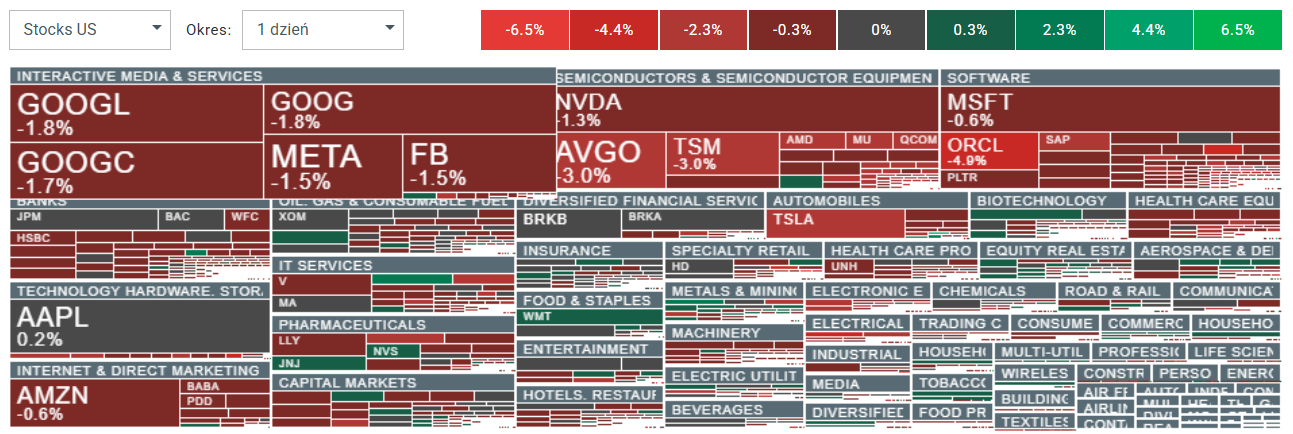

U.S. indices are falling as the dollar strengthens, driven by robust GDP growth, firm durable goods orders, and lower jobless claims. Investors are questioning whether the Fed will really continue monetary easing this year at the previously expected “fast pace.”

-

US500 down more than 0.9%, US2000 drops nearly 2%

-

Lithium Americas rallies on speculation of a potential U.S. government stake

-

Oracle shares react negatively to a Rothschild & Co Redburn report

-

The U.S. dollar gains and Treasury yields climb after Q2 GDP came in at 3.8% YoY, beating forecasts of 3.3%

-

Jobless claims fell to 217K, compared with expectations of 233K and 233K previously

-

Consumer spending rose 2.5% in Q2, well above the 1.6% forecast and just 0.5% previously

US500 Technical View (D1)

The US500 is trading nearly 1% lower today. Key support appears near 6,500 points, where the 50-day EMA (orange line) is located. The index has tested this level three times in recent months. On the upside, resistance is defined by the recent price reaction around 6,800 points.

Source: xStation5

Source: xStation5

Company News

-

Immuneering Corp. (IMRX) down ~15% after reporting an 86% overall survival rate at nine months in pancreatic cancer patients treated with atebimetinib plus mGnP. The positive news triggered profit-taking.

-

Jabil (JBL) falls nearly 9% even though the manufacturing services company posted Q4 results that beat analyst estimates.

-

Lithium Americas (LAC) jumps almost 12% following reports the Trump administration is considering taking a stake in the company.

-

Oracle (ORCL) drops nearly 5% amid broader tech sector weakness. Rothschild & Co Redburn initiated coverage with a sell rating, arguing the market is significantly overestimating the value of the company’s cloud revenues. Shares remain well above the 50-day EMA but are testing recent local lows below $300.

Sources: xStation5

Daily Summary: Wall Street ends the week with a calm gain 🗽 Cryptocurrencies slide

NATGAS surges 5% reaching 3-year high 🔎

Bitcoin loses 3% 📉Technical bearish flag pattern?

3 markets to watch next week (05.12.2025)

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.