Wall Street enters the Fed decision week relatively stable, underpined by the uncertainty about the future guidance for the monetary policy in the US. Russell 2000 futures (US2000) gain the most (+0.6%), recovering Friday’s drop. Among big cap indices, tech-heavy Nasdaq continues to outperform (US100: +0.1%), with S&P 500 (US500) and DJIA (US30) currently trading flat.

With the December rate cut almost fully priced in, market sentiment now focuses on how the Fed will communicate the move and what actions might follow in January. This week’s meeting is likely to be marked by a new disents, as some hawkish FOMC members disagree with Chair Powell on the disinflationary impact of AI-driven productivity gains. There is also rising discussion of a cautious, “hawkish” cut, signaling that the Fed may maintain a careful approach in 2026, even under a new chair appointed by Trump.

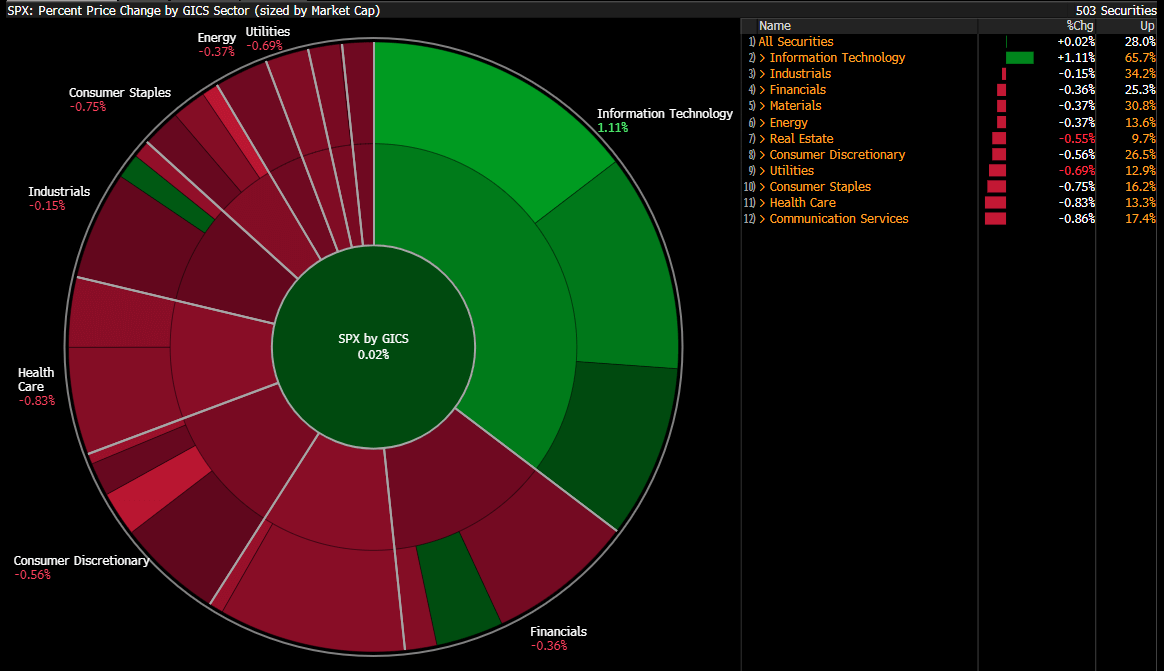

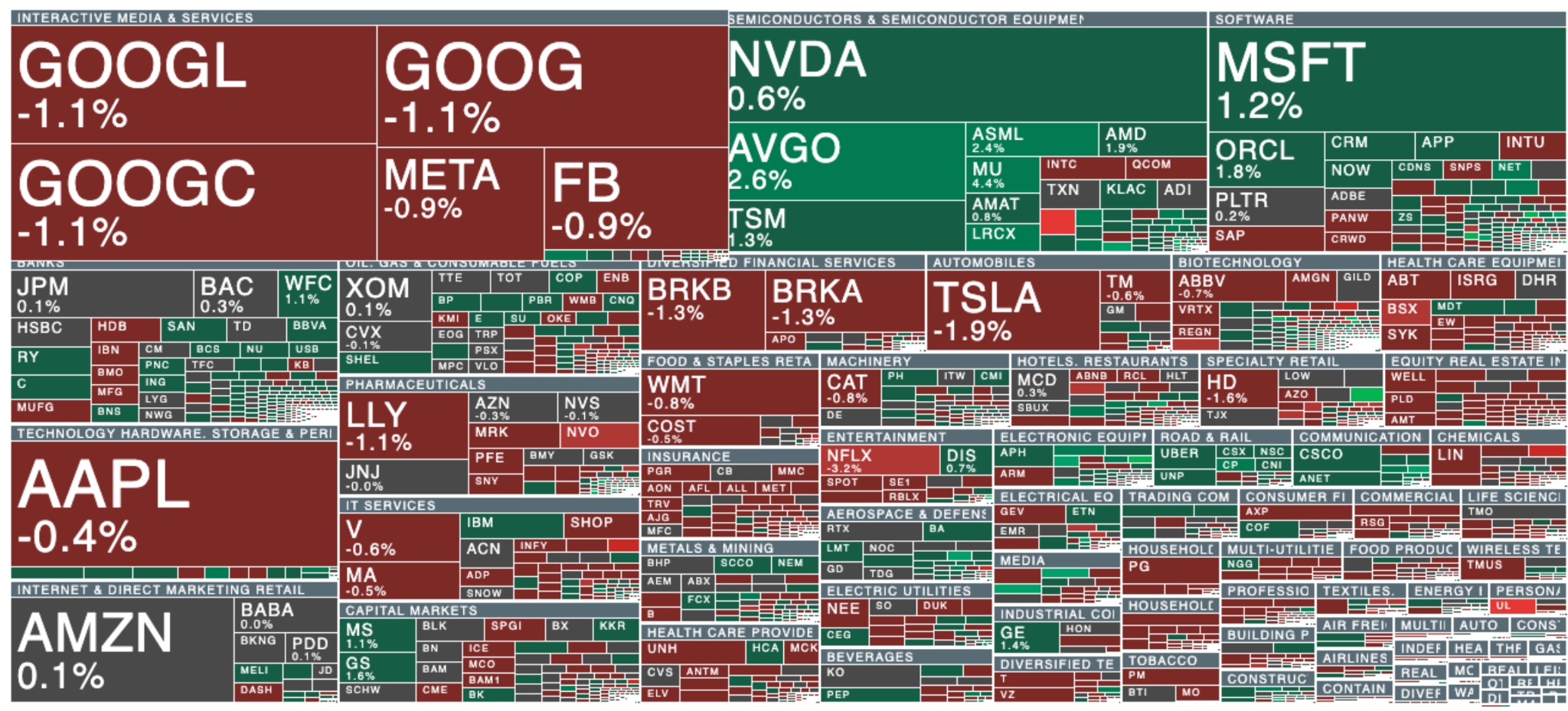

Tech stocks are driving gains once again, with the software and semiconductor sectors posting the highest gains at the start of the week. The tech risk weighs on defensive stocks (healthcare, utilities, consumer goods), which see the biggest capital outflows. Other sectors experience milder losses, with overall sentiment being relatively stable.

