- Wall Street erases a good portion of the gains at the opening. US100 loses slightly

- US PCE data came in as expected, but reaction was dovish

- U.S. spending slows, at a time when there still may be no talk of policy easing at the Fed

- Dell (DELL.US) shares lose nearly 20% as investment in AI according to the company will significantly reduce quarterly earnings and margins

- Strong results from GAP (GPS.US) and a lift in expected margins in 2024 drove the apparel company's stock price up 21%

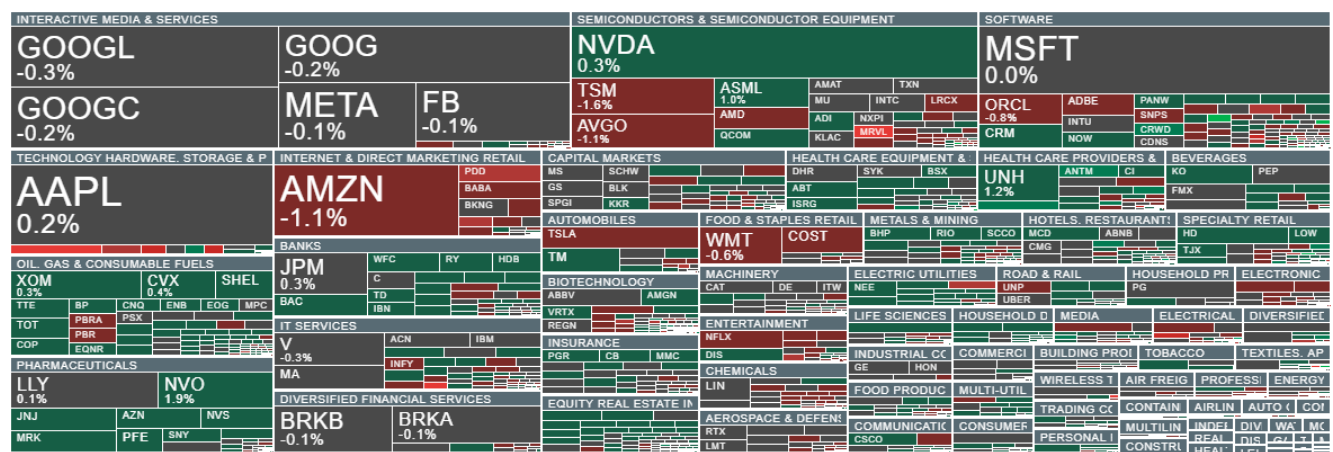

The euphoric reaction of the stock market did not last long, and Wall Street stopped enjoying the PCE data moments after the market opened. Technology stocks are losing today. Clear weakness is evident today in the ADRs of Chinese stocks including Alibaba (BABA.US) and PDD Holdings (PDD.US), which are slipping with the already nearly 10% correction in the Hang Seng Index that has happened over the past 10 days. The PCE data does not give the market much illusion and reassures the market that the Fed's main measure of inflation will not fall to its 2% target this year, giving the Federal Reserve an argument for a 'higher for longer' policy.

US Secretary of State, Anthony Blinken conveyed that President Biden has approved the use of U.S. weapons on Russian territory, by the Armed Forces of Ukraine. As a result, investors may become a bit more uncertain about a potential escalation, in the geopolitical arena. After yesterday's more than 20% sell-off in Salesforce shares, today we are seeing strong downward pressure in the shares of another company named among the beneficiaries of AI, Dell (DELL.US). Its shares are already losing almost 20%, and interestingly the reason is the scale of investment in artificial intelligence, which will be very costly for the company. At 2:45 PM BST, the market will learn the reading of the Chicago regional PMI index.

Companies in the S&P 500 are not seeing much change at the opening. Taiwan Semiconductor Manufacturing (TSM.US) is losing nearly 2%. Nearly 10% is lost by chipmaker Marvell Technology (MRVL.US), after disappointing results. Source: xStation5

US100 (M5 interval)

For the past few days, the momentum of Nasdaq 100 (US100) contracts has indicated a growing bearish appetite for a correction, which is being met with less and less buyer activity, signaling a possible 'exhaustion' of demand in the short term.

