Summary:

-

ISM in focus after impact of Tuesday’s releases

-

NFP release also on the radar

-

S&P500 languishes near 5-week lows

Two economic releases from the US in the next 24 hours could well go a long way to dictating the outcome of the next Fed rate decision at the end of the month. First off the ISM non-manufacturing PMI is due at 3PM (BST) and given the strong negative reaction seen to Tuesday’s manufacturing equivalent this could well have a clear impact on equities.

Comparatively speaking, the non-manufacturing or service sector is far larger than the manufacturing and is therefore arguably more important, and with the data coming just 30 minutes after the opening bell it will likely set the tone for the rest of the session.

Tomorrow’s US jobs report (read our preview here) is potentially the biggest of the year as if it shows a clear weakening of the labour market then the pressure will be ramped up further on the Fed to act and provide further stimulus later this month. The ADP yesterday was a little weak but not horrendous and we’ve also just got the latest initial jobless claims which came in at 219k vs 215k expected. The prior week was revised higher to 215k from 213k originally.

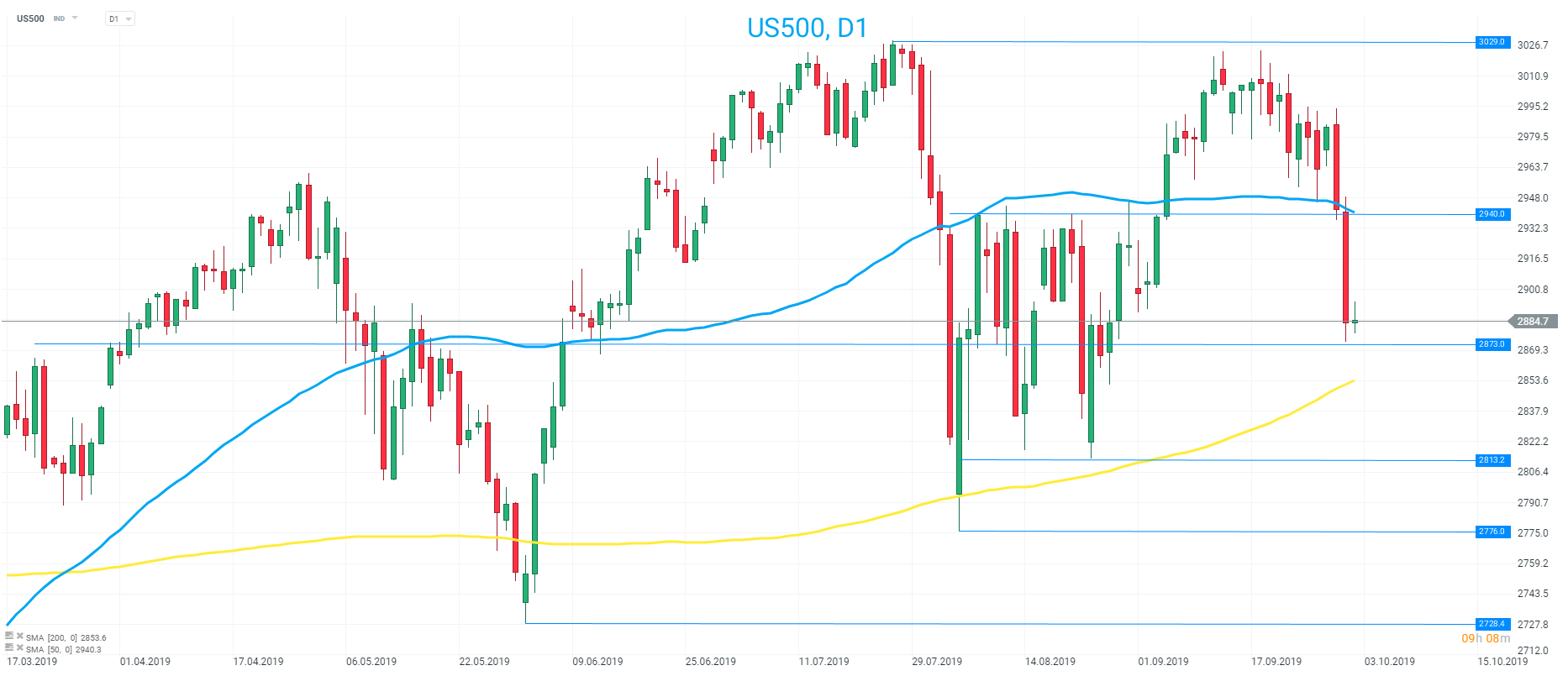

The outlook for US stocks has changed quickly this week with the S&P500 falling from trading around 1% from its all-time high to trade not that far from the 200 SMA in the space of just a couple sessions. Source: xStation

The outlook for US stocks has changed quickly this week with the S&P500 falling from trading around 1% from its all-time high to trade not that far from the 200 SMA in the space of just a couple sessions. Source: xStation

Three markets to watch next week (09.02.2026)

US100 gains after the UoM report🗽Nvidia surges 5%

Market wrap: European indices attempt a rebound after Wall Street’s record selloff 🔨

📈Wall Street rebounds, VIX slips 5% 🗽What does US earnings season show us?

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.