- US indices open lower on the last day of the week

- Semiconductor sector leads the declines

- USDIDX gained in the first part of the day

- US bond yields trade lower

The cash session in the US opened slightly lower. However, declines accelerated after much better preliminary PMI data for June. The investors' reaction was short-lived, and the indices began to pare initial losses shortly thereafter. At the time of publication, the US500 is down by 0.25%, and the US100 is trading 0.50% lower.

02:45 PM BST, United States - PMI Data for Jun:

- S&P Global US Manufacturing PMI: actual 51.7; forecast 51.0; previous 51.3;

- S&P Global Services PMI: actual 55.1; forecast 53.4; previous 54.8;

- S&P Global Composite PMI: actual 54.6; previous 54.5;

On one hand, the good mood from the PMI data suggests a solid condition of the US economy. On the other hand, it indicates to the Fed that the high interest rates have not yet fully impacted the entire economy. The same conclusions can be drawn by analyzing recent hard macroeconomic data, such as retail sales or industrial production.

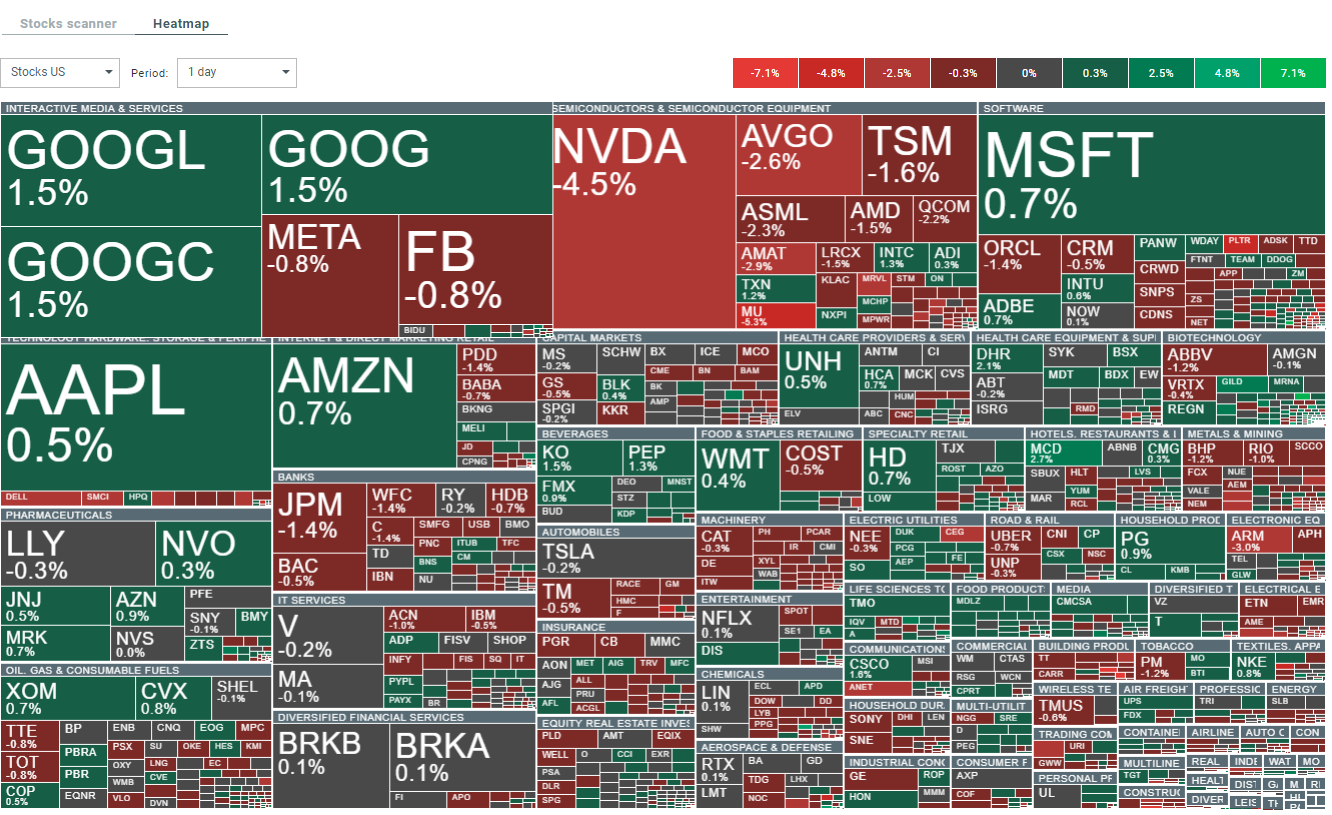

The clear leaders of today's session are once again the biggest technology companies such as Apple, Microsoft, Amazon, and Google. Here, we observe the most significant market gains. On the other side, there are companies from the AI and semiconductor sectors. Nvidia, for example, is losing over 4.00% at the time of publication, falling below the market cap of Apple and Microsoft. Alongside Nvidia, companies like Micron, Broadcom, AMD, and TSM are also losing.

Source: xStation 5

Source: xStation 5

US500

At the time of publication, the US500 index is down 0.25% to 5530 points. After marking a local peak at around 5585 points yesterday following the rollover of contracts, today we observe a slight correction. In recent days, we have experienced almost parabolic increases. However, in case of a correction, the area worth noting is around the last consolidation starting at about 5330 points.

Source: xStation 5

Company news

Asana (ASAN.US) gains 14% after reaffirming its revenue forecasts for Q2 and fiscal year 2024, and announcing a new $150 million share repurchase program set to run until June 30, 2025. The company expects quarterly revenues to be between $177 million and $178 million, closely mirroring the consensus estimate of $177.7 million, and forecasts annual revenues in the range of $719 million to $724 million, closely aligning with the expected $722 million.

Sarepta Therapeutics (SRPT.US) witnessed a robust 40% increase in its stock price following the FDA’s dual approvals—accelerated for non-ambulatory patients and traditional for ambulatory patients—of its Elevidys treatment for Duchenne muscular dystrophy. The company has initiated the ENVISION Phase 3 post-marketing trial to validate Elevidys’ effectiveness in non-ambulatory and older ambulatory patients.

Smith & Wesson Brands (SWBI.US) experienced a roughly 13% decline in its stock despite surpassing expectations in its fourth fiscal quarter earnings. The drop was attributed to a conservative outlook, with the company predicting a 10% decline in both unit and dollar sales year-over-year in the first quarter. This projected downturn is partly due to fewer handgun sales, although somewhat offset by increased sales of long guns. Additionally, Smith & Wesson foresees a 3% to 5% increase in operating costs for the year driven by wage inflation, a competitive market, and greater investment in research and development.

Palantir Technologies (PLTR.US) dips more than 4.70% after an analyst downgrade by Monness, Crespi, Hardt from Neutral to Sell with a price target of $20. The downgrade was prompted by generally disappointing results in the enterprise software industry, and the analyst highlighted that the expected revenue surge from generative artificial intelligence in this sector has so far proved to be an illusion this year.

Palo Alto acquires CyberArk. A new leader in cybersecurity!

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.