Source: xStation5

News from companies

- GAP (GPS.US) shares gained as the apparel and footwear maker signaled strong results and raised its full-year forecast, giving investors evidence that its business improvement strategy is working. The company pointed to the strength of Old Navy and other brands. Online sales grew 5% year-on-year and already account for 38% of total sales. Quarterly point-of-sale sales increased 3% y/y. The company's estimated margins for 2024 have been raised by 150 basis points, up from a previously assumed 50 bps increase. The company expects sales to show year-on-year growth, while it had previously signaled they would be flat. In the quarter ended May 4, sales totaled $3.39 billion versus $3.29 billion forecast. Earnings per share were $0.41, compared to expectations of just $0.14

- Tesla will recall 125,227 vehicles for review due to a malfunctioning seatbelt system, but shares of Elon Musk's company did not react to the news from the National Highway Traffic Safety Administration

- Costco (COST.US) shares are down nearly 2.5% although the wholesale operating company reported results above analysts' forecasts. Costco's strong results suggest that the U.S. consumer situation remains tight, with the consumer looking to save money by checking out the lowest-priced retailers. Sales came in at $58.52 billion versus $58.07 billion forecasts. Earnings per share in Q1 were $3.78, compared to expectations of $3.7

- Dell (DELL.US) shares are experiencing a 20% sell-off today as quarterly earnings came in below forecasts, and the company signaled higher costs, due to the construction of AI servers, which will rightfully squeeze margins. According to the company, margins will fall by 150 basis points in fiscal Q1 2025. The company expects $1.65 earnings per share with a tolerance of 10 cents either way in the current quarter. Analysts had expected $1.84. At the same time, Dell raised its full-year 2025 revenue forecast between $93.5 billion and $97.5 billion versus Wall Street's expectation of $91-95 billion, signaling that AI investments could ultimately prove profitable at a time when the core business continues to grow.

Dell shares (DELL.US, D1 interval)

Wall Street is 'short-selling' Dell shares today, amid uncertainty about the profitability and short-term returns of the company's AI investments. Source: xStation5

Source: xStation5

📉 Microsoft Q1 2026 Earnings: Strong Numbers Mask Investor Anxiety Over AI Spending

🚀 Alphabet Soars on AI-Driven Results, Shares Rally 7% in After-Hours Trading

Meta drops 8% despite strong revenue growth 🔎

Upcoming Meta earnings: will the AI transformation be well received by the market? 🔎

The content of this report has been created by XTB S.A., with its registered office in Warsaw, at Prosta 67, 00-838 Warsaw, Poland, (KRS number 0000217580) and supervised by Polish Supervision Authority ( No. DDM-M-4021-57-1/2005). This material is a marketing communication within the meaning of Art. 24 (3) of Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU (MiFID II). Marketing communication is not an investment recommendation or information recommending or suggesting an investment strategy within the meaning of Regulation (EU) No 596/2014 of the European Parliament and of the Council of 16 April 2014 on market abuse (market abuse regulation) and repealing Directive 2003/6/EC of the European Parliament and of the Council and Commission Directives 2003/124/EC, 2003/125/EC and 2004/72/EC and Commission Delegated Regulation (EU) 2016/958 of 9 March 2016 supplementing Regulation (EU) No 596/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the technical arrangements for objective presentation of investment recommendations or other information recommending or suggesting an investment strategy and for disclosure of particular interests or indications of conflicts of interest or any other advice, including in the area of investment advisory, within the meaning of the Trading in Financial Instruments Act of 29 July 2005 (i.e. Journal of Laws 2019, item 875, as amended). The marketing communication is prepared with the highest diligence, objectivity, presents the facts known to the author on the date of preparation and is devoid of any evaluation elements. The marketing communication is prepared without considering the client’s needs, his individual financial situation and does not present any investment strategy in any way. The marketing communication does not constitute an offer of sale, offering, subscription, invitation to purchase, advertisement or promotion of any financial instruments. XTB S.A. is not liable for any client’s actions or omissions, in particular for the acquisition or disposal of financial instruments, undertaken on the basis of the information contained in this marketing communication. In the event that the marketing communication contains any information about any results regarding the financial instruments indicated therein, these do not constitute any guarantee or forecast regarding the future results.