-

US indices trade flat after first hour of final pre-Christmas session

-

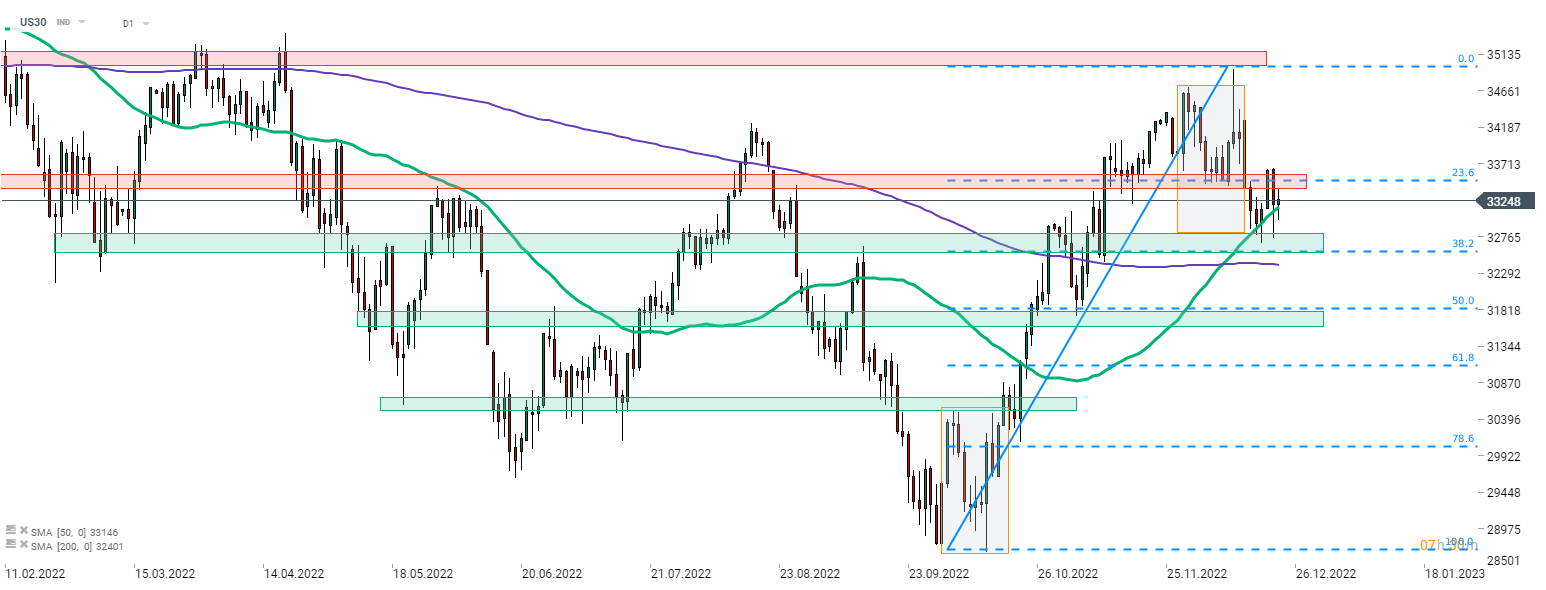

Dow Jones bounces off 50-session moving average

-

US PCE core inflation slows less than expected

US indices launched the final pre-Christmas session lower, with Nasdaq opening with the biggest bearish price gap (-0.36%). Indices dropped further after opening of the session and are now all trading 0.4-0.8% lower. Release of University of Michigan data at 3:00 pm GMT did not trigger major market moves as it was a revision to December's report. However, it is noteworthy that the headline index was revised higher from 59.1 to 59.7.

On the other hand, US index futures saw some wild moves after release of PCE inflation data for November at 1:30 pm GMT. Report showed a slowdown in headline and core price growth but it was smaller than expected. Key core PCE slowed from 5.0% to 4.7% YoY (exp. 4.6% YoY) while the headline slowed from 6.1% to 5.5% YoY. This reading, combined with yesterday's upward revision to US Q3 GDP, signals that there is still some room to tighten monetary policy further. US500 dropped 0.9% after the release before jumping 1.3%. However, this gain was also erased later on.

Dow Jones (US30) bounced off the support zone, ranging between the lower limit of the Overbalance structure and 38.2% retracement of recent upward impulse. Index launched recovery move and 50-session moving average (green line) is acting as the nearest support. Breaking and close daily candlestick below would make technical outlook more bearish. In case a deeper drop follows, 50% retracement in the 31,800 pts area will be the next support level to watch. Source: xStation5

Dow Jones (US30) bounced off the support zone, ranging between the lower limit of the Overbalance structure and 38.2% retracement of recent upward impulse. Index launched recovery move and 50-session moving average (green line) is acting as the nearest support. Breaking and close daily candlestick below would make technical outlook more bearish. In case a deeper drop follows, 50% retracement in the 31,800 pts area will be the next support level to watch. Source: xStation5

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.