- US market opens near the last closing price

- Delta and PepsiCo beat estimates

- China leverages rare earth metals against west

- Powell absent from FOMC conference

- US market opens near the last closing price

- Delta and PepsiCo beat estimates

- China leverages rare earth metals against west

- Powell absent from FOMC conference

Today's opening of the stock markets in the United States is proceeding in moderately cool moods. Investors, after yesterday's euphoria, are approaching trading with greater caution, analyzing both incoming company results and the macroeconomic situation in the face of the ongoing federal administration shutdown. Most indices at the opening remain around yesterday's closing levels. Contracts on US100 are falling by 0.20%.

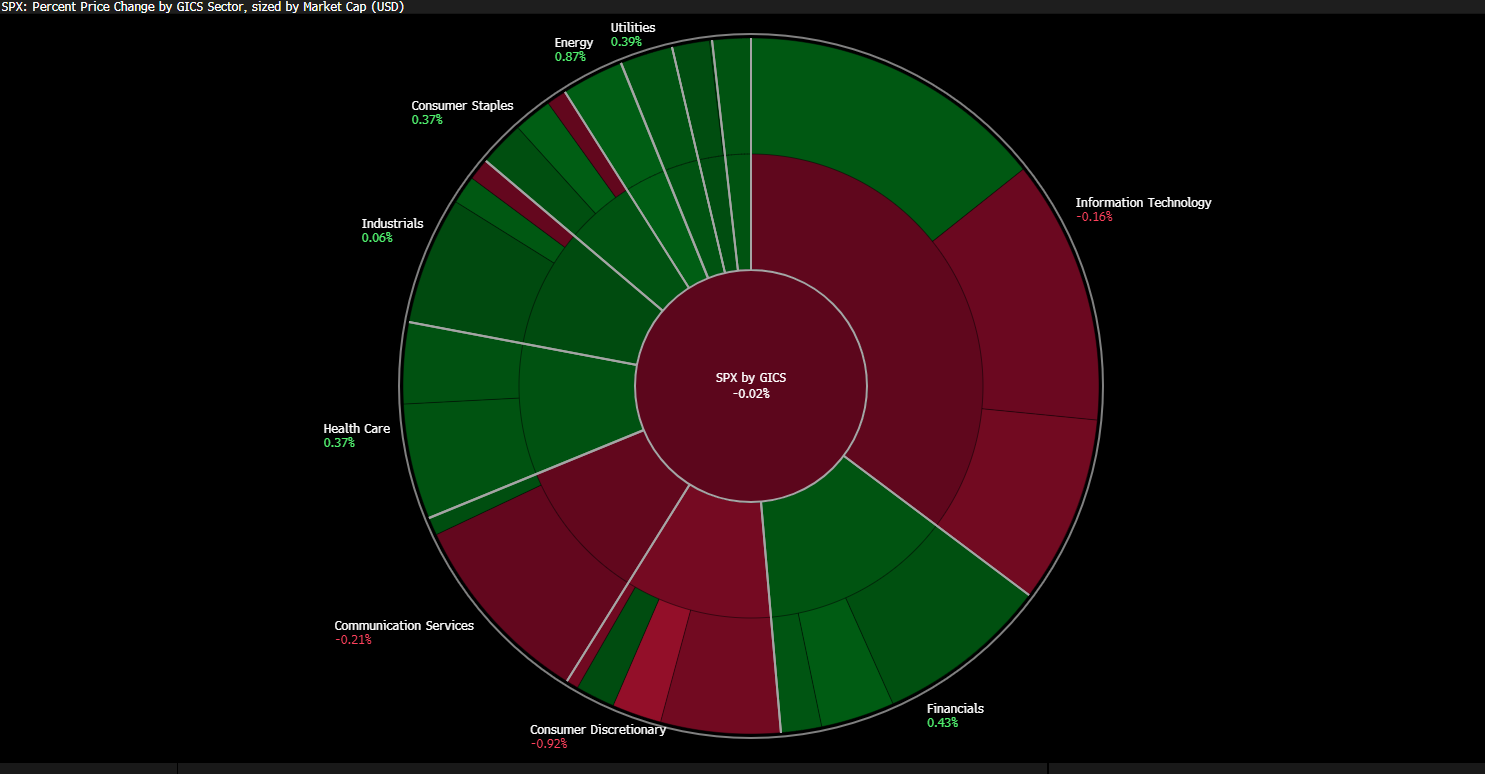

Source: Bloomberg Finance Lp

The mining and financial sectors are performing best today. IT and broadly defined retailers are lagging behind.

Yesterday's session brought further historical highs on the main indices. The publication of the minutes from the last Federal Reserve meeting was interpreted by the market as confirmation of a dovish stance in monetary policy. Market participants interpreted the content of the protocol as a signal that the Fed intends to cut rates by 25 basis points at the next meeting.

The US government shutdown continues, and most key macroeconomic data is not being published. Fed Chairman Jerome Powell could not participate in the planned conference, depriving the market of important clues regarding the future path of monetary policy. The lack of communication from monetary authorities in a situation of limited access to data may increase investor uncertainty.

At the corporate level, quarterly reports from PepsiCo and Delta Air Lines are drawing attention. Both companies published results above expectations, providing valuable information about the condition of American consumers in conditions of limited macroeconomic transparency. Delta's report was particularly well-received after the company's CEO emphasized that the ongoing federal government shutdown does not affect the company's current operations, which supported the carrier's pre-session trading.