Volatility in S&P 500 sectors. Source: Bloomberg Finance LP

US stocks today. Source: xStation5

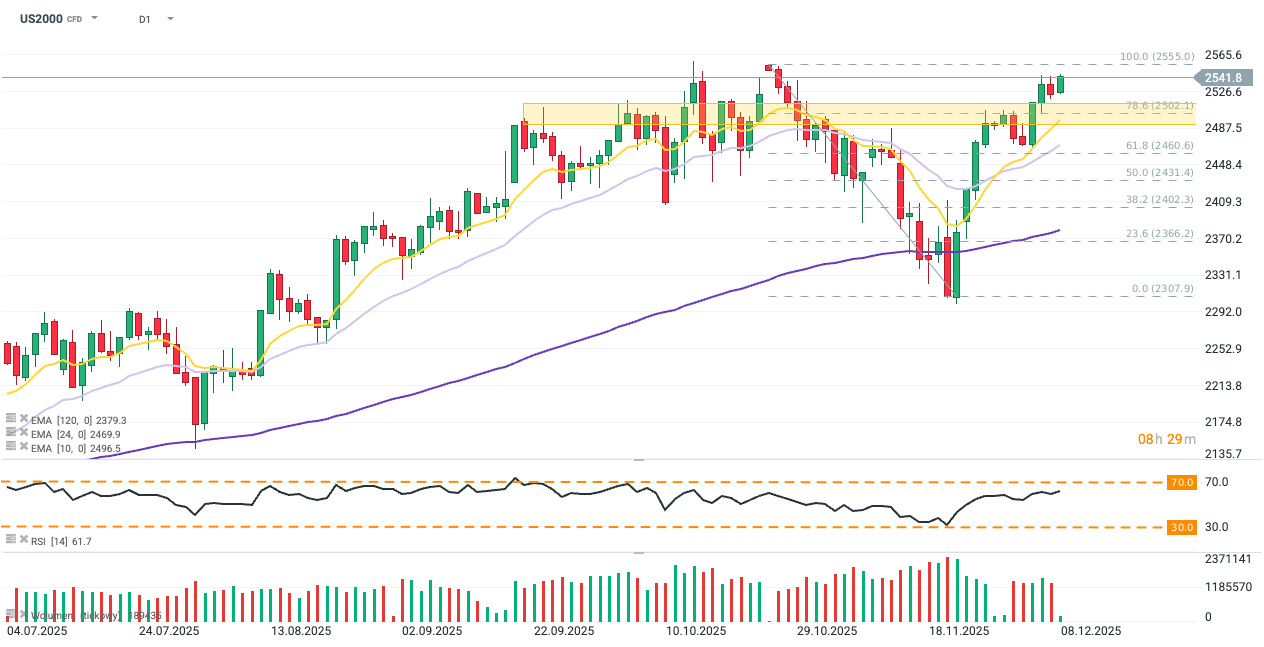

US2000 (D1)

Russell 2000 futures are approaching a key resistance near October’s all-time high, around 2,555. Immediate support is at the 78.6% Fibonacci retracement, coinciding with the psychological 2,500 level. The contract has consistently respected its 10-day EMA (yellow) as a reference for both bullish and bearish waves. Holding above this moving average could pave the way for new highs, especially as lower interest rates continue to support smaller-cap stocks. Conversely, a break below the EMA10 would likely bring back October’s consolidation.

Source: xStation5

Company news:

-

Agios Pharmaceutica is up 0.5% despite premarket losses after the FDA delayed its decision on Agios’ supplemental new drug application for mitapivat in alpha- and beta-thalassemia, with the application still under active review. No new data has been requested, and discussions focus on labeling and REMS. The FDA has not given a new decision timeline; Agios continues to work toward completion.

-

Carvana shares gained over 8% after S&P Global said the company will join the S&P 500 on Dec. 22. The move reflects the company’s sharp market-cap recovery and is expected to trigger passive inflows as index funds adjust holdings ahead of the inclusion.

-

IBM agreed to buy Confluent for $11bn, paying $31 per share — a ~29% premium — as it deepens its shift toward AI and cloud services. Confluent shares surged nearly 30% pre-market, currently up 28%. IBM expects the data-streaming platform to strengthen its generative-AI capabilities, streamline overlapping products, and contribute to profits within a year after the expected mid-2026 close.

-

CoreWeave shares are down 5% after announcing a $2bn convertible notes offering. The company plans to use part of the proceeds for capped call transactions to limit dilution or offset potential excess conversion payments, with the remainder earmarked for general corporate purposes.

-

US President Trump flagged potential antitrust concerns over Netflix’s $72bn acquisition of Warner Bros and HBO, citing its large market share. The deal, set to complete after Warner Bros splits in H2 2026, would consolidate major franchises like Harry Potter and Game of Thrones on Netflix. Industry experts expect regulatory review, possible concessions, and heightened White House involvement in the approval process. Netflix trades 3% lower today, while WBD hiked 6.6%

-

Additionally, Paramount Skydance launched a hostile $30-per-share bid for Warner Bros. Discovery after losing to Netflix in the $72bn deal for the studio and streaming assets. Backed by Ellison family equity, RedBird Capital, and $54bn in debt, Paramount argues its smaller, standalone deal would face a faster regulatory review amid antitrust concerns over Netflix’s larger acquisition.

BREAKING: Stronger than expected ADP fails to support the dollar 🇺🇸

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Market wrap: European and US stocks try to rebound rebound 📈

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.