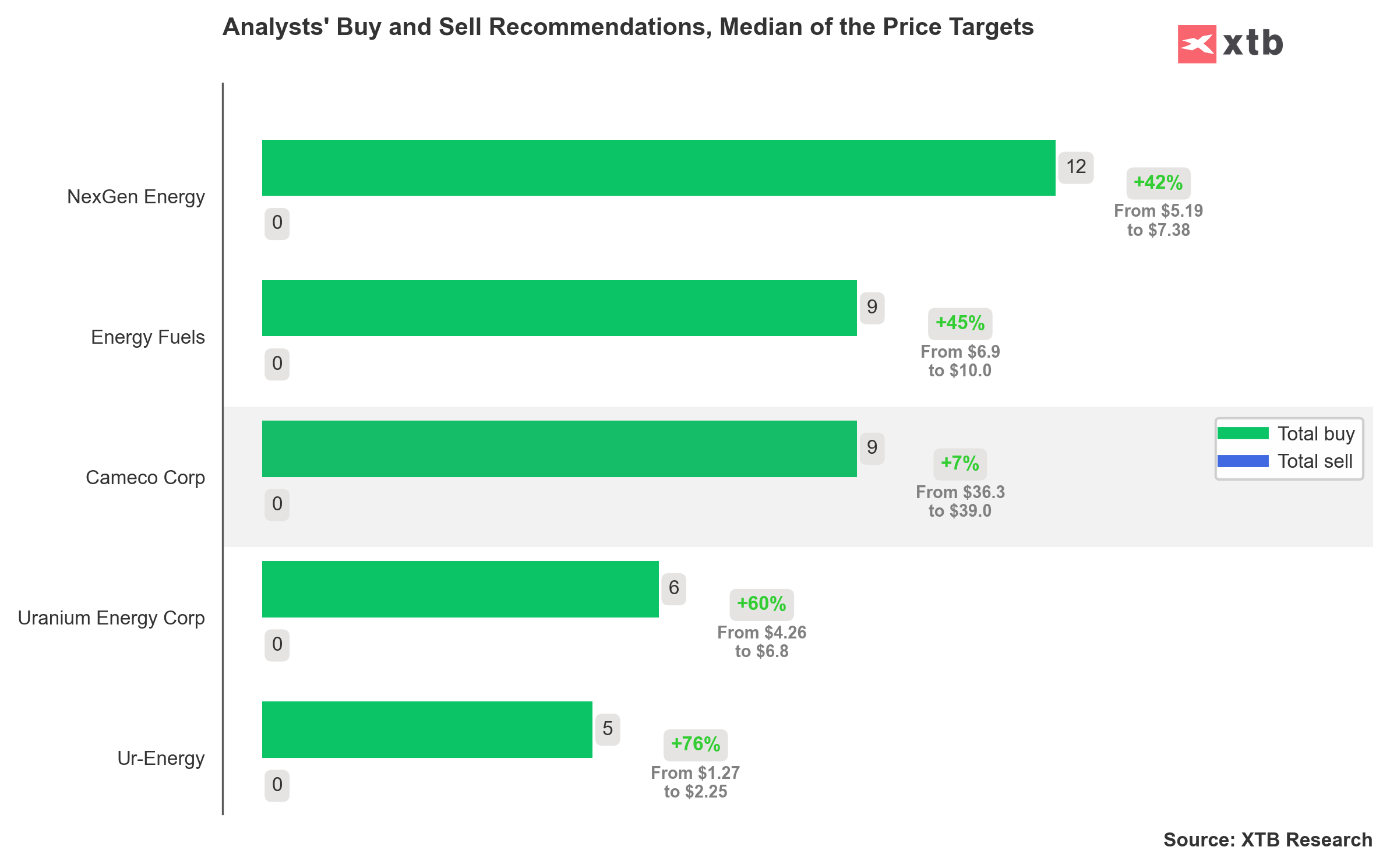

All analyst recommendations are positive, with no recommendations indicating a sell signal

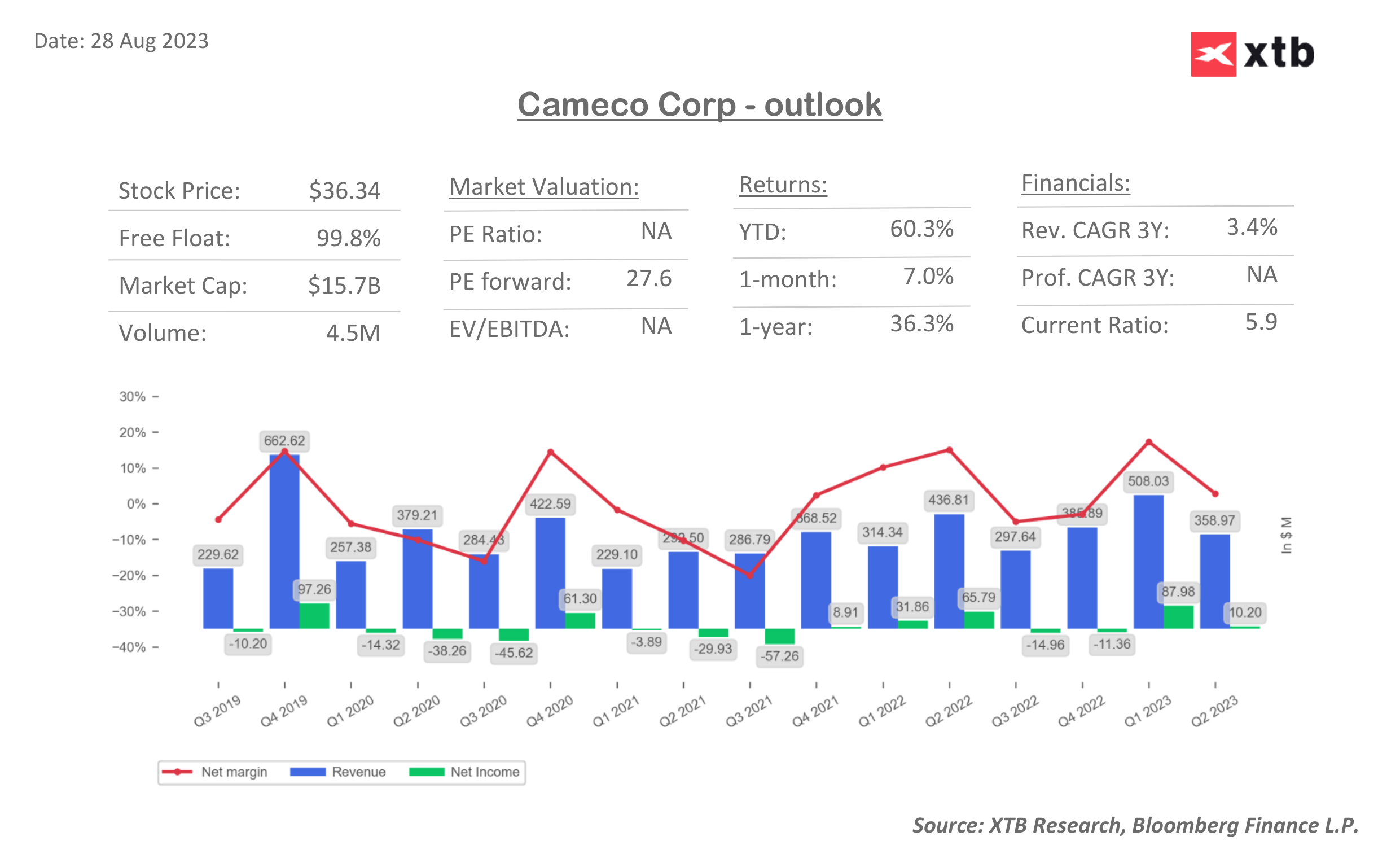

On August 2, 2023, Cameco, based in Saskatoon, Saskatchewan, unveiled its Q2 results revealing an EPS of ($0.01), falling short of estimates by ($0.17), and generating $360 million in revenue, marking a 13.6% revenue decline year-over-year. Despite challenges company benefits from the uptrend in the nuclear energy industry, the demand for uranium is projected to surge. Cameco, as one of the primary suppliers, is set to witness a rise in demand for its products, especially with improving uranium market fundamentals.

On August 2, 2023, Cameco, based in Saskatoon, Saskatchewan, unveiled its Q2 results revealing an EPS of ($0.01), falling short of estimates by ($0.17), and generating $360 million in revenue, marking a 13.6% revenue decline year-over-year. Despite challenges company benefits from the uptrend in the nuclear energy industry, the demand for uranium is projected to surge. Cameco, as one of the primary suppliers, is set to witness a rise in demand for its products, especially with improving uranium market fundamentals.

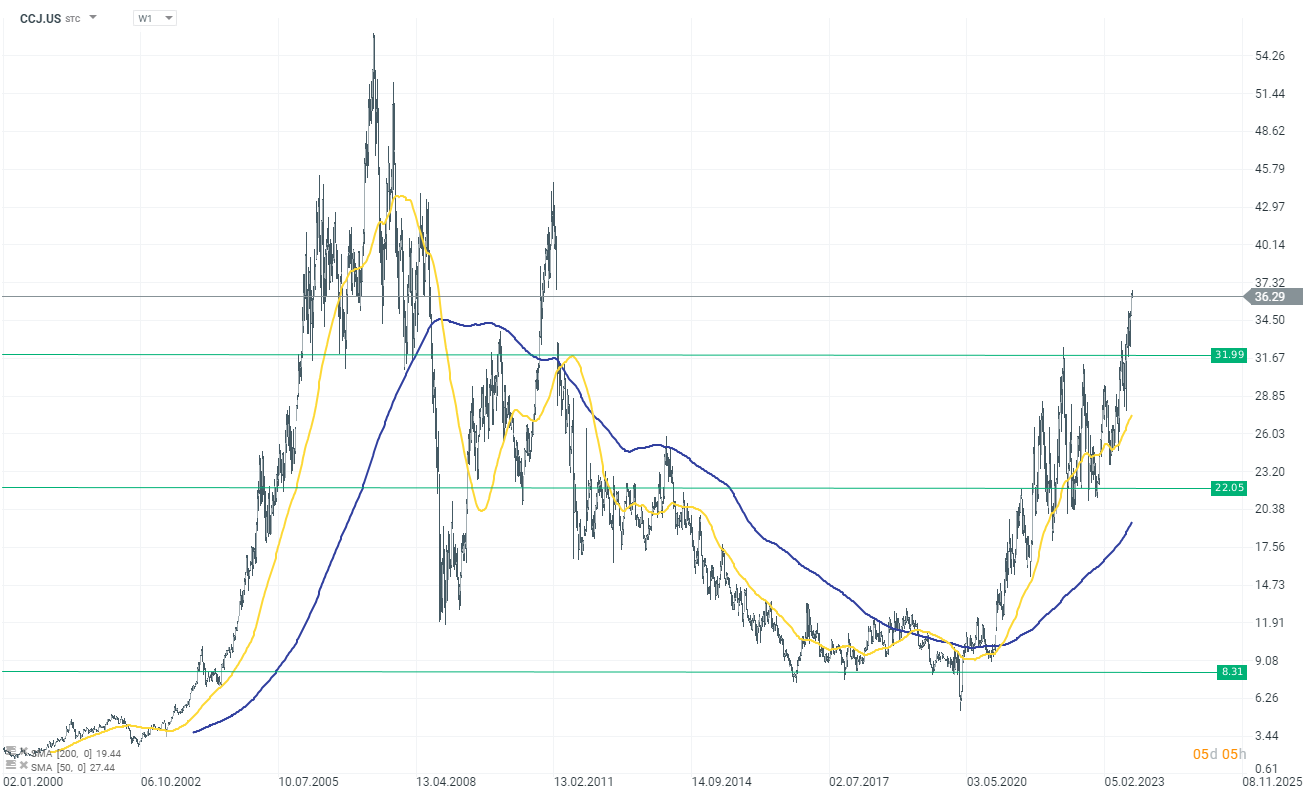

Cameco (CCJ.US) shares experienced significant gains starting in 2020. The rise in the company's stock price reflects the immense potential of the uranium market and the anticipated growth in demand.

Cameco (CCJ.US) shares experienced significant gains starting in 2020. The rise in the company's stock price reflects the immense potential of the uranium market and the anticipated growth in demand.

Will Europe run out of fuel?

US OPEN: War in Iran hits the markets

Sentiments on Wall Street are falling 📉S&P 500 earnings season highlight

Daily summary: The beginning of the end of disinflation?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.