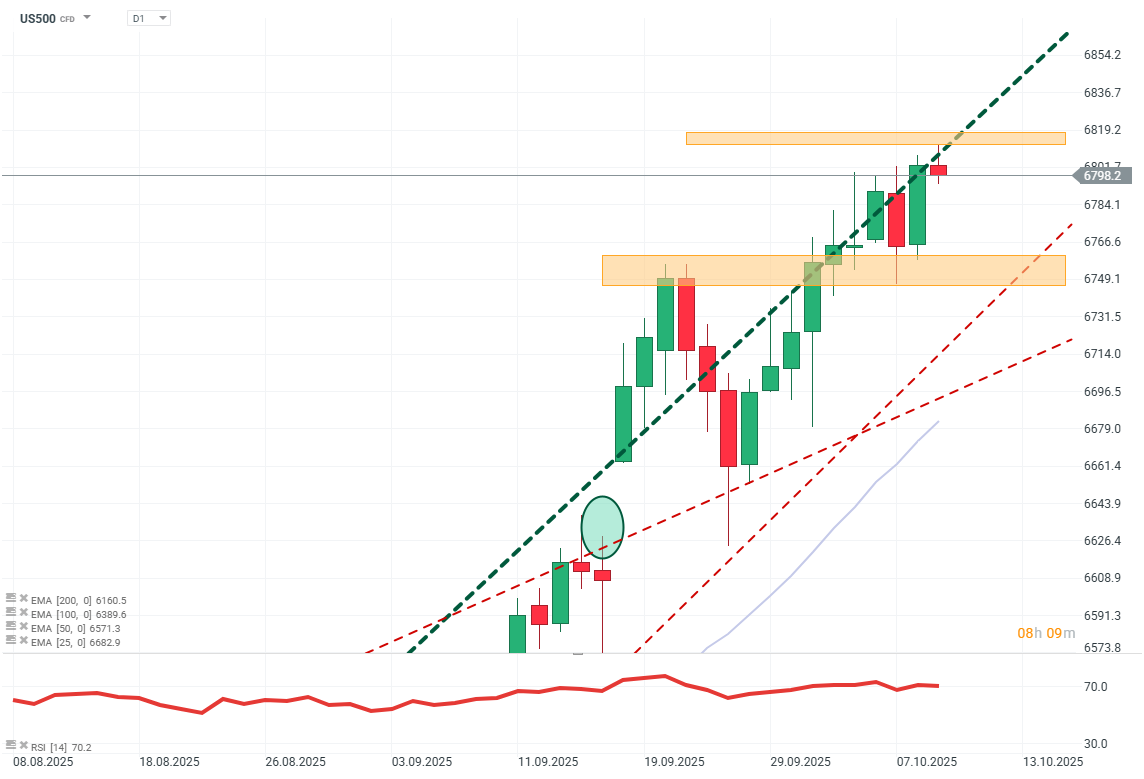

US500 (D1)

Source: Xstation5

The price is currently very close to historical highs, which means, among other things, that the space for potential correction seems relatively large. Considering the ranges of previous corrections, a possible pullback could reach even the lower boundary of the growth channel (marked in red) and around 6700 points. However, for such a scenario to materialize, a clear break of the nearest local support in the region of 6750 points remains a key condition. An additional factor supporting the supply side is the relatively high level of the RSI indicator, which oscillates around 70 points, signaling market overbought and increasing risk of short-term pullback.

Company News:

Nvidia (NVDA.US) - The world's largest company is rising at the opening by about 1%. This is driven by positive news that the chip manufacturer has started selling its AI chips in the UAE as part of a new trade initiative by the US president.

US Rare Metals (USAR.US) - Companies related to the extraction and refining of rare earth metals are rising on the wave of new restrictions from China, which forces increased production in developed countries. US Rare Metals is rising at the opening by over 6%.

Apogee Therapeutics (APGE.US) - The biotech company is losing over 6% at the opening. The valuation of the previously announced public offering at $41 was deemed unfavorable by the market.

PepsiCo (PEP.US) - The soft drink producer published results that slightly beat market expectations regarding EPS (2.29, Ex.: 2.26) and Revenue (23.94B$, Ex.: 23.86B$). At the earnings conference, the CEO indicated plans to cut costs to increase margins and noted that demand from Asia is working in the company's favor.

Freeport (FCX.US) - Copper mining companies are rising on the wave of good sentiment towards the industrial metal and forecasts of its growth in the coming years. The company is rising at the opening by about 2%.

Diginex Inc (DGNX.US) - The software production company is rising by about 30% for the second session in a row. This is caused by the company's strategic growth towards cryptocurrencies, tokenization, and AI.

Delta Airlines (DAL.US) - The leader of American airlines also published its results today, in which it beat expectations. This is a particularly important reading allowing the assessment of the strength of American business and consumers in conditions of reduced macroeconomic transparency. The company is rising at the opening by over 5% thanks to assurances from the CEO that the government shutdown did not affect the results and that the company is recording record operating revenues thanks to demand from premium customers.

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉

🚨Gold slumps 3% amid markets preparing for Chinese Lunar Year pause

